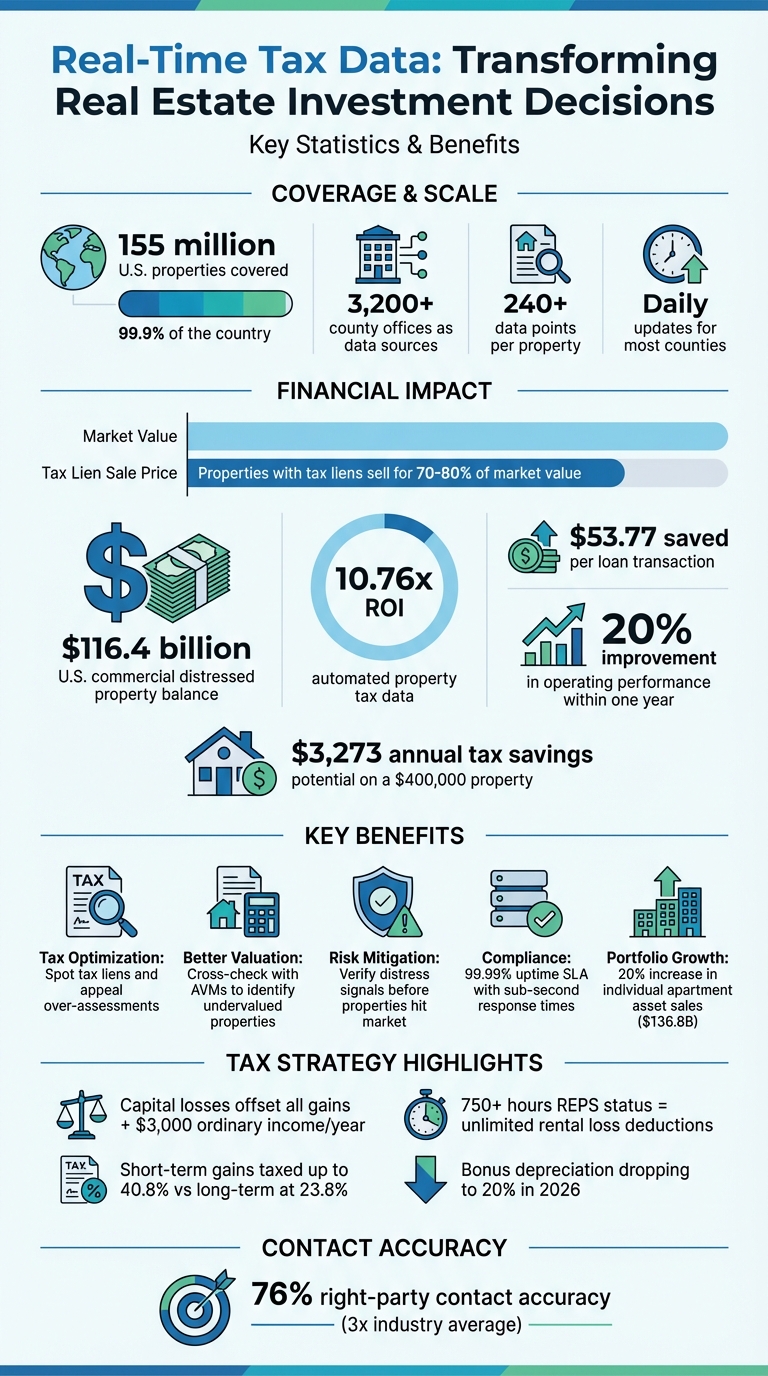

Real-time tax data is transforming how real estate investors make decisions. Unlike outdated static records, this data provides daily updates on property taxes, valuations, and ownership details and contact info. By accessing information directly from over 3,200 county offices, investors can track tax liens, assessment changes, and market values for 155 million U.S. properties. This enables faster, more informed decisions, reducing risks and uncovering opportunities.

Key Takeaways:

- Daily Updates: Stay ahead with property tax data refreshed every day.

- Tax Savings: Spot tax liens and appeal over-assessments to reduce costs.

- Improved Valuation: Use accurate tax data to refine property valuations and ROI calculations.

- Compliance Made Simple: Automate workflows and track deadlines to avoid errors.

- BatchData Advantage: Access 240+ data points per property via APIs or bulk delivery.

Real-time tax data isn’t just a tool – it’s a smarter way to manage portfolios, optimize taxes, and identify investment opportunities. Platforms like BatchData make integrating this information easy and fast, ensuring you stay competitive in today’s market.

