Lender's title insurance is a non-negotiable policy that protects your mortgage lender’s financial investment in your property, paid for with a one-time fee at closing. It is a mandatory requirement for nearly every mortgage in the U.S. because it shields the loan itself from historical ownership claims, fraud, or hidden liens that could threaten the lender's collateral. Without this policy, the risk of a flawed property title would make most mortgage lending impossible.

Here's the direct value: this policy guarantees the lender's loan holds the primary legal claim on the property. This security allows financial institutions to lend confidently and sell mortgages on the secondary market, which is the engine that maintains liquidity in the U.S. housing system.

| Key Takeaway | Impact for You (the Borrower) |

|---|---|

| Protects the Lender | You pay for it, but it does not cover your equity or down payment. |

| Covers Past Issues | Guards against undiscovered historical defects, not future problems. |

| Mandatory Requirement | You cannot get a mortgage without it. |

| One-Time Cost | The premium is paid once at closing, typically 0.5%–1% of the loan amount. |

This guide breaks down exactly what the policy covers, what it costs, and why it's a critical component of every real estate transaction.

How does lender's title insurance actually work?

Lender's title insurance works by transferring the financial risk of historical title problems from the mortgage lender to a title insurance company. It is a backward-looking policy that indemnifies the lender against financial loss caused by undiscovered issues in the property's title history that existed before the loan was issued. Before closing, a title company performs a detailed search of public records to find any potential red flags tied to the property.

However, no search is infallible. Human error, forged documents, or unrecorded liens can remain hidden. These undiscovered issues are known as title defects, and they can jeopardize the lender's legal claim to the property as collateral. The insurance policy covers these gaps.

Core Policy Mechanics

The policy is designed exclusively to protect the lender, not the homebuyer. For borrowers, understanding its function is critical for navigating the closing process. Before proceeding, it helps to grasp the broader concept of title insurance and its role in real estate deals.

- Protected Party: Exclusively covers the mortgage lender. It provides zero protection for the homeowner's equity.

- Coverage Scope: Insures the lender against financial loss up to the outstanding loan amount. As the loan is paid down, the coverage value decreases.

- Payment: The borrower pays a one-time premium at closing. This fee is non-recurring.

- Core Function: It guarantees the lender’s lien priority. This legal standing ensures their mortgage is the first debt to be repaid if the property is sold or foreclosed, a critical checkpoint in any real estate due diligence checklist.

Policy Attributes at a Glance

The table below provides a concise summary of the policy's key attributes.

| Attribute | Description |

|---|---|

| Who It Protects | The mortgage lender or financial institution. |

| What It Covers | The outstanding loan balance against past title defects. |

| Premium Payment | A one-time fee, paid by the borrower at closing. |

| Policy Duration | For the life of the mortgage loan. It terminates when the loan is paid off. |

| Is It Mandatory | Yes, for approximately 99% of mortgage loans in the United States. |

In essence, the policy is a financial backstop ensuring the lender's investment is secure from title claims that predate the transaction.

Why is this insurance required by lenders?

Lenders require this insurance to protect their financial investment and ensure the mortgage they issue is a secure, saleable asset. A mortgage is collateralized by the property, and this policy guarantees the lender holds the primary legal claim—or lien priority—against that collateral. Without it, a hidden title defect could render the lender's claim secondary or worthless, exposing them to a total loss.

This protection is the bedrock of the secondary mortgage market. A lender's title insurance policy makes a mortgage a low-risk, standardized asset that can be packaged and sold to investors like Fannie Mae and Freddie Mac. This process recycles capital back to the lender, allowing them to issue new loans and maintain liquidity in the housing market.

A lender views an uninsured mortgage as an unacceptable risk. A surprise claim, such as an unrecorded mechanic's lien from a prior owner, could legally supersede the mortgage lien, potentially erasing the lender's ability to recover its capital in a foreclosure.

Mitigating Financial Threats

This requirement is a direct response to tangible financial threats buried in a property's history. While a title search is thorough, it is not perfect. Lender's title insurance exists to cover the gaps where human error, hidden liens, or fraud create potential for future financial loss.

The title insurance industry was created from a legal precedent set in the 1868 Pennsylvania Supreme Court case, Watson v. Muirhead, where a buyer lost their property due to a lien his conveyancer had mistakenly cleared. The ruling confirmed a professional opinion was insufficient; a financial guarantee was necessary. The first title insurance company was established in 1876 as a direct result.

