SEO Title: Find Real Estate Leads | Data-Driven Strategies & Sources

SEO Meta Description: Learn how to find real estate leads using data-driven tactics. This guide covers high-impact sources, skip tracing, automation, and optimizing for high ROI.

SEO Meta Keywords: how to find real estate leads, real estate lead generation, motivated seller leads, find property owners, real estate data, skip tracing real estate, real estate marketing, lead generation for real estate agents

Building a predictable pipeline of real estate leads requires a data-driven engine, not outdated manual tactics. The highest-performing investors and agents win by combining public records, MLS data, and specialized datasets to pinpoint high-intent sellers before they hit the open market. This guide details the exact strategies, data sources, and automation workflows needed to systematically find and engage motivated sellers.

| Core Takeaway | Description |

|---|---|

| Data-First Approach | Focus on high-propensity segments like absentee owners and pre-foreclosures. |

| Contact Enrichment | Use high-accuracy skip tracing to get verified phone numbers and emails. |

| Systematic Automation | Integrate data feeds with your CRM to trigger instant outreach campaigns. |

| Performance Tracking | Measure Cost Per Acquisition (CPA) and ROI by channel to optimize spend. |

This integrated, data-first approach consistently outperforms isolated channels like generic mailers or endless cold calling.

What is the Modern Playbook For Finding Real Estate Leads?

