API integration for tax data saves time, reduces errors, and lowers costs for businesses dealing with property tax information. By automating data retrieval through APIs, companies can eliminate manual processes, improve accuracy, and handle large volumes of data efficiently. APIs provide quick access to property tax details like assessed values, annual taxes, and jurisdiction codes across 155+ million U.S. properties, ensuring reliable and consistent information.

Key Benefits:

- Lower Labor Costs: Automation replaces manual tasks like data entry and report formatting, freeing up staff for higher-value work.

- Fewer Errors: Built-in validation ensures accurate, up-to-date tax data, reducing costly mistakes.

- Scalability: APIs handle growing data demands without additional staff or infrastructure.

BatchData offers flexible pricing starting at $500/month for 20,000 records, with options for custom datasets and bulk data delivery. Their solution simplifies tax data management, making it faster and more cost-effective for businesses to access and utilize property tax information.

Cost Benefits of Tax Data API Integration

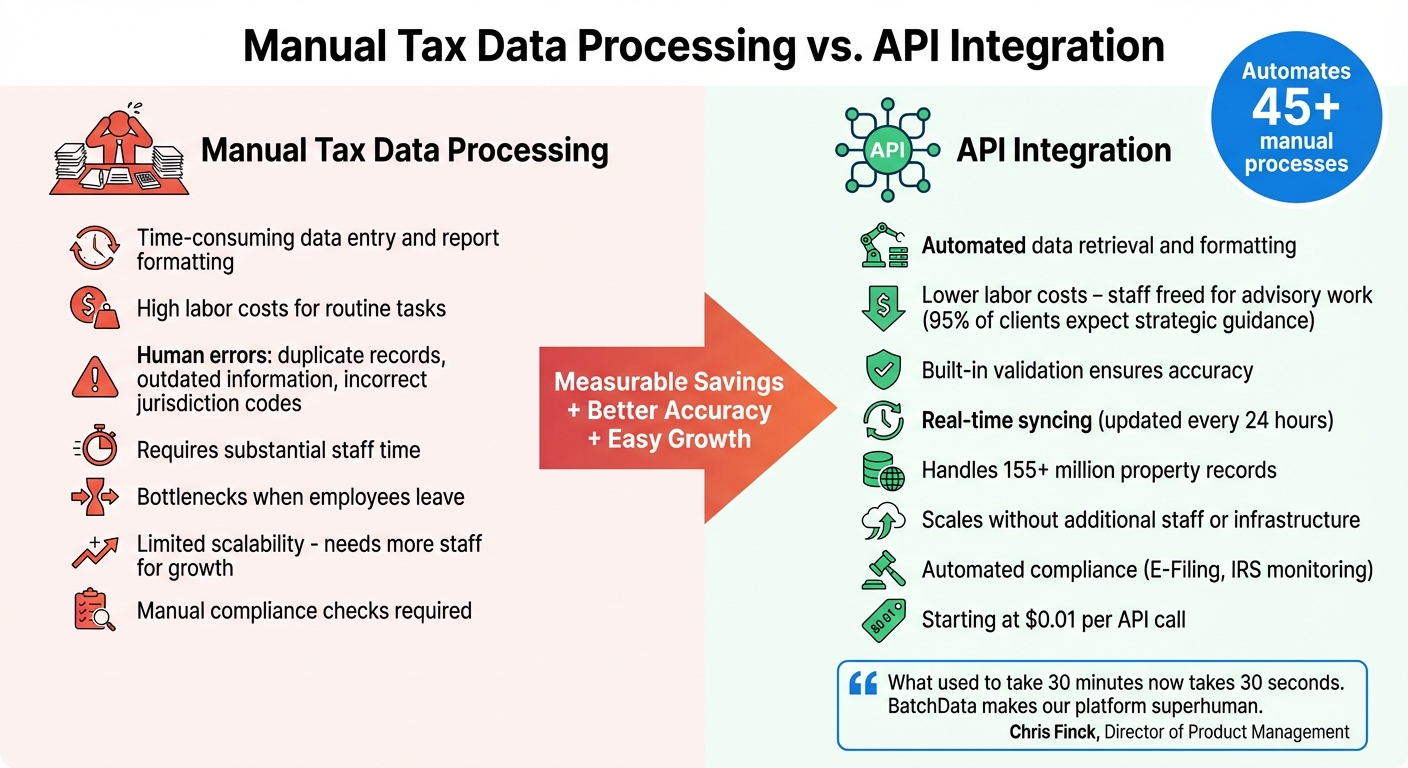

Cost Comparison: Manual Tax Data Processing vs API Integration

Shifting from manual tax data collection to API integration can significantly lower labor costs, reduce expenses tied to errors, and easily adapt to increased transaction volumes. These improvements translate into measurable savings, better accuracy, and the ability to grow without added strain.

Lower Labor Costs and Faster Processing

Manual tax workflows often require substantial time and effort from staff. Tasks like retrieving client lists, formatting reports, and cleaning up spreadsheets can eat up hours that could be spent on more valuable work. By using APIs, businesses can streamline these processes. APIs serve as a central data hub, automatically feeding information into multiple systems. This automation frees up staff to focus on high-value services, such as advisory roles, which are increasingly in demand – nearly 95% of tax professionals say clients now expect strategic guidance.

"APIs can increase efficiency and reduce redundancy by enabling disconnected systems to work together to compare data sets. This helps accountants automate tasks that bog down productivity."

- Dustin Teribery, API Sales Specialist, Thomson Reuters

Automation also takes over routine compliance tasks like E-Filing and IRS monitoring, eliminating the need for manual checks. For instance, BatchData’s mortgage and lien data API starts at just $0.01 per call, highlighting how automation can offer a cost-effective alternative to manual processes.

Fewer Errors and Lower Error-Related Costs

