SEO Title: 12 Best Real Estate Investment Analysis Tools (Data & Software)

Meta Description: A deep-dive comparison of the top 12 real estate investment analysis tools. Compare platforms for data, underwriting, and portfolio management.

Meta Keywords: real estate investment analysis tools, real estate analysis software, property analysis tools, cre investment analysis, real estate data tools, investment property calculator

Relying on outdated spreadsheets for real estate analysis is a direct path to missed opportunities and flawed underwriting. The market moves too fast for manual data entry and broken formulas, introducing significant risk from calculation errors that can compromise entire deals. Just as there are pitfalls of relying on online short-term rental calculators, a poorly constructed spreadsheet leads to inaccurate analyses.

This guide delivers a definitive breakdown of the 12 essential real estate investment analysis tools that automate data collection, standardize underwriting, and provide the predictive insights needed to win deals. We dissect each platform's core function, ideal user, and critical limitations to provide a comprehensive resource for investors and lenders.

- Core Takeaways:

- Data vs. Analysis: Your primary bottleneck dictates your tool choice—either data acquisition (BatchData, PropStream) or financial analysis (DealCheck, RealData).

- Specialization is Key: Tools are purpose-built for specific asset classes (ARGUS for CRE) or strategies (Mashvisor for STR vs. LTR).

- Integration Wins: The most effective workflows combine a foundational data provider with a specialized analysis tool.

This is your blueprint for building a faster, more accurate, and profitable real estate analysis workflow.

How does BatchData function as a foundational data tool?

BatchData is a developer-first real estate data platform providing unified, high-velocity data for production-scale workflows. It consolidates over 155 million U.S. property records enriched with more than 1,000 standardized attributes and updated daily, making it an exceptionally powerful tool for proptech companies, institutional investors, and lenders who require actionable intelligence integrated directly into their systems.

The platform's core strength is its comprehensive, API-first delivery model. Unlike closed-system dashboards, BatchData provides low-latency APIs and flexible bulk data delivery (via S3, Snowflake, or flat files), enabling development teams to power their own applications, train machine learning models, and run complex analytics without being constrained by a third-party UI.

Key Features

- Smart Property Search API: Build custom search experiences.

- Bulk Data Feeds: Back-test investment strategies across entire markets.

- Contact Enrichment: Services like skip tracing and phone verification transform property data into high-intent leads.

- BatchRank: A proprietary propensity score that identifies properties most likely to transact.

Limitations & Target Audience

BatchData's enterprise focus and quote-based pricing create a barrier for individual investors or small teams needing a simple, off-the-shelf solution. Coverage is also limited to the U.S. market. It is best for proptech platforms, mortgage lenders, insurers, and large-scale investors who need reliable, scalable, and API-accessible property data to power their core operations.