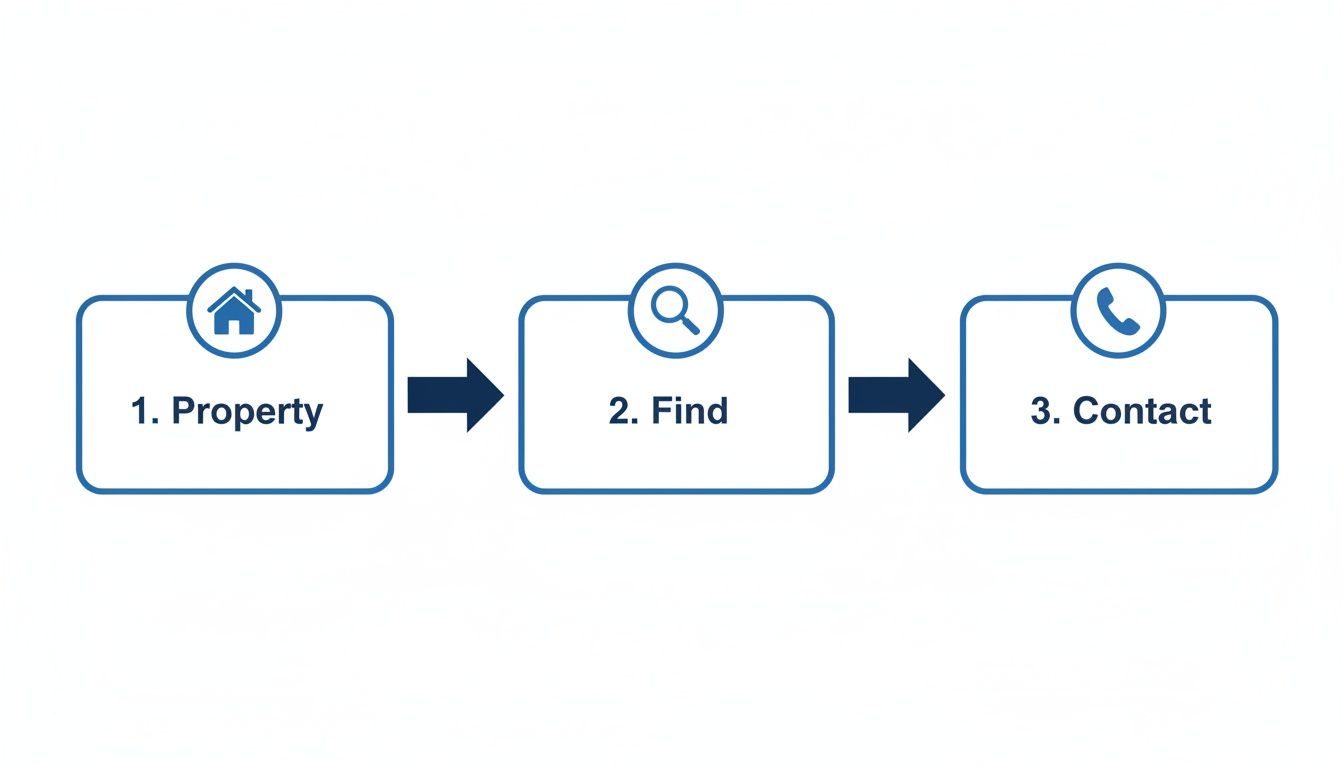

The modern playbook for finding real estate leads is a predictable, scalable system built on high-quality data and targeted outreach, not just chasing volume. The core principle is building a "lead stack" that seamlessly integrates powerful data sources with enrichment and outreach tools. This creates a direct pipeline from property identification to owner contact. Digital strategies, like targeted PPC Management for Real Estate, can then drive motivated traffic directly into this optimized funnel.

The Critical Role of Speed and Automation

In real estate, speed is the primary competitive advantage. Leads contacted within 5 minutes are 9 times more likely to convert. Yet, only 21% of real estate leads become sales, with a mere 1.5% reaching closing. Automation addresses this gap directly; marketing teams using it see a 451% increase in qualified leads by turning raw data into immediate conversations.

The single biggest differentiator between top-performing investors and everyone else is the ability to systematically identify and engage motivated sellers before they hit the open market. This requires a proactive, data-first mindset.

High-Impact Lead Sources

To activate a lead engine, focus on data sources providing the strongest signals of selling intent. These channels offer the highest return on investment.

| Lead Source | Ideal Target | First Action Step |

|---|---|---|

| Public Records | Homeowners with high equity, long-term owners, absentee owners. | Access county assessor and recorder data to filter by ownership tenure and equity. |

| MLS Data | Expired or withdrawn listings, properties on the market for an extended period. | Set up alerts for status changes on target properties within your MLS. |

| Pre-Foreclosure Filings | Distressed homeowners facing default or auction. | Monitor public notices of default (NOD) and Lis Pendens filings daily. |

| Owner Contact Enrichment | Any property list where direct outreach is the goal. | Use a skip tracing service to append verified phone numbers and emails to addresses. |

Combining these sources creates a powerful, multi-channel lead generation machine that identifies motivated sellers from multiple angles.

How Do You Pinpoint Ideal Motivated Sellers and Buyers?

To efficiently find real estate leads, you must target individuals with a compelling reason to act, defined by specific financial situations and life events. Success depends on creating a granular Ideal Customer Profile (ICP)—a laser-focused picture of your perfect lead based on layered data points, not vague descriptions like "3-bedroom homes." The goal is to isolate property owners whose circumstances make them more motivated than the average homeowner.

High-Propensity Segments

An ICP is built by layering data points to create a composite sketch of the person most likely to sell. Start by mapping motivations to your investment strategy (e.g., fixer-uppers vs. turnkey rentals), as each goal requires a different ICP.

High-value segments include:

- High-Equity Absentee Owners: Landlords who do not live in the property and have over 40% equity are often tired of managing tenants and ready to liquidate.

- Long-Term Owners with Low Debt: Individuals owning a home for 15+ years with a small mortgage balance are prime candidates for downsizing or relocating.

- Pre-Foreclosure with Equity: Homeowners in early foreclosure stages who retain equity are highly motivated to sell quickly to protect their credit and salvage their investment.

- Life Event Triggers: Data can identify major life events like probate filings (inheritance) or divorce records, signaling an urgent need to sell.

Granular Property Data

Modern data platforms power this level of targeting by consolidating thousands of property attributes, enabling hyper-specific list creation.

You can combine powerful filters:

- Financial Filters: Target specific equity percentages, automated valuation models (AVMs), mortgage balances, and loan origination dates.

- Property Characteristics: Filter by square footage, bedroom/bathroom count, year built, and lot size to match your exact acquisition criteria.

- Ownership Details: Isolate absentee owners (in-state vs. out-of-state), corporate-owned properties, or trusts.

- Distress Signals: Zero in on properties with active pre-foreclosure status, tax delinquencies, or other liens.