Beyond labor savings, reducing human error is another major benefit. Manual data entry and CSV uploads often lead to duplicate records, outdated information, or incorrect jurisdiction codes, all of which require time and money to fix. APIs minimize these risks by incorporating built-in validation for critical elements like addresses, tax jurisdictions, and identification numbers. Real-time syncing – usually updated every 24 hours – ensures that tax rates and billing decisions remain accurate across all regions and product categories. This level of precision is vital, as even a single tax calculation error can disrupt transactions, delay invoices, and strain client relationships.

"Calculating tax rates manually or through CSV uploads can lead to costly human errors that hurt your relationships with customers and/or suppliers and lead to lost revenue."

- Jon Gitlin, Senior Content Marketing Manager, Merge

Scalability Without Proportional Cost Increases

APIs are built to handle increasing data demands without requiring more staff or infrastructure. With pre-built connectors, businesses can integrate systems using drag-and-drop tools, bypassing the need for specialized developers. This ensures continuity, as API-driven workflows reduce reliance on individual employees’ knowledge, preventing bottlenecks when team members leave. APIs also offer modular flexibility, allowing businesses to add new software or third-party tools to their tech stack without disrupting operations. Many integration platforms connect to thousands of web services, providing extensive functionality with minimal manual effort. Since providers have already invested in development, businesses can take advantage of these integrations without needing extra IT resources.

BatchData‘s API Solutions for Tax Data Integration

BatchData takes the hassle out of tax data integration with tailored solutions designed to simplify processes and boost efficiency. Their platform ensures uninterrupted access to a vast database of property records, even during local outages, making it a reliable choice for businesses.

BatchData’s system taps into 155+ million U.S. property records sourced from over 3,200 locations, delivering a steady stream of data. This reliable infrastructure powers their real-time tax data solutions, which are outlined below.

Real-Time Property Tax Data Access

BatchData’s REST API enables on-demand access to property tax information with minimal delay. Key data points include assessed values, tax amounts, tax years, and Assessor’s Parcel Numbers (APNs). The Core Property dataset alone offers over 240 data points, covering tax assessor records, building details, and legal descriptions – all accessible in a single API call. With daily updates and a 99.99% uptime SLA, businesses can count on accurate and up-to-date tax data when they need it most.

