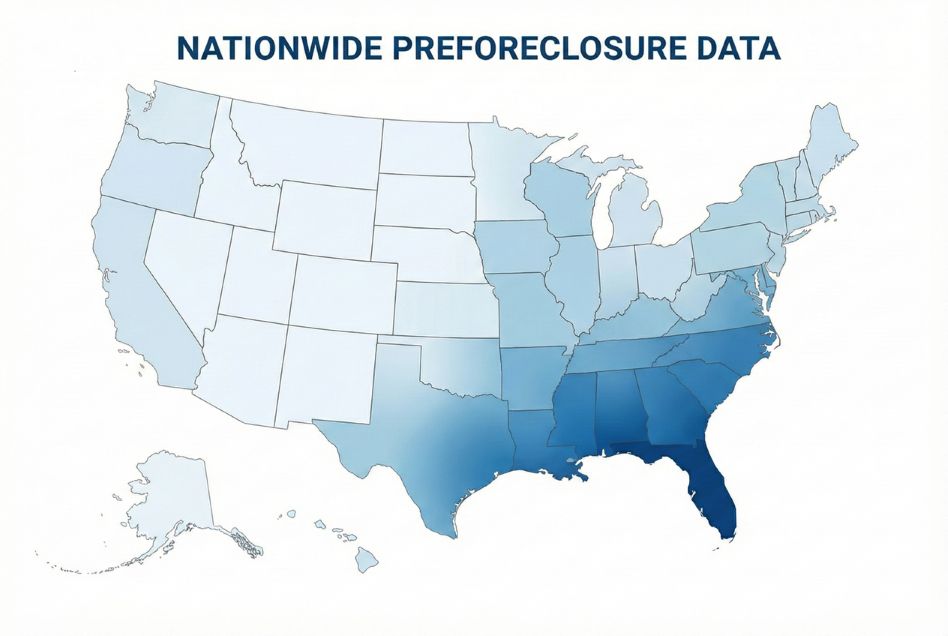

Turn Distressed Assets Into Your Next Opportunity

Access the most timely and comprehensive nationwide pre-foreclosure data, from initial default notices to scheduled auction details, and uncover opportunities weeks or months ahead of the competition

Daily

Updates

TRUSTED BY LEADING BRANDS

Understand the Foreclosure Lifecycle

Our data provides a detailed view into every stage of the foreclosure process, giving you the critical information needed to identify and act on opportunities as they emerge.

Notice of Default (NOD)

The initial public notice filed by a lender after a borrower misses payments, signaling the first stage of the foreclosure process.

Lis Pendens(LP)

A formal lawsuit filing that indicates a pending legal action involving the. property, typically a judicial foreclosure.

Notice of Sale(NTS/NFS)

The official announcement that apropenty wilbe soldatapublic auction, including the scheduled date, time, and location.

Real Estate Owned (REO)

Properties that do not sell at auction and are repossessed by the lender, becoming bank-owned inventory.

Timely & Comprehensive Coverage

Our pre-foreclosure data is sourced daily from thousands of counties nationwide, ensuring you have the freshest information on distressed assets

as s00n as it becomes public record.

Daily Updates from 3,200+ Sources

New filings are captured and processed within 24-48 hours.

Full Document Details.

Access key data points including default amounts, lenders, and trustees.

Complete Auction Information

Get scheduled auction dates, times, locations, and ninimum buds.

Explore Pre-Foreclosure Data Points

Our unified data model provides the granular details you need to evaluate distressed properties and make informed decisions quickly.

Filing & Status Details

- Document Type

- Case Number

- Document Number

- Recording & Filing Dates

- Current Status (NOD,TS)

- Release Date

Loan & Default Information

- Unpaid Balance

- Original Loan Amount

- Loan Number

- Past Due Amount

- Defaut Date

- Due Date

Key Parties

- Borrower Name

- Current Lender Name

- Attorney Information

- Trustee Name & Contact

- Trustao Salo Number

- Trustee Address

Auction Information

- Auction Date & Time

- Auction Location

- Auction City

- Minimum Bid Amount

- Contact Name

- Postponement Info

The Modern Advantage: Why Companies Switch to BatchData

Move beyond fragmented, slow, and incomplete data. Here’s why industry leaders are choosing our API-first platform.

Multi-Source Resilience

No single point of failure. Our blended intake from over 3,200 sources mitigates county outages, ensuring a continuous and reliable data flow for your business.

Operational Accuracy

Trust every record. We combine automated tests on every run with human-in-the-loop QA for edge cases, delivering enterprise-grade data quality.

Faster Time-to-Value

Onboard in days, not months. We accelerate your integration with data samples, expert mapping help, and prebuilt joins to get you to market faster.

Powering High-Value Strategies

Real Estate Investing

Find fix-and-flip or rental opportunities at a discount before they hit the open market.Target motivated sellers directly

Agents & Brokers

Identify potential listing opportunities by reaching out to distressed homeowners. Help buyers find undervalued properties at auction.

Mortgage & Lending

Offer refinancing or “rescue” loans to homeowners in early-stage default. Identify and ‘monitor at-risk loans in your portfolio.

Legal Services

Provide bankruptcy, foreclosure defense, or short sale assistance to property owners who have received a default notice.

Targeted Marketing

Market relevant services Like credit repair, moving companies, or cash-for-homes. directly to owners of distressed properties.

Institutional Analysis

Analyze defautt rates and foreclosure trends at a macro level to assess market health and portfolio risk.

Frequently Asked Questions

Our data is updated daily. New pre-foreclosure filings, such as Notices of Default and auction announcements, are typically available via our API within 24 to 48 hours of being recorded by the county, giving you a critical time advantage.

We provide comprehensive data across the entire pre-foreclosure lifecycle, including the initial Notice of Default (NOD) or Lis Pendens (LP), the announcement of the Notice of Trustee Sale (NTS) or Foreclosure Sale (NFS), and detailed auction information.

Yes. When a property is scheduled for auction, our data includes the auction date, time, location (address), the minimum bid amount, and contact information for the trustee handling the sale, where available.

Yes, our database contains a deep historical archive of foreclosure filings. This allows you to analyze trends over time, research the history of a specific property, or identify patterns in default activity at a market level.

We aggregate data directly from thousands of county recorder offices, courts, and other official government sources across the nation. Our technology then standardizes and verifies this data to deliver a clean, accurate, and consistent dataset.

Turn Data into DecisionS

Get personalized assistance tailored to unique needs and discover how to leverage rich data for maximum impact.