SEO Title: Title Company Fees Explained: A Guide for Investors

Meta Description: A complete guide to title company fees. Learn what they are, how they're calculated, and proven strategies to negotiate and reduce your closing costs.

Meta Keywords: title company fees, title fees, real estate closing costs, what are title fees, negotiate title fees, title insurance cost, settlement fees

Title company fees are the unavoidable closing costs that shield your real estate investment from hidden legal and financial claims that could otherwise lead to a total loss. These fees cover a package of non-negotiable services, including a deep historical title search and a one-time insurance premium, that verify the seller's legal right to transfer the property to you, free and clear. The national average cost is approximately $1,900 per transaction, or between 0.5% and 1.0% of the property's sale price.

- What they are: A bundle of service fees for verifying legal ownership and insuring a property title against future claims.

- What they cover: Title search, title insurance, escrow services, and document recording.

- Who pays: Varies by location but is always negotiable; buyers typically pay for lender's insurance, while owner's insurance is often paid by the seller.

- How to save: Shop for providers, ask for a "reissue rate," and scrutinize your statement for junk fees.

This guide breaks down every line item, explains who pays for what, and details actionable strategies to reduce these mandatory costs.

What do title company fees actually cover?

Title company fees pay for the legal and administrative services required to ensure a property's title—the legal right to own it—is legitimate and can be transferred without future disputes. The title company's primary function is to guarantee the seller has the undisputed right to sell the property, clear of any hidden debts, claims, or ownership conflicts. These services mitigate catastrophic financial risk, as an unforeseen claim like a forged deed or an unknown heir could trigger legal battles costing tens of thousands or even result in the loss of the property.

Core Fee Categories

The total fee is a bundle of distinct services, each playing a critical role in securing the transaction. According to a study from First American Financial Corporation, these combined title and settlement fees account for less than 1% of a borrower's total mortgage expenses over the loan's lifetime. More information on this data is available at firstam.com.

| Fee Category | Core Purpose | Protects Against |

|---|---|---|

| Title Search & Examination | Researching public records to verify the property's legal history. | Undisclosed heirs, forged documents, illegal deeds, and past fraud. |

| Title Insurance Premiums | Issuing policies that protect the new owner and lender from future title claims. | Liens, encumbrances, and ownership disputes missed in the search. |

| Escrow & Closing Fees | Acting as a neutral third party to hold and disburse funds and manage documents. | Mishandling of funds, improper document execution, and transaction fraud. |

| Recording & Notary Fees | Filing the new deed and mortgage with the county and notarizing signatures. | Unofficial property transfer, document invalidity, and public record errors. |

Each service layer works in concert to produce a legally sound real estate transfer, protecting both the buyer's equity and the lender's collateral. For more on the insurance component, see our guide on lender's title insurance in our related guide.

How are title fees calculated and who pays them?

The final title fee is calculated based on the property's purchase price, the loan amount, and state-specific regulations; it is not a flat rate. The core principle is risk-based pricing: a higher-value property or one with a complex ownership history represents a greater financial risk to insure, thus commanding a higher fee. The two largest components influencing the cost are the Lender's and Owner's Title Insurance policies, whose premiums are often set by state insurance commissions and scale directly with the transaction's value. A $500,000 property will have a higher insurance cost than a $250,000 one because the liability is greater.

Core Calculation Factors

- Purchase Price: The primary driver for the Owner's Title Insurance premium.

- Loan Amount: The basis for the Lender's Title Insurance premium, protecting the lender's financial stake.

- State Regulations: Title insurance rates are highly variable by state. Some states have government-promulgated rates, while others allow for competitive pricing.

- Property History: A complex ownership history with multiple liens or transfers requires more extensive research, increasing the title search and examination fees.

The stability of title company fees, even when the market is a rollercoaster, provides a predictable cost anchor for investors. Title searches average around $200, but when you bundle in underwriting and settlement services, you're typically looking at 0.5% to 1.0% of the loan amount—a critical metric for any financial model.

Real estate professionals leverage comprehensive platforms like BatchData, which provide detailed lien and ownership histories to streamline due diligence and forecast these unavoidable costs accurately. For historical context, refer to this report on title insurance testimony.

Who Pays The Bill: Buyer or Seller?