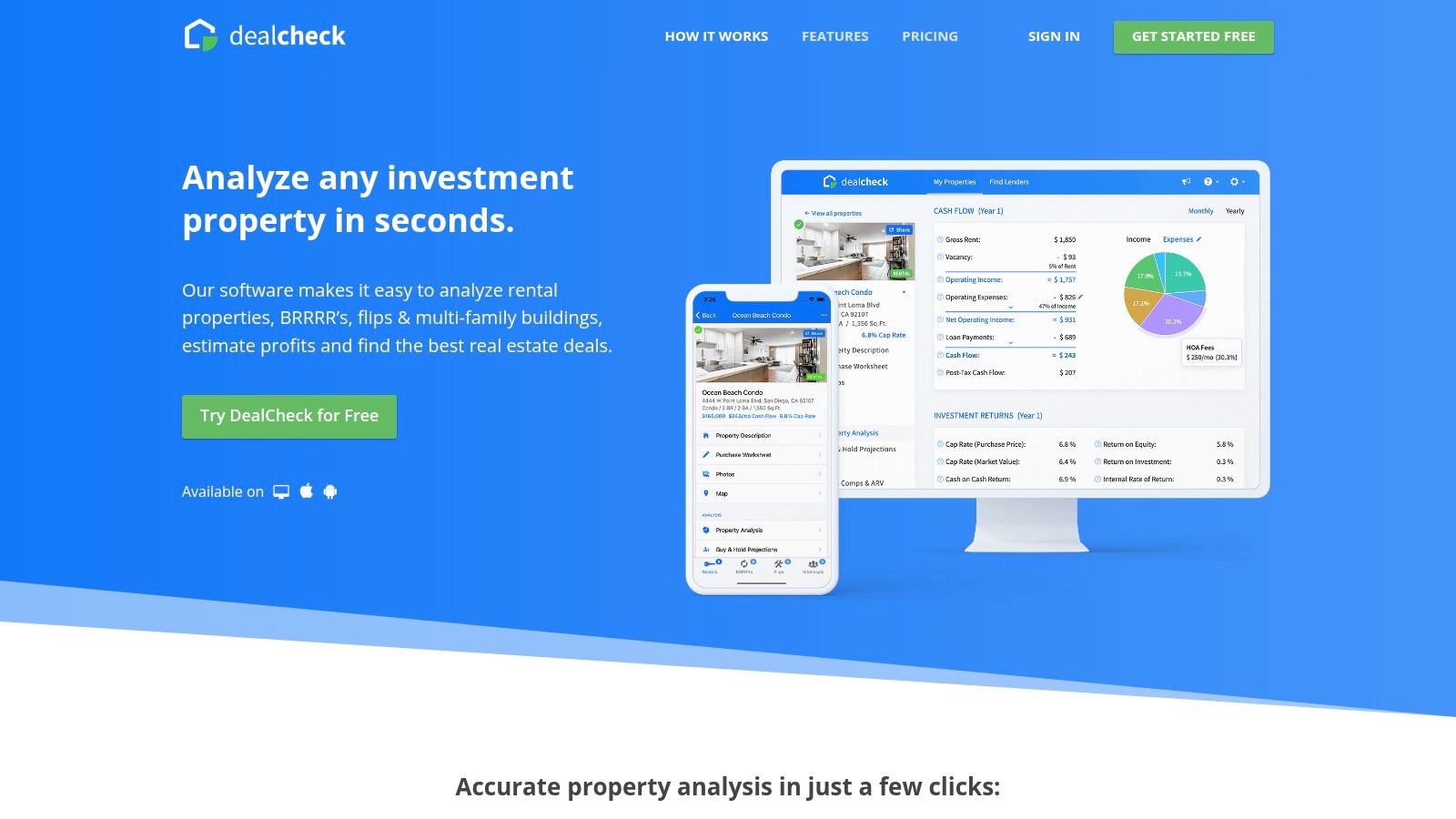

What makes DealCheck effective for rapid underwriting?

DealCheck is a web and mobile software platform purpose-built for the rapid underwriting of residential and small commercial properties. Its primary value is speed, using an intuitive interface to guide users through rental, BRRRR, flip, and short-term rental (Airbnb) deal structures, making it one of the most accessible real estate investment analysis tools for individual investors and agents.

The software automatically calculates key metrics like Cash on Cash Return (CoC), Internal Rate of Return (IRR), and After Repair Value (ARV). Learn more about how DealCheck compares to other real estate valuation software on batchdata.io.

Key Features

- Analysis Workflows: Dedicated calculators for rentals, BRRRR, flips, and multi-family properties.

- Data Integration: Includes sales/rental comps and property owner lookups.

- Reporting: Generates shareable, interactive reports and branded PDFs.

- Platform Access: Full functionality across web, iOS, and Android with cloud sync.

Limitations & Target Audience

DealCheck offers a free starter plan, with paid tiers ranging from approximately $14 to $29 per month. Its U.S.-centric data is a limitation for international investors, and its feature set for complex portfolio management is lighter compared to enterprise-grade CRE platforms.