A policy is designed to neutralize specific, high-stakes threats:

- Undisclosed Heirs: A previously unknown relative of a former owner emerges with a valid claim to the property.

- Fraud and Forgery: A signature on a past deed was forged, which could invalidate the entire chain of title.

- Filing Errors: Clerical mistakes in public records that incorrectly describe property boundaries or ownership.

- Hidden Liens: Unpaid property taxes or debts from contractors (mechanic's liens) that were not discovered during the initial title search.

By transferring these risks to an insurer, the lender secures its lien position. Understanding the 5 common issues in title verification clarifies why this coverage is a non-negotiable requirement for virtually every U.S. mortgage.

What is the difference between lender's and owner's title insurance?

The primary difference is who is protected: lender's title insurance protects the mortgage lender's financial stake, while owner's title insurance protects the property owner's equity. While both policies defend against historical title defects, they cover separate financial interests and are not interchangeable. The lender's policy is mandatory for a mortgage, whereas the owner's policy is technically optional but highly recommended.

The lender's policy ensures the bank can recover its outstanding loan balance if a title issue arises. Critically, it provides zero protection for the owner's investment, including the down payment, appreciation, and principal paid.

Beneficiary

The fundamental distinction is the beneficiary. A lender's policy is an expense paid by the borrower that exists solely for the mortgage provider. It guarantees their lien is secure, ensuring that in a forced sale, the lender is repaid first. An owner's title insurance policy is your personal safeguard. It defends your ownership rights and covers legal fees or financial losses if your claim to the property is challenged.

A lender's policy protects the loan. An owner's policy protects the owner's equity. If a catastrophic title defect emerges and you only have a lender's policy, the bank will be compensated, but you could lose your home and your entire investment.

Coverage and Duration

The value and lifespan of the policies differ significantly, impacting the long-term financial security for each party.

- Lender's Policy: Coverage is tied to the mortgage balance. As you pay down your loan, the policy's value decreases accordingly. Once the mortgage is fully paid, the policy terminates.

- Owner's Policy: Coverage is fixed at the property's full purchase price and does not decrease. This protection lasts for as long as you or your heirs legally own the property, offering permanent security for a single premium.

Comparison Table

This table breaks down the critical distinctions between the two policy types.

| Feature | Lender's Title Insurance | Owner's Title Insurance |

|---|---|---|

| Protected Party | The mortgage lender | The property owner/borrower |

| Requirement | Mandatory for nearly all mortgages | Optional, but highly recommended |

| Coverage Amount | The outstanding loan balance (decreases over time) | The full purchase price of the property (does not decrease) |

| Coverage Duration | For the life of the loan | As long as the owner or their heirs hold the title |

| Premium | One-time fee paid at closing, usually by the borrower | One-time fee paid at closing, often by the seller |

Understanding this difference is not academic; it is crucial for protecting what is likely your largest financial asset.

How are lender's title insurance costs calculated?

The cost of lender's title insurance is a one-time premium paid at closing, with the primary determining factor being the total loan amount. A larger mortgage represents a greater financial risk to the lender, so the premium is scaled proportionally to cover that exposure.

As a benchmark, the premium typically falls between 0.5% and 1.0% of the loan value. For a $400,000 mortgage, the cost would likely be between $2,000 and $4,000. However, this is only an estimate, as state regulations are the second major factor influencing the final price.

State Regulation

Title insurance rates are heavily regulated by each state's Department of Insurance. These agencies approve the rate schedules that title companies can use, meaning the cost for an identical loan can vary significantly across state lines. Some states, like Texas and Florida, have state-promulgated rates, where all insurers must charge the same price. Iowa uses a state-run title system. This regulatory variation makes a universal price quote impossible.

The U.S. title insurance industry generated $26.2 billion in premiums in 2021, a 36% increase from the previous year. The market is highly concentrated, with the four largest underwriters controlling over 85% of market share. You can explore more data on market dynamics and consumer impact to understand the industry's scale.