The magic isn't just in having the data; it's in creatively stacking the filters to uncover hidden pockets of opportunity. A list of 'out-of-state owners with 50%+ equity, a property tax delinquency, and ownership of 10+ years' is infinitely more valuable than a generic list of all absentee owners.

This screenshot from a property intelligence platform like BatchData shows the depth of layering criteria like property class, ownership info, and financials.

Advanced Targeting Strategies

Sophisticated tactics involve pulling from multiple datasets to paint a complete picture of a property owner.

- Portfolio Analysis: Identify owners holding multiple properties in your target area. These portfolio landlords are often open to offloading several assets at once.

- Permit and Construction Data: Monitor building permit applications. A major renovation permit may signal preparation for a sale, while a lack of maintenance permits on an older home could indicate neglect.

- Propensity Modeling: Some platforms use predictive analytics to assign a "propensity to sell" score (like BatchRank) to properties, calculated using hundreds of variables to identify high-intent leads automatically.

What are the Best Data Sources for a Lead Funnel?

The best data sources are fresh, accurate, and complete, as your ability to convert leads depends on information quality, not quantity. The competitive edge comes from platforms that consolidate disparate sources—public records, MLS activity, lien filings—into a single, clean feed. This provides a 360-degree view of every property and eliminates the manual work of cross-referencing outdated spreadsheets.

Primary Data Pillars

Understanding the strengths and weaknesses of each core data type is essential for building an effective lead funnel.

- Public Tax & Assessment Records: This is the foundation, providing essential property specs (square footage, bed/bath), ownership history, and assessed value. It is the most reliable source for identifying long-term owners and establishing a baseline for equity.

- MLS Data: The Multiple Listing Service offers a real-time market pulse. Its primary value for off-market investors lies in spotting properties that failed to sell, such as expired or withdrawn listings. These owners have demonstrated intent to sell.

- Pre-Foreclosure & Lien Records: This data provides the strongest signals of financial distress and motivation. Tracking filings like Notice of Default (NOD), Lis Pendens, and tax liens connects you with homeowners who have a time-sensitive need to sell.

The real power emerges when you layer these sources. For example, filtering for properties with an active Notice of Default that also have over 40% equity and an out-of-state owner's address creates a hyper-targeted list of highly motivated sellers.

The Advantage of Unified Data Feeds

Manually sourcing, cleaning, and combining datasets is inefficient and error-prone. Platforms delivering clean, unified data via a single API or bulk feed create a massive competitive advantage. Our ultimate guide to real estate APIs explains how this technology transforms lead generation by ensuring you always work with the most current information, which is non-negotiable in a fast-moving market.

Comparison of Real Estate Data Sources

| Data Source | Primary Use Case | Pros | Cons |

|---|---|---|---|

| Public Records | Identifying high-equity, long-term, and absentee owners. | Comprehensive coverage; reliable for ownership and property facts. | Data can be slow to update; lacks real-time motivation signals. |

| MLS Data | Targeting expired, withdrawn, or aged listings. | Shows clear intent to sell; data is generally accurate and fresh. | Highly competitive; properties have already been exposed to the market. |

| Pre-Foreclosure | Finding distressed homeowners needing a fast sale. | Highest indicator of motivation; creates time-sensitive opportunities. | Data can be complex; requires speed and sensitivity in outreach. |

| Lien Records | Identifying owners with financial pressure (e.g., tax, mechanic's liens). | Uncovers hidden distress signals not visible in foreclosure data. | Lien amounts can be small; may not always indicate a desire to sell. |

Your choice of data sources must directly reflect your investment strategy. A wholesaler will focus on pre-foreclosure and lien records, while a buy-and-hold investor will leverage public records to find tired landlords.

How Can You Get Accurate Contact Information for Property Owners?

Accurate contact information is the critical link that turns a property address into an actionable lead. The process of obtaining verified phone numbers and emails is called skip tracing. Modern skip tracing cross-references an owner's name or property address against massive consumer databases to pinpoint contact details. High-accuracy data is essential for both efficiency and brand reputation.