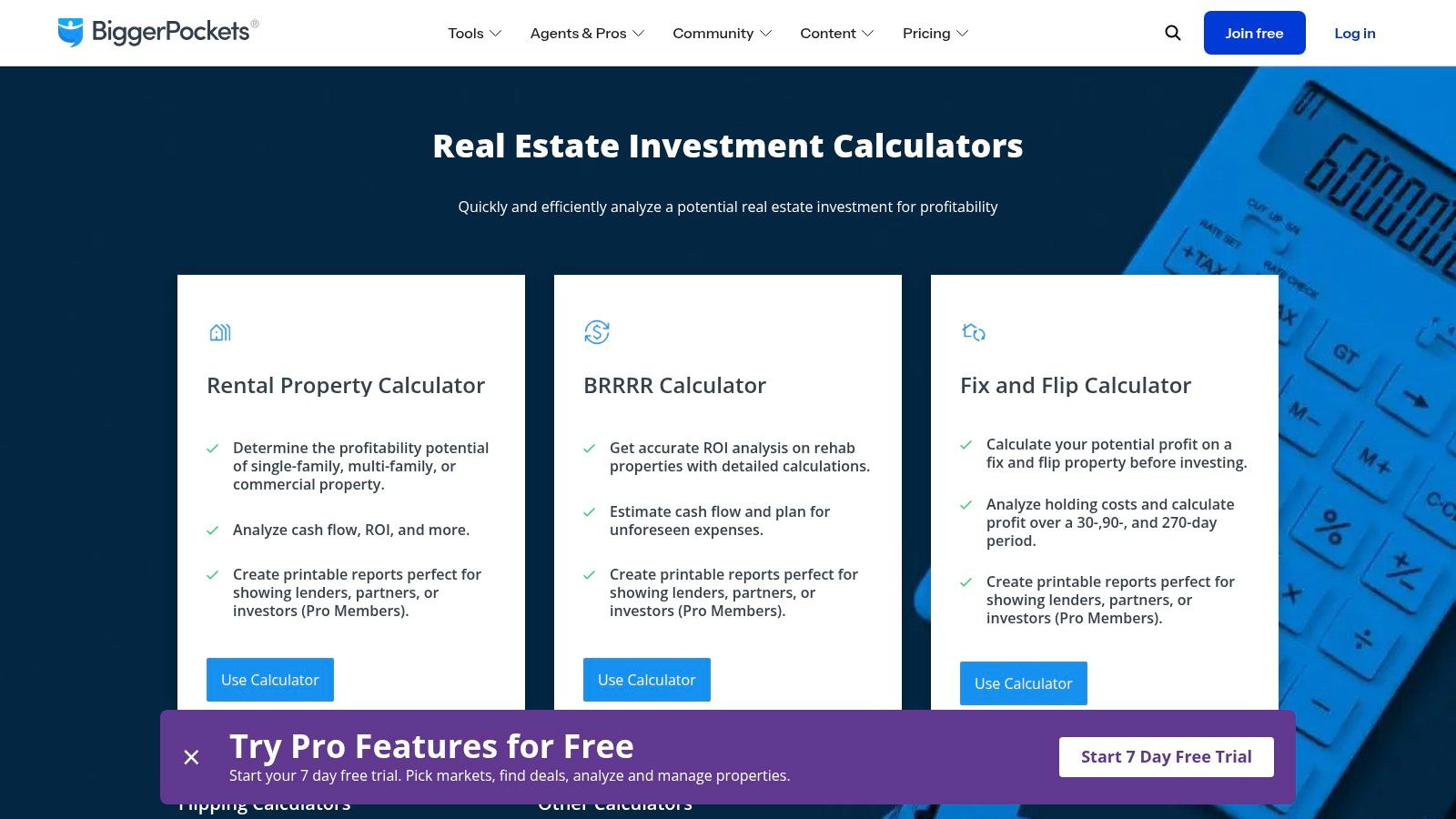

How do BiggerPockets Calculators support new investors?

The BiggerPockets Calculators are a suite of web-based tools integrated into a large real estate investor community, designed for clear analysis of common investment strategies. They are excellent educational and practical real estate investment analysis tools for new and intermediate investors, offering dedicated calculators for rentals, BRRRR, fix-and-flips, and wholesaling.