Simultaneous Issue Discount

The most significant cost-saving opportunity is the simultaneous issue discount. This is a substantial price reduction offered when you purchase both a lender's policy and an owner's policy from the same provider at the same closing. The core title search and examination work is only performed once, and insurers pass this efficiency on to the consumer. By bundling the policies, you typically pay the full premium for the lender's policy and receive the owner's policy at a steep discount.

What does the policy cover and exclude?

A lender’s title insurance policy exclusively covers historical title defects—problems that already existed before the policy was issued but were not discovered during the title search. It is a backward-looking safeguard designed to protect the lender's lien priority against a specific list of past issues, ensuring their investment remains secure.

Covered Risks

The policy protects the lender from title-related issues that could undermine their legal claim to the property as collateral.

| Covered Risk | Description |

|---|---|

| Fraud or Forged Documents | Protects against prior deeds or releases that were illegally signed or forged, which could invalidate the entire chain of title. |

| Undisclosed Heirs | Covers the lender if a previously unknown heir of a former owner emerges with a valid legal claim to the property. |

| Unresolved Liens | Covers liens missed during the title search, such as unpaid property taxes or a mechanic's lien from a contractor a previous owner failed to pay. |

| Filing Errors | Protects against clerical mistakes in public records that create ambiguity or errors in the property's ownership history or legal description. |

| Improper Foreclosure Proceedings | Covers defects from a past foreclosure that was not conducted according to legal requirements, leaving the title vulnerable to future challenges. A foreclosure lis pendens signals such a risk. |

Excluded Items

It is equally important to understand what a lender's policy does not cover. The policy has clearly defined boundaries and will not protect a lender from problems that arise after the policy date or fall outside the scope of legal title.

A lender's policy is not a catch-all solution. It is surgically focused on defects in legal ownership and lien priority that originated in the past.

The following are standard exclusions found in nearly every policy:

- Issues Created After the Policy Date: Any liens or claims that arise after the closing date are not covered. For example, a mechanic's lien from a contractor the current borrower fails to pay is not the policy's responsibility.

- Zoning and Building Code Violations: The policy does not cover violations of land use regulations or local zoning ordinances.

- Environmental Hazards: Contamination issues like asbestos, lead paint, or polluted soil are outside the scope of title insurance.

- Known Defects: Any title issue the borrower was aware of but did not disclose to the lender or title company is excluded from coverage.

- Eminent Domain: The policy provides no protection against the government's right to seize private property for public use.

How does the title insurance claims process work?

The claims process begins when a hidden title defect is discovered, transforming the policy from a theoretical safeguard into a tangible financial defense for the lender. A potential issue could be a notice of an unknown lien, a letter from an undisclosed heir, or a survey revealing a boundary error in the public record.

Claim Initiation

The lender initiates the process by formally notifying the title insurance company. This claim submission must detail the nature of the defect and provide all relevant documentation. Once filed, the insurer launches an investigation to scrutinize public records, re-examine the original title search, and analyze the claim's validity. This determines the subsequent course of action.

The primary goal of the claims process is not just to pay for a loss but to actively "cure" the underlying title defect, restoring the lender's secure lien position.

Resolution Pathways

Following the investigation, the title insurer pursues one of two primary resolution paths.

- Curing the Defect: If the claim is valid, the insurer’s first priority is to resolve the issue directly. This can involve paying off a verified lien, negotiating a financial settlement with a claimant, or filing corrective legal documents to fix a clerical error.

- Defending the Title: If the defect requires litigation, the insurer hires and pays for attorneys to defend the lender's title in court, covering all associated legal costs.