The Mechanics of Modern Skip Tracing

Effective skip tracing is a sophisticated data-matching process, not a simple lookup. It sifts through hundreds of data points to append the correct contact information, which is complex when dealing with common names, LLCs, or owners with multiple properties.

A top-tier skip tracing service delivers:

- Multiple Phone Numbers: A mix of landlines and mobile numbers, often with primary line indicators.

- Email Addresses: Personal and business emails for multi-channel outreach.

- Confidence Scores: A rating indicating the likelihood that the contact information is correct.

- DNC Scrubbing: Automatic flagging of numbers on the National Do Not Call Registry for compliance.

This is what it looks like in a modern platform—cleanly organized data with all the phone numbers, emails, and compliance flags you need to take quick action.

Integrating Contact Enrichment into Your Workflow

The goal is to make enrichment a seamless part of your operation. For investors and brokerages working at scale, this is achieved in two ways, which we detail in our guide on how to find property owners.

- Bulk Processing: Upload a large list of properties (e.g., a CSV file) and receive an enriched file in minutes. This is ideal for prepping large marketing campaigns like direct mail or cold calling.

- Real-Time API Lookups: An API allows your CRM or software to request contact details one by one, instantly. This is perfect for enriching new leads as they enter your system from a web form.

The biggest mistake investors make is treating contact data like a commodity. Cheap, low-quality skip tracing leads to wasted time, brand damage from calling wrong numbers, and serious legal risk. Investing in a premium service with a high match rate is a direct investment in your own efficiency and compliance.

Compliance is Non-Negotiable

Possessing contact information carries significant legal responsibilities. Ignoring regulations like the Telephone Consumer Protection Act (TCPA) can result in business-crippling fines.

Absolute must-dos:

- Scrub Against DNC Lists: Before any cold calling campaign, scrub your list against National and state-level Do Not Call registries.

- Understand TCPA Rules: Familiarize yourself with restrictions around automated dialers and unsolicited text messages, especially to mobile phones.

- Verify Phone Numbers: Use a phone verification service to confirm if a number is active and identify its type (mobile vs. landline) to align with TCPA guidelines.

How Do You Automate and Scale a Lead Generation Engine?

To build momentum, you must replace manual list-pulling and one-off campaigns with an automated system that works 24/7. This involves using APIs and bulk data feeds to create a workflow that finds and engages prospects autonomously, shifting your operation from reactive to proactive. Instead of hunting for deals, the deals find you.

From Manual Effort to Automated Workflows

True automation uses triggers to initiate action sequences. When a specific event occurs—like a property entering pre-foreclosure—it should instantly launch a marketing and sales response, ensuring no hot opportunity is missed.

Consider these automated scenarios:

- Portfolio Monitoring Alerts: When a tracked property enters pre-foreclosure, an alert automatically triggers a CRM campaign: an initial text is sent, an email follows, and a call task is created for an acquisitions manager.

- Instant Website Lead Enrichment: A seller completes a website form. An API call instantly enriches the lead with full property intelligence (equity, mortgage data) and routes it to the appropriate team member based on predefined rules.

The process is a repeatable three-step flow.

Automation allows this process to be executed thousands of times per day.

Connecting Your Tech Stack

Seamless execution occurs when your tools communicate. Connecting your property data source directly to your Customer Relationship Management (CRM) platform creates a frictionless pipeline from data to outreach. Tools like Zapier enable you to build these connections without writing code. Our guide on how to use Zapier to generate real estate leads shows how this is done.

Your goal is to build a "nervous system" for your business. When a piece of data changes, your system should react instantly and intelligently, sending the right information to the right person at exactly the right time. That’s the core of a scalable operation.

Lead Scoring and Routing

Not all leads are equal. Lead scoring automatically differentiates high-value leads by assigning points based on attributes, ensuring your team prioritizes the best opportunities. A homeowner with 70% equity in pre-foreclosure is a top priority.

| Lead Attribute | Score | Rationale |

|---|---|---|

| Pre-Foreclosure Status | +50 | This is the strongest sign of motivation. This lead needs attention now. |

| Equity > 40% | +25 | There's enough margin to structure a viable deal. |

| Out-of-State Owner | +15 | Absentee owners are often more pragmatic and less emotionally attached. |

Once a lead's score passes a certain threshold, automated routing takes over. A high-scoring lead is sent directly to your top acquisitions manager, while a lower-scoring lead might be placed in a long-term nurture campaign.