Who pays for title fees is determined by local custom and is a negotiable point in the purchase agreement. There is no universal rule, creating a patchwork of norms across the United States. In a buyer's market, the seller may be convinced to cover costs traditionally paid by the buyer, while the reverse is true in a seller's market.

| Fee Type | Typically Paid by the Buyer | Typically Paid by the Seller | Often Split or Negotiable |

|---|---|---|---|

| Owner's Title Insurance | ✔ | ✔ (Varies by state) | |

| Lender's Title Insurance | ✔ | ||

| Escrow/Closing Fee | ✔ | ✔ (Often 50/50 split) | |

| Title Search Fee | ✔ | ✔ | ✔ (Varies by custom) |

| Recording Fees (Deed) | ✔ | ||

| Recording Fees (Mortgage) | ✔ |

Can you provide a breakdown of every line item?

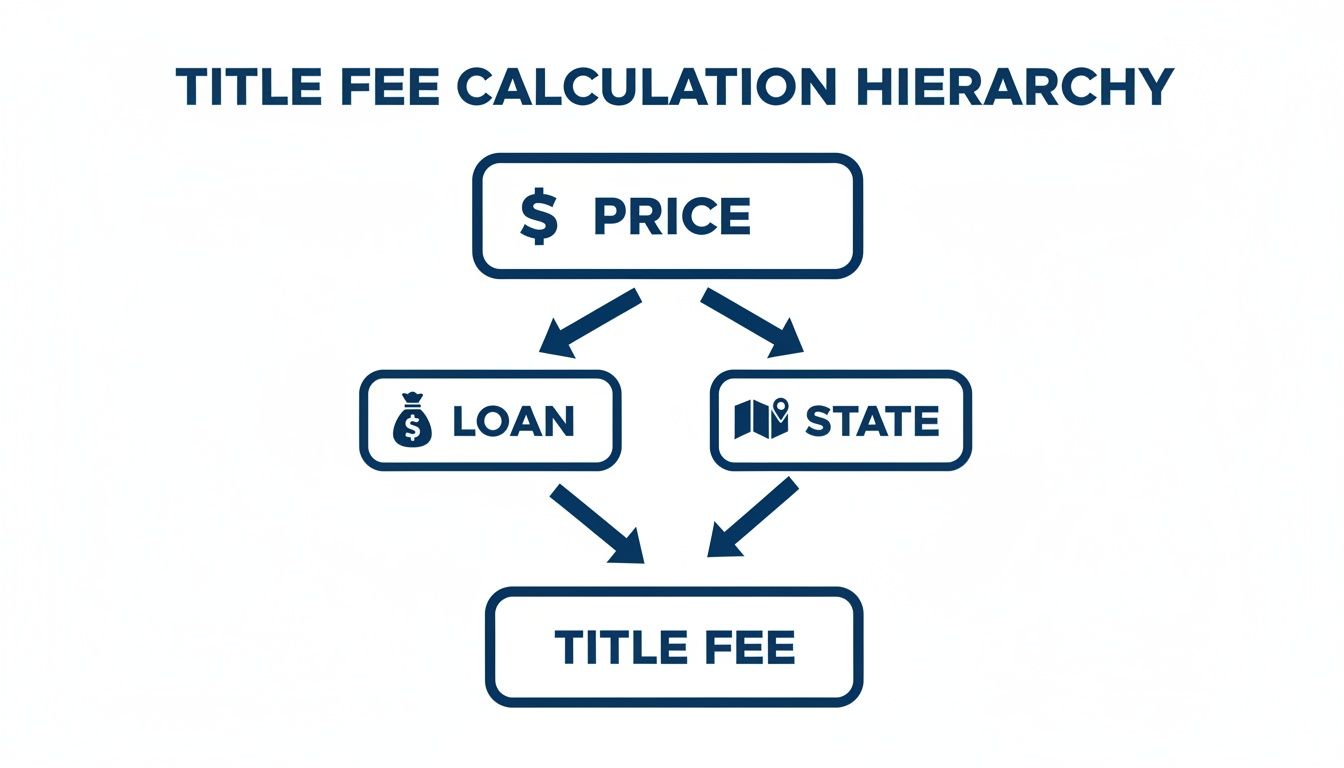

Yes, a settlement statement contains several distinct title company fees, each corresponding to a specific service. Understanding these line items removes the ambiguity from your closing costs. The calculation hierarchy is driven by the property's price, the loan amount, and state-level regulations.

This structure ensures that the fees scale directly with the transaction's value and the legal framework governing it.

Title Search and Examination Fees

This fee pays for a professional title examiner to conduct a deep-dive investigation of public records, including deeds, court filings, and property indexes. The objective is to verify the seller's legal right to sell and identify any "clouds" on the title that could jeopardize ownership.

Defects uncovered during this process can include:

- Outstanding mortgages or liens from unpaid taxes or contractors.

- Easements granting others the right to use part of the property.

- Pending legal actions like bankruptcies or divorce proceedings.