Its primary advantage is the symbiotic relationship with the BiggerPockets ecosystem of forums and podcasts, making the calculators a gateway to learning and community validation.

Key Features

- Strategy-Specific Calculators: Tailored tools for rental, BRRRR, fix-and-flip, and Airbnb analysis.

- Community Integration: Connected to BiggerPockets forums for context and support.

- Printable Reporting: Generates simple, professional PDF reports summarizing key metrics.

- Educational Focus: The workflow teaches the fundamentals of deal analysis.

Limitations & Target Audience

Basic calculator access is free. Unlocking unlimited reports requires a BiggerPockets Pro membership for $39 per month. The primary limitation is its simplicity; it lacks the advanced, multi-scenario modeling of professional-grade underwriting software.

What is Stessa's role in portfolio management?

Stessa is a rental property finance platform for landlords to track, manage, and optimize their real estate portfolios. Its primary function is automating income and expense tracking by linking directly to bank accounts, positioning it as a practical tool for ongoing asset management rather than pre-acquisition underwriting.

The platform simplifies bookkeeping and tax preparation, organizing transactions into IRS-friendly categories and offering a dashboard view of portfolio performance, tracking metrics like net cash flow and return on equity.

Key Features

- Automated Financials: Connects to financial institutions to automatically import and categorize transactions.

- Performance Dashboards: Visualizes key metrics like NOI, cash flow, and valuation.

- Document Management: Provides secure cloud storage for leases, receipts, and closing statements.

- Tax-Ready Reporting: Generates income statements and other reports that streamline tax filing.

Limitations & Target Audience

Stessa's core platform is free for unlimited properties, with paid tiers starting around $20 per month for advanced features. Its main limitation is its focus on post-purchase management; its pre-acquisition analysis capabilities are less robust than dedicated deal analyzers.