"What used to take 30 minutes now takes 30 seconds. BatchData makes our platform superhuman."

- Chris Finck, Director of Product Management

Flexible Pricing Models

BatchData provides tiered monthly plans to suit different business needs, starting at $500 per month for 20,000 property records. Here’s a quick breakdown:

- Lite Plan: $500/month for API access and Core Property Data (20,000 records).

- Growth Plan: $1,000/month for 100,000 records.

- Professional Plan: $2,500/month for 300,000 records.

- Scale Plan: $5,000/month for 750,000 records.

For businesses with specific needs, additional datasets like Property Valuation ($150–$1,500/month) and Deed History ($50–$1,000/month) can be added without committing to bundled packages. If skip tracing or contact enrichment is required, pay-as-you-go options provide flexibility with no monthly contracts.

Custom Datasets and Professional Services

BatchData’s professional services team takes care of legacy system migrations, handling data mapping and normalization to lighten the load on internal teams. By delivering data directly to platforms like Snowflake, BigQuery, or Databricks, they eliminate the need for complex ETL infrastructure. Businesses can start working with standardized datasets right away.

Additional services include system audits, custom dataset creation, and match-and-append capabilities to fill in missing tax or ownership details. For large-scale projects like analytics or machine learning, BatchData supports bulk data delivery via AWS S3 or SFTP, offering scheduled updates and historical snapshots that integrate seamlessly into existing workflows.

How to Implement Tax Data API Integration

Integrating a tax data API can streamline operations and help manage costs effectively. Here’s a practical guide to ensure your integration is both efficient and reliable. These steps combine technical precision with cost-conscious strategies.

Choosing the Right Tax Data API

Start by selecting a RESTful API that uses predictable URLs and JSON responses. This format works smoothly with popular programming languages like Python, PHP, Node.js, and Ruby. For secure communication, ensure the API uses API key authentication via custom HTTP headers (e.g., "apikey") and requires all requests to be sent over HTTPS.

Look for an API that offers nationwide coverage across all U.S. tax jurisdictions – some solutions cover over 12,000 jurisdictions, eliminating the need to piece together multiple data sources. Specialized endpoints, such as /price for real-time tax calculations or /tax_rates for jurisdiction-specific data, can simplify your workflows. Before committing, test the API in a sandbox environment. This allows you to validate authentication and transaction processes without incurring production costs.

Automating Workflows to Reduce Overhead

Automation begins with efficient data retrieval. Use the fields parameter to request only the data you need, enabling server-side aggregation and reducing the load on your client system. For handling large datasets, implement pagination with parameters like page[size] and page[number] to prevent timeouts and manage memory usage effectively.

Error handling is another critical component. Handle HTTP response codes like 429 (rate limiting) and 304 (caching) to optimize bandwidth and processing power. Use filters in your API calls, such as filter=record_date:gte:2024-01-01, to ensure you’re working with current and relevant data. Additionally, map your internal item codes to standardized tax codes early in the process. This step automates tax calculations across various product categories, reducing the need for manual intervention.

Tracking Usage to Control Costs

Accurately tracking API usage is key to managing costs. Monitor the meta object for metrics like total-count and total-pages to gauge your data consumption. Pay attention to your call ratios – specifically, the ratio of calculation and address validation calls to committed documents. This helps you avoid unnecessary API usage fees.

| Parameter | Function | Cost Benefit |

|---|---|---|

fields | Limits response to specific data points | Reduces payload size and triggers server-side aggregation |

filter | Returns only records matching criteria | Minimizes data processing and transfer |

page[size] | Sets number of rows per request | Prevents memory overloads and manages data flow |

Finally, implement back-off logic for rate limits. If you receive a 429 response code, configure your system to pause and retry instead of continuing to send failed requests. This approach helps conserve resources and ensures smoother API interactions.

sbb-itb-8058745

Measured ROI and Cost Savings Examples

Cost Comparison Before and After Integration

Integrating a tax data API delivers undeniable financial advantages by automating more than 45 manual processes. This shift not only reduces non-billable hours but also allows teams to dedicate more time to advisory and strategic tasks. The result? Tangible ROI and noticeable cost savings.