- Errors or forgeries in past deeds that could invalidate the chain of ownership.

Title Insurance Premiums: Lender and Owner

Title insurance is a one-time fee that protects against financial loss from past events that the title search may have missed, such as fraud or recording errors. It is fundamentally different from other insurance types that cover future events.

- Lender's Title Insurance: This is mandatory for any transaction involving a mortgage. It protects the lender's investment up to the loan amount, ensuring their collateral is secure against title defects.

- Owner's Title Insurance: This policy protects the buyer's equity and legal right to the property. It provides coverage for as long as the owner or their heirs hold the title. Learn more about the cost and value of owner's title insurance.

The combined cost for both policies typically ranges from 0.5% to 1.0% of the property's purchase price.

Escrow and Closing Fees

This charge, also known as a settlement fee, pays the title company to act as a neutral third party managing the exchange of funds and documents between the buyer, seller, and lender.

The escrow officer’s role is to ensure that every condition of the purchase agreement is met before the property and money officially change hands. This prevents fraud and ensures all parties fulfill their obligations.

This fee covers critical administrative tasks, including holding earnest money, preparing the Closing Disclosure (CD), paying off the seller's existing mortgage, prorating taxes, and ensuring all documents are executed correctly.

Miscellaneous Recording and Notary Fees

This category includes smaller, non-negotiable administrative costs required to legally finalize the transaction.

- Recording Fees: Charged by the local government (typically $125 to $250) to officially record the new deed and mortgage in public land records, making the ownership transfer public.

- Notary Fees: Pays a licensed notary public to witness signatures, verify identities, and prevent fraud.

- Courier and Wire Fees: Covers the transactional costs of transporting physical documents or wiring funds electronically.

Understanding these costs in the broader context of professional services, like the IRS regulations surrounding attorney fees, helps clarify their legal and financial necessity.

How can I reduce and negotiate my title company fees?

While state-regulated title insurance premiums are non-negotiable, many ancillary service charges like closing, settlement, and document prep fees are set by the title company and can be reduced. A strategic approach can save hundreds or even thousands of dollars. The key is to differentiate between regulated insurance rates and competitive service fees.

Shop for Title and Settlement Services

The most effective cost-reduction strategy is to shop around. The Real Estate Settlement Procedures Act (RESPA) grants you the legal right to choose your own title company. You are not obligated to use the "preferred" partner of your lender or real estate agent. Obtain itemized quotes from at least three different title companies to compare their operational service fees directly.

Request a Reissue Rate

If the property was sold within the last 10 years, you are likely eligible for a reissue rate or reissue credit. This discount exists because a prior title policy is already in place, meaning the title company only needs to update the existing search rather than conduct a full historical one from scratch.

The reissue rate is not always offered proactively—you must ask for it. This discount can reduce the owner's title insurance premium by up to 40%, representing one of the largest potential savings available.

Bundle Services

Using the same company for both title insurance and closing services often results in a bundled discount. Title companies are incentivized to handle the entire transaction and may reduce their settlement fee to secure your business. When requesting quotes, explicitly ask if they offer a discount for bundling services.

Scrutinize the Settlement Statement for Junk Fees

Request your preliminary settlement statement, or Closing Disclosure (CD), at least three days before closing. Review it line by line and question any vague, duplicative, or excessive charges. Target ambiguous items like "processing fee," "email fee," or "courier fee" (if documents were handled digitally). Often, these "junk fees" can be reduced or eliminated entirely. For expert assistance in this review, leveraging affordable paralegal services can be a cost-effective strategy.

Standard vs. Negotiated Title Fee Comparison

| Fee Type | Standard Cost Example | Negotiated Cost Example | Potential Savings |

|---|---|---|---|

| Settlement/Closing Fee | $850 | $650 (Shopped around) | $200 |

| Owner's Title Insurance | $1,500 | $900 (Reissue Rate) | $600 |

| Document Prep Fee | $150 | $0 (Questioned as junk fee) | $150 |

| Courier Fee | $75 | $0 (Questioned as junk fee) | $75 |

| Total Potential Savings | $1,025 |

A few hours spent making phone calls and reviewing documents can yield over $1,000 in direct savings.

Why do title fees matter for Proptech and Lenders?

For proptech firms and lenders, title company fees are a critical data point representing the cost of risk, friction, and manual labor inherent in verifying property ownership. The traditional title search process is a significant operational bottleneck, often delaying closings for weeks. Modern data platforms that supply instant property and lien data address this pain point directly, enabling a proactive assessment of a property's history long before an official title search begins.