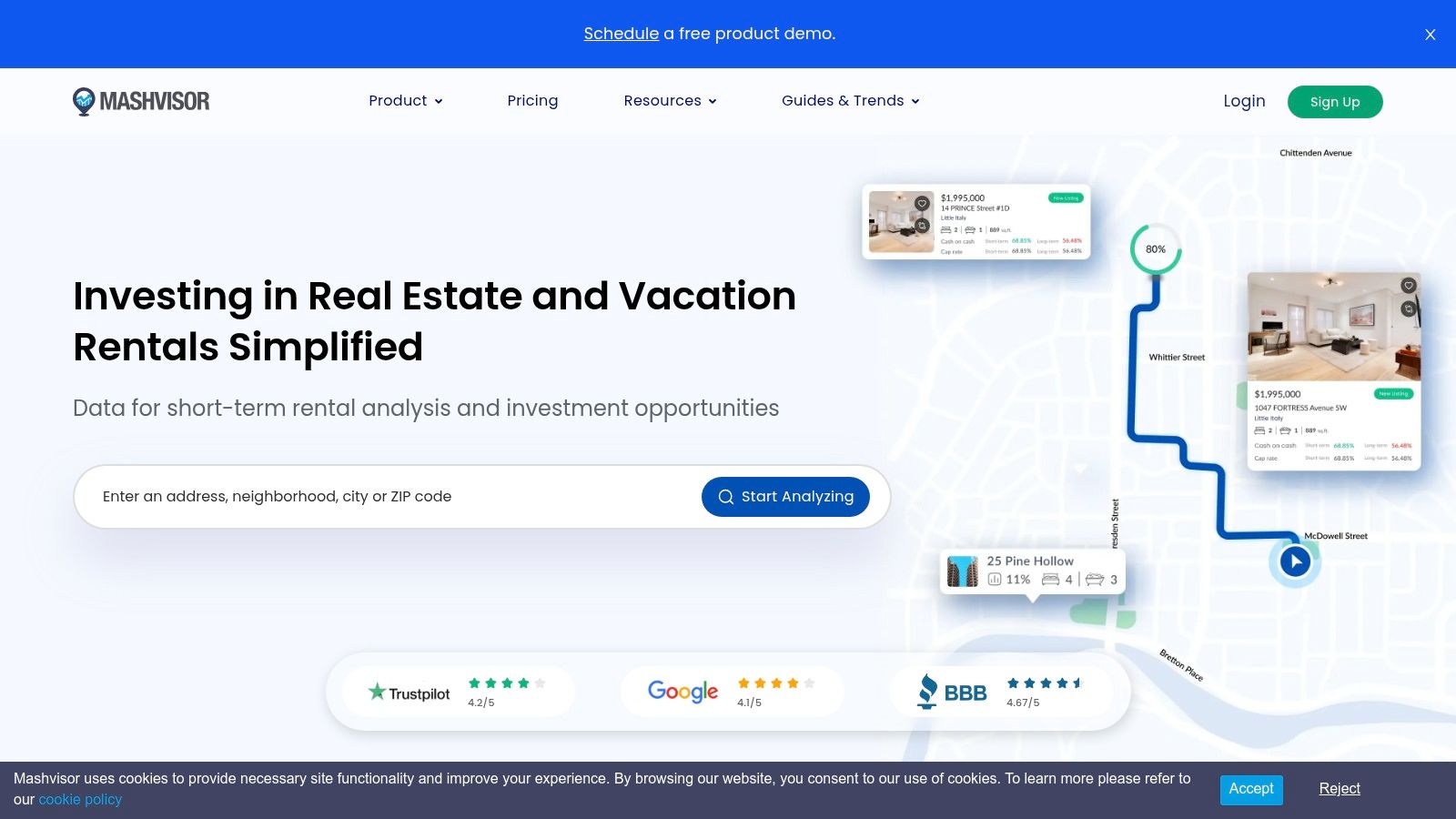

How does Mashvisor compare rental strategies?

Mashvisor is a specialized analytics platform for investors targeting residential properties, with a strong emphasis on comparing long-term versus short-term rental (STR) strategies. It excels at market-level analysis, allowing users to scan neighborhoods using visual heatmaps to identify opportunities based on cash flow potential from traditional and Airbnb-style rentals.

Its core value is aggregating and presenting complex rental data in an easily digestible format. You can explore how platforms like Mashvisor leverage large datasets in our overview of real estate data analytics.

Key Features

- Market Finder & Heatmaps: Visually search U.S. markets using filters like listing price and CoC return.

- STR vs. LTR Analytics: Provides side-by-side financial projections for properties, modeling them as either a traditional rental or an Airbnb.

- Mashmeter Scoring: A proprietary algorithm that scores a property's investment potential.

- API Access: Offers data access for proptech companies.

Limitations & Target Audience

Mashvisor offers subscription plans starting around $49 per month, often requiring longer-term commitments. Some users report mixed experiences with customer support and clarity around trial periods.

Why is PropStream used for deal sourcing?

PropStream is a data-driven lead generation platform designed to fuel the top of the investment funnel. It provides nationwide property data, MLS records, and marketing tools to help investors find and contact property owners, excelling at identifying viable off-market opportunities.

The platform allows users to build highly targeted marketing lists based on over 120 unique filters, such as pre-foreclosure status or high equity. Dive deeper into how platforms like this utilize a real estate data API on batchdata.io.

Key Features

- Nationwide Data Access: Combines public records, MLS data, and private sources.

- List Builder & Marketing: Advanced filters to create targeted lead lists with integrated skip tracing and direct mail.

- Comps & Value Estimation: Provides sales comps and a proprietary value estimate.

- Mobile Functionality: A robust mobile app allows for driving for dollars and lead management.

Limitations & Target Audience

PropStream's primary plan is around $99 per month, with add-ons for marketing. Its financial analysis is basic; it provides comps but lacks the detailed underwriting of dedicated analysis software. It is best used for acquisition and initial vetting.

Who benefits from the Roofstock marketplace?

Roofstock is an online marketplace for buying and selling single-family rental (SFR) properties, many already tenant-occupied. It combines a property marketplace with embedded analytics, making it ideal for remote investors seeking turnkey assets.