How Can You Measure and Optimize Lead Generation Performance?

To be profitable, you must understand what is working, what isn't, and why. Focus on Key Performance Indicators (KPIs) that directly map to revenue, not vanity metrics like raw lead volume. Tracking the entire journey from initial contact to a closed deal creates a data-driven feedback loop, allowing you to systematically test and double down on what is profitable. This is about engineering a predictable revenue machine.

Core Metrics That Drive Revenue

Track the numbers that reflect the health and efficiency of your business to understand the true cost and value of customer acquisition from each channel.

- Cost Per Lead (CPL): Total marketing spend on a campaign divided by the number of leads generated.

- Cost Per Acquisition (CPA): Total campaign cost divided by the number of closed deals. This is the most critical metric.

- Lead-to-Close Ratio: The percentage of leads that result in a closed deal (e.g., 100 leads to 1 deal is a 1% ratio). A higher ratio indicates better lead quality and sales efficiency.

- Return on Investment (ROI) by Channel: Calculated as

(Revenue - Cost) / Costfor each channel (direct mail, cold calling, PPC) to identify which are profitable.

Mastering your Cost Per Lead (CPL) and strategies to lower it is essential for pushing your ROI higher.

Building a Performance Dashboard

A simple spreadsheet is sufficient to start a performance dashboard. The key is consistent tracking of core KPIs weekly and monthly to spot trends.

| Channel | Leads Generated | Deals Closed | CPL | CPA | Lead-to-Close % |

|---|---|---|---|---|---|

| Direct Mail | 250 | 2 | $80 | $10,000 | 0.8% |

| Cold Calling | 400 | 4 | $50 | $5,000 | 1.0% |

| Referrals | 10 | 3 | $5 | $167 | 30.0% |

The data doesn't lie. In this example, cold calling has a better CPA and close rate than direct mail. Referrals, however, are in a different league, highlighting their critical importance.

The Unbeatable Power of Referrals

Never neglect the gold standard of lead generation. Referrals are the engine behind approximately 30% of all real estate transactions and boast conversion rates that can exceed 30%. This dwarfs the typical 1.5% completion rate for cold leads. Referrals come with built-in trust and are pre-qualified, delivering the highest possible ROI. You can discover more insights about lead generation statistics on RealEstateBees.com.

What are the Top Questions About Real Estate Leads?

Adopting a data-first strategy for real estate leads often raises several key questions. Here are the direct answers to the most common inquiries from investors and agents building a modern lead generation machine.

What is the best lead source for a beginner?

The best lead source for a beginner is public records. Start by targeting absentee owners or individuals who have owned their homes for 15+ years. This data is reliable, easily accessible, and provides a perfect training ground. It allows you to practice outreach and build systems in a less competitive, lower-pressure environment than channels like pre-foreclosures.

How much should a real estate lead cost?

The cost of a real estate lead varies significantly by channel, with a blended industry average of $198 per lead that lacks specific context.

A more realistic breakdown by channel is:

- Direct Mail: $80-$120 per qualified response.

- Cold Calling: $50-$75 per lead, depending on list quality and caller efficiency.

- PPC/Digital Ads: Can easily exceed $200-$400 per lead for competitive keywords.

Chasing the lowest Cost Per Lead (CPL) is a rookie mistake. The only number that truly matters is your Cost Per Acquisition (CPA)—what it costs to get a signed contract. A cheap lead that goes nowhere is just an expensive waste of time.

How long does it take to see results?

With a targeted, data-driven plan, you can generate your first qualified leads within one week. Pulling a list, skip tracing it, and launching the first campaign can be done in a few days. However, converting those initial conversations into closed deals typically takes 30 to 90 days, depending on your follow-up process and the seller's timeline. Relentless consistency, not a single campaign blast, is what builds a predictable pipeline.

Ready to stop guessing and start targeting the right leads with precision? BatchData provides the comprehensive property data, owner contact information, and workflow tools you need to build a scalable lead generation engine. Explore our platform today.