Build Trust Through Fee Transparency

In mortgage lending, unexpected costs at closing destroy borrower trust. Lenders and proptech companies that provide precise, upfront estimates of all closing costs, especially variable title company fees, gain a significant competitive advantage. Accurate initial Loan Estimates that align with the final Closing Disclosure build borrower confidence and mitigate TRID (TILA-RESPA Integrated Disclosure) compliance risks, which can trigger costly cures and operational failures.

For a lender, accurately predicting title fees is a direct measure of their operational control and data intelligence. Getting it right signals reliability to the borrower and reduces regulatory risk for the institution.

Automate Underwriting and Streamline Operations

The traditional title process is a major bottleneck that halts underwriting workflows. Automated data solutions provide a clear competitive edge by allowing lenders to integrate real-time property data APIs. This automation enables underwriting teams to:

- Instantly Flag High-Risk Properties: Automated systems can identify properties with new liens, ownership disputes, or active foreclosures, allowing for immediate escalation.

- Slash Manual Review Time: Underwriters can validate critical data points like ownership and mortgage history in seconds, not days.

- Reduce Turn Times: Faster preliminary reviews directly shorten closing cycles, a key performance indicator for any lending operation.

For more details on this industry shift, explore how proptech is transforming real estate operations.

Position Data as a Strategic Asset

Title company fees are a symptom of a fundamental information problem in real estate—the high cost reflects the manual effort required to assemble and verify decades of fragmented public records. Leading proptech and lending firms understand this and are investing in direct access to comprehensive property data. This allows them to build proprietary risk models, create hyper-accurate fee calculators, and design a fundamentally faster and more transparent closing experience. Understanding title fees is not just about paying a bill; it's about identifying an opportunity for data-driven market disruption.

What are the most frequently asked questions about title fees?

Here are direct answers to the most common questions about title company fees to help you navigate your next real estate transaction.

Are title company fees regulated by the government?

Yes and no. The title insurance premium is highly regulated at the state level by the Department of Insurance, which sets or approves rates to ensure fairness. This means the insurance policy cost itself will not vary significantly between companies within the same state. However, ancillary service fees—such as settlement, courier, or document prep fees—are set by individual companies and are not state-regulated. This is where shopping around creates savings. Federally, the Consumer Financial Protection Bureau (CFPB) enforces laws like RESPA, which mandate full cost transparency via the Loan Estimate and Closing Disclosure documents.

What is the difference between lender's and owner's title insurance?

The sole difference is who the policy protects. One policy protects the lender's financial interest, while the other protects the owner's equity. They are two separate policies covering different parties in the same transaction.

| Feature | Lender's Title Insurance | Owner's Title Insurance |

|---|---|---|

| Who It Protects | The mortgage lender only. | The property owner (you). |

| Is It Required? | Yes, by virtually all lenders. | No, it is optional but highly recommended. |

| Coverage Amount | Decreases as the loan is paid down. | Fixed at the purchase price; can grow with an inflation rider. |

| Payment | One-time premium at closing. | One-time premium at closing. |

| Purpose | Guarantees the lender's mortgage is the primary lien on the title. | Protects your financial stake and legal right to the property from past claims. |

Can a buyer choose their own title company?

Yes, absolutely. Section 9 of the Real Estate Settlement Procedures Act (RESPA) makes it illegal for a seller to require the use of a specific title company as a condition of sale. While your real estate agent or lender may recommend a preferred partner, you have the legal right to choose your own provider.

Shopping for title services is your right and your best tool for managing closing costs. Make it a rule to get at least three itemized quotes. This allows you to compare the unregulated service fees head-to-head, a move that could easily save you hundreds of dollars.

How do title issues affect a real estate deal?

A title issue, or a "cloud on the title," can halt a real estate closing until the defect is resolved through a process called "curing the title."

- Minor Issues: A typo on a deed or a small, unpaid utility lien can often be resolved within a few days or weeks, causing a manageable delay.

- Major Issues: The discovery of an unknown heir, a forged signature on a past deed, or a major unresolved lien can require months of legal work. These situations often lead to the deal's collapse, as the buyer may choose to walk away.

The title search and insurance process is designed specifically to identify and resolve these issues before you take ownership, ensuring you receive a "clear title."

At BatchData, we understand that accurate, accessible property data is the foundation of every successful real estate decision. Our platform provides the comprehensive lien, ownership, and property history details that empower proptechs, lenders, and investors to anticipate title complexities and streamline their entire workflow. By replacing legacy data systems with a modern, unified API, we help you make faster, data-driven decisions from acquisition to closing. To see how our data can transform your operations, visit BatchData.