Its core value is streamlining the acquisition of cash-flowing properties by integrating analysis directly into the purchase process. Users can browse vetted listings, view underwriting dashboards, and make an offer on the site.

Key Features

- Turnkey Marketplace: Access to a curated inventory of certified, often tenant-occupied, SFR homes.

- Integrated Due Diligence: Each listing includes inspection reports, valuation estimates, and financial projections.

- Analytics Dashboards: Interactive tools to analyze potential returns, including gross yield and net cash flow.

- Post-Acquisition Support: Offers connections to vetted property managers and lenders.

Limitations & Target Audience

Buyers pay a marketplace fee of 0.5% of the contract price (or $500), and sellers pay a 3% commission (or $2,500). The main limitation is that inventory is confined to the properties listed on their platform.

What is the advantage of RealData's Excel-based models?

RealData provides Excel-based software for serious real estate investment analysis, making its templates a staple for analysts and brokers who require transparent, auditable financial models. It specializes in detailed underwriting for multifamily, commercial-industrial, and development projects, offering a depth that many web-based tools lack.

Its core value is delivering institutional-grade modeling without recurring subscription fees. Users purchase a specific software package and own it outright. Learn more at www.realdata.com.

Key Features

- Property-Specific Models: Dedicated software for multifamily (REIA Pro), commercial, and development projects.

- Excel-Native Environment: All models operate within Microsoft Excel for maximum flexibility and control.

- One-Time Purchase: Avoids the SaaS subscription model.

- Comprehensive Reporting: Generates detailed reports from APOD statements to partnership return analysis.

Limitations & Target Audience

Software is sold via a one-time license, with prices ranging from $199 to over $1,495. The primary limitation is its spreadsheet-centric interface, which lacks a modern UX. It is also Windows-first and not a native macOS application.

Why is ARGUS the standard for commercial real estate?

Altus Group’s ARGUS is the institutional-grade standard for commercial real estate (CRE) valuation and cash-flow modeling. It is engineered for the deep, lease-by-lease underwriting required by asset managers, institutional investors, and large brokerage firms, making it one of the most powerful real estate investment analysis tools for complex, multi-tenant commercial properties.

Its strength is its granular, multi-tenant cash-flow engine, which allows for intricate scenario testing. Learn more at altusgroup.com.

Key Features

- Cash-Flow Engine: Provides detailed lease-by-lease financial modeling.

- Valuation & Scenario Testing: Supports multiple valuation methods and complex "what-if" analysis.

- Portfolio Governance: Offers centralized data and over 40 configurable reports.

- Cloud Integration: ARGUS Intelligence brings cloud capabilities for enhanced accessibility.

Limitations & Target Audience

ARGUS operates on a quote-based pricing model for institutional teams. Its primary limitation is its steep learning curve; proficiency is a specialized skill requiring dedicated training. It is overkill for simple residential analysis.

How does CREXI Intelligence integrate data and listings?

CREXI Intelligence is the data and analytics subscription layer built into the CREXI commercial real estate marketplace. It tightly integrates property data with active listings, making it highly efficient for brokers and investors focused on active deal sourcing.

Users can instantly access nationwide property records, over 13 million sales comps, and verified ownership contact information while browsing listings. Explore it at crexi.com/intelligence.

Key Features

- Integrated Data: Access property records, 13M+ sales comps, and owner contacts directly from listings.

- Interactive Map Overlays: Enrich underwriting with data layers like population density and traffic counts.

- Prospecting Workflow: Combines a CRE marketplace with intelligence tools.

- Portfolio Insights: Track and analyze owned property portfolios.

Limitations & Target Audience

CREXI Intelligence operates on a subscription model. Its premium pricing may be a barrier for infrequent users. A monthly credit system for exporting owner contact details can restrict high-volume outreach.

What is PropertyShark's strength in due diligence?

PropertyShark is a property research platform providing deep, parcel-level data for due diligence. It specializes in reports on ownership history, existing liens, building permits, and zoning information, with robust coverage in New York City and other major U.S. metropolitan areas.