Before automation, manual data entry processes were prone to errors and required more staff to manage. With API integration, real-time data syncing becomes seamless, enabling businesses to scale operations without a matching rise in costs. Modern cloud-based tax APIs handle billions of calls each year, offering scalability without driving up compliance expenses. By lowering labor costs and minimizing errors, these integrations enhance overall efficiency while cutting unnecessary expenses.

Examples of Successful API Implementations

The financial benefits of API integration are clear in real-world applications. Companies that have adopted these systems have streamlined tax calculations and compliance processes, leading to significant cost reductions. Automation not only lowers the risk of expensive errors but also allows teams to shift their focus to high-value financial strategies, boosting productivity and operational effectiveness.

Additionally, advanced security measures ensure client data remains protected. By consolidating information into a unified system, these integrations simplify data management and reduce the costs associated with maintaining multiple platforms.

Conclusion

Integrating tax data APIs has transformed how property data is managed, offering businesses a way to significantly reduce labor costs, limit mistakes, and scale operations without a proportional increase in expenses. BatchData is a standout example of these advantages, offering solutions designed to meet these needs.

BatchData provides access to detailed tax assessor information for over 155 million U.S. properties, with more than 240 data points per property. Impressively, it boasts a 76% right-party contact accuracy rate – three times higher than the industry norm.

With flexible delivery methods, including real-time lookups via REST API or direct cloud delivery, BatchData eliminates the need for costly ETL processes. Their tiered pricing starts at $500 per month for 20,000 records, ensuring businesses only pay for what they actually use.

One satisfied client shared their experience:

"What used to take 30 minutes now takes 30 seconds. BatchData makes our platform superhuman."

- Chris Finck, Director of Product Management

This integration isn’t just about convenience – it delivers measurable returns and boosts operational efficiency, no matter the scale.

FAQs

How can API integration help lower labor costs in tax data management?

API integration simplifies tax data management by automating essential tasks such as data extraction, calculations, and transfers. This automation not only reduces the reliance on manual data entry but also frees up staff from spending time on repetitive processes.

Additionally, APIs eliminate the need for extensive in-house development and ongoing maintenance, which can significantly lower operational costs. With these savings, your team can concentrate on more strategic, higher-priority tasks, ultimately boosting efficiency while cutting labor expenses.

How does API integration ensure accurate tax data and minimize errors?

API integration plays a key role in maintaining precise tax data by blending secure technology, thorough testing, and built-in validation tools. Secure authentication methods – like API keys and HTTPS encryption – help guard against unauthorized access while ensuring the integrity of the data being exchanged. To further streamline operations, error-handling features, such as detailed status codes and validation flags, enable developers to quickly spot and resolve issues before they escalate.

Many APIs also offer testing environments, allowing teams to simulate various scenarios without impacting live data. These controlled spaces, combined with practices like integration testing and data validation scripts, help identify potential problems early on. Platforms like BatchData take accuracy a step further by cross-referencing property and ownership records from multiple sources, flagging any inconsistencies for review. By using these tools and strategies, organizations can ensure their tax data workflows remain dependable and free of errors.

How does BatchData’s pricing model support businesses with different tax data needs?

BatchData provides a range of pricing plans designed to suit different business needs. The Lite plan starts at $500 per month and includes 20,000 records, while the Scale plan offers 750,000 records for $5,000 per month. For businesses with larger demands or unique requirements, there are custom Enterprise solutions and pay-as-you-go options available.

This flexibility ensures businesses can select a plan that matches their tax data integration needs and budget.