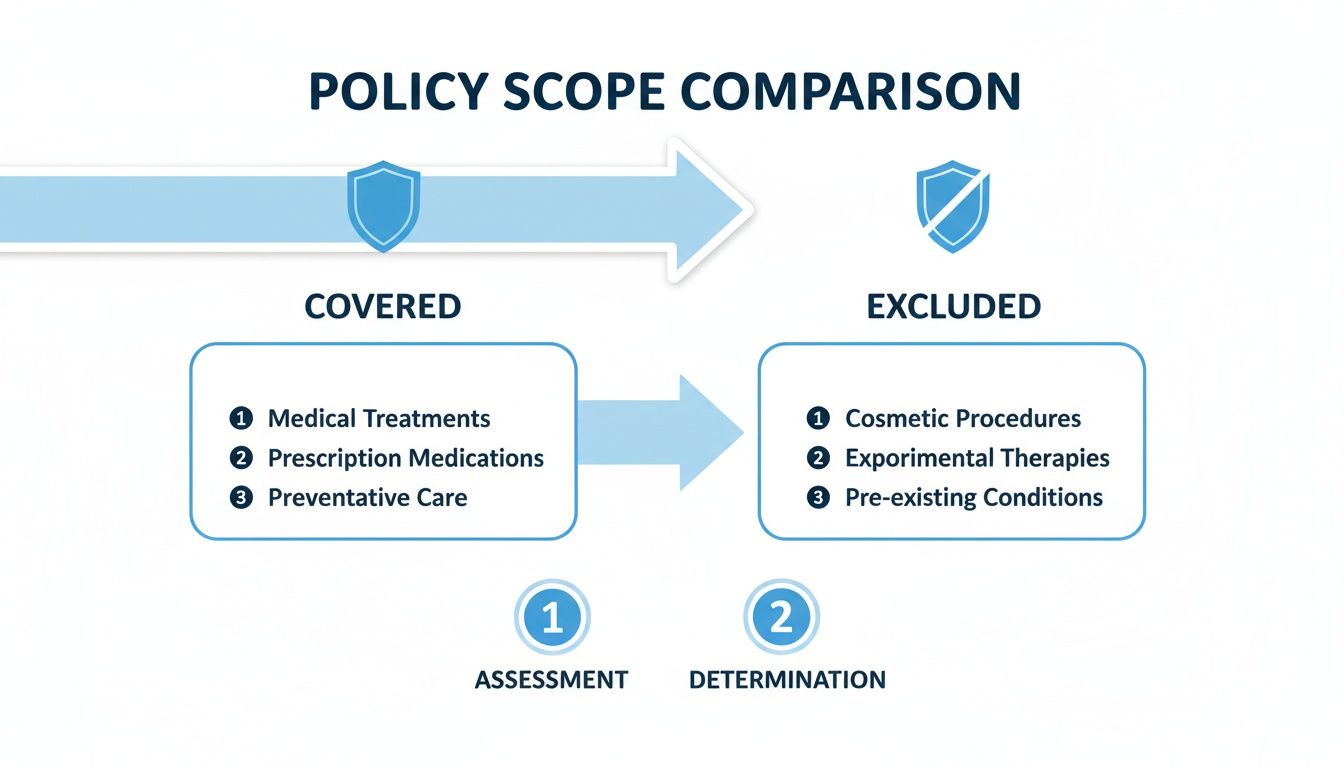

This infographic breaks down the kind of past issues a policy covers versus the future problems it typically excludes.

If a defect cannot be cured or legally defended, the policy pays out to compensate the lender for their financial loss, up to the current outstanding loan balance.

What are common questions about lender's title insurance?

Even after closing, questions often arise about how a lender's title insurance policy functions over the long term. The policy is a dynamic instrument that evolves with your mortgage.

Does the coverage decrease over time?

Yes, the policy's coverage is directly tied to the outstanding loan balance. As you make monthly mortgage payments and reduce your loan principal, the lender's financial exposure shrinks. Consequently, the policy's coverage amount decreases in lockstep with the loan balance. When the loan is paid off, the lender has no remaining financial stake, and the policy terminates.

What happens when I refinance my mortgage?

When you refinance, you are taking out a new loan to pay off your old one. Because the original lender's title policy was tied specifically to that original loan, it is extinguished the moment that loan is paid off. A new lender's title insurance policy must be purchased to protect the new lender and their new loan. This is a mandatory requirement, even if you refinance with the same lender, because a new loan constitutes a new risk.

Can I choose the title insurance company?

Yes. Although the lender requires the policy, federal law—specifically the Real Estate Settlement Procedures Act (RESPA)—grants you, the borrower, the right to shop for and select your own title insurance provider. This allows you to compare costs and services among different title companies.

Navigating mortgage requirements can be complex. For professional guidance on everything from title insurance to loan options, a useful resource is the brokermap homepage.

At BatchData, we deliver the deep property data and analytics that title companies and underwriters depend on. Our platform provides the accurate, real-time insights needed to assess risk, make confident decisions, and protect major investments. See how our data can sharpen your workflow at https://batchdata.io.