Its core value is aggregating hard-to-find public records into a single interface. Investors use it to verify ownership, identify potential title issues, and build targeted marketing lists. Visit the official PropertyShark website.

Key Features

- Detailed Property Reports: Access comprehensive data including ownership, sales history, and liens.

- Foreclosure & REO Data: Provides regional pre-foreclosure, auction, and bank-owned property listings.

- Data List Builder: Create and export targeted mailing lists for direct marketing.

- Comparables: Find recent sales of similar properties to assist in valuation.

Limitations & Target Audience

PropertyShark operates on a subscription model with monthly report quotas. Its deep data coverage is not uniform nationwide, being strongest in major markets. Users must be mindful of report quotas to manage costs.

Why is Rentometer essential for rental analysis?

Rentometer is a specialized web platform focused on validating rental income assumptions. It delivers fast, hyper-local rent comparisons, making it an essential resource for investors and property managers who need to quickly determine market rates.

Its core value is speed and simplicity. Users input an address to receive an instant rent estimate and a map of nearby comparables. Find out more at www.rentometer.com.

Key Features

- QuickView Estimates: Instant rent analysis with average rent, median rent, and percentile data.

- Pro Reports: Generates detailed, branded PDF reports with comparable property details.

- Batch Processor: Upload a list of up to 500 addresses for large-scale rent analysis.

- Rent Yield Tracker: Compare current rents against market rates to identify opportunities for increases.

Limitations & Target Audience

Rentometer offers a free tier with limited searches. Paid plans range from $29 to $99 per year. Its main limitation is its singular focus; it is not a comprehensive financial modeling platform.

What is the best real estate investment analysis tool?

The "best" tool depends entirely on your primary bottleneck: data acquisition or financial analysis. No single platform excels at everything. The most effective investors build a tech stack that combines a foundational data engine with a specialized analysis application.

Data Acquisition Tools vs. Financial Analysis Software

| Feature | Data Acquisition Tool (e.g., BatchData) | Financial Analysis Tool (e.g., DealCheck) |

|---|---|---|

| Primary Goal | Find and qualify opportunities | Underwrite a known property |

| Core Function | Delivers raw property & owner data via API/bulk | Calculates metrics (CoC, IRR, Cap Rate) |

| Use Case | Fueling a deal pipeline, market research | Go/no-go decision on a specific deal |

| Output | Actionable lead lists, enriched datasets | PDF reports, pro forma projections |

How should you choose a real estate analysis tool?

Your selection process should be a strategic evaluation of your workflow's primary constraint.

- Solve a Data Problem First: If your biggest challenge is finding viable deals, identifying motivated sellers, or enriching property records, your bottleneck is data acquisition. Platforms like BatchData and PropStream provide the raw materials: comprehensive property details, owner information, and predictive analytics. For high-volume investors and proptech platforms, this data layer is non-negotiable infrastructure.

- Then Solve the Analysis Problem: If you have consistent deal flow but struggle with quick and accurate financial evaluation, your bottleneck is analysis. Tools like DealCheck and the BiggerPockets Calculators excel here. They take a known property and standardize the underwriting process, preventing costly calculation errors.

Building Your Technology Stack

The most sophisticated operators combine platforms to address both needs.

- Start with the Source: Secure a reliable, comprehensive data provider to fuel your deal pipeline. Your ability to scale is directly tied to the quality of your data.

- Layer on the Analysis: Integrate that data into a dedicated analysis tool. This could mean exporting a list from BatchData into DealCheck for quick underwriting or piping API data into a proprietary platform.

- Incorporate Advanced Evaluation: For comprehensive property evaluations, consider advanced tools like an AI Real Estate Property Analyzer to streamline data-driven decision-making and synthesize vast amounts of data into actionable insights.

The best real estate investment analysis tools are those that directly solve your most significant operational hurdle. By correctly identifying whether your core need is data acquisition or financial modeling, you can build a system that creates a seamless flow from discovery to decision.