Real-Time Tax Data Benefits for Real Estate Investors: Key Statistics and ROI

Utilizing AI to Automatically Pull Tax Default List for Real Estate

sbb-itb-8058745

Key Benefits of Real-Time Tax Data for Real Estate Investors

Real-time tax data offers a game-changing edge for real estate investors, addressing the shortcomings of static data. By providing daily updates, it enhances tax strategies, improves property valuation, and ensures smoother compliance, helping investors avoid costly errors while uncovering lucrative opportunities throughout the investment process.

Tax Optimization and Savings

One of the biggest advantages of real-time tax data is the ability to spot tax liens. Properties with active tax liens often sell for 70–80% of their market value, giving investors room to negotiate and secure deals below market prices. Considering the U.S. commercial real estate market’s distressed property balance has hit $116.4 billion, keeping tabs on tax delinquencies can give investors a critical first-mover advantage.

Another key benefit is the ability to appeal property tax assessments. Regularly updated tax data can reveal over-assessments, opening the door to lower annual tax bills. Deloitte emphasizes the importance of this strategy for cutting unnecessary expenses. Accurate tax data also plays a crucial role in calculating essential metrics like Net Operating Income (NOI) and cap rates. Even small errors in tax figures can lead to major missteps in profitability and cash flow projections.

| Metric | Formula | Role in Tax Optimization |

|---|---|---|

| Net Operating Income (NOI) | Gross Operating Income – Operating Expenses | Ensures accurate cash flow projections by factoring in taxes. |

| Cap Rate | NOI / Current Market Value | Provides realistic property comparisons by including tax costs. |

| Cash-on-Cash Return (CoC) | Annual Pre-Tax Cash Flow / Total Cash Invested | Helps forecast actual returns after accounting for tax impacts. |

These strategies not only optimize taxes but also feed into more precise property valuation practices.

Better Property Valuation and ROI

Updated tax data is a goldmine for property valuation. Information like assessed values, land values, and tax history can be cross-checked with Automated Valuation Models (AVMs) to identify undervalued properties. For example, using the formula Estimated Equity = AVM Value – Estimated Mortgage Balance can help determine whether a distressed property has enough equity to justify an investment.

Sophisticated investors often layer distress indicators – such as combining a tax lien with a pre-foreclosure notice or code violation – to spot the most promising opportunities. This strategy has proven effective, with individual apartment asset sales growing by 20% to $136.8 billion as investors targeted distressed Class C properties using these methods.

"A property’s asking price is a suggestion. Its true value is revealed only through rigorous, unbiased analysis of its potential income and liabilities." – BatchData

Easier Compliance and Audit Preparedness

With daily updates from over 3,200 sources covering 155 million properties, real-time tax systems make audit preparation a breeze. These systems are often powered by a real estate API that integrates directly into existing workflows. Automated solutions replace error-prone manual spreadsheets, addressing a common pain point for tax departments. Deloitte notes that many property tax teams face annual challenges in managing compliance due to disorganized data.

These systems also include property tax calendars to track appeal deadlines, reducing the risk of missed opportunities for informal resolutions that could avoid costly formal hearings. Before finalizing a deal, checking for active tax liens or code violations ensures legal liabilities are avoided. Additionally, setting up automated alerts for new tax delinquencies or other distress signals keeps investors ahead of the curve, enabling swift action before properties hit the broader market.

This proactive approach turns compliance into a strategic advantage, streamlining operations and positioning investors for success.

Using Real-Time Tax Data in Investment Strategies

Real-time tax data lets investors make quicker, smarter decisions in competitive markets. Instead of relying on outdated annual reports, they can now track property tax changes, signs of financial distress, and depreciation opportunities as they occur. This approach transforms how portfolios are managed and tax strategies are planned.

Portfolio Management and Risk Mitigation

Savvy investors use multiple distress indicators – such as combining a tax lien with a pre-foreclosure notice or code violation – to find motivated sellers before properties hit the open market. With the U.S. commercial real estate distressed property balance at $116.4 billion, keeping tabs on these signals in real-time provides a crucial edge.

To reduce risks, verify distress signals directly with county recorders or tax assessors, as data can quickly become outdated. Use the formula Estimated Equity = AVM Value – Estimated Mortgage Balance to determine if a distressed owner has enough equity to negotiate a discounted sale. This helps avoid pitfalls like clouded titles or unexpected debts that could derail an investment.

According to EY, combining internal data with real-time tax insights improved operating performance by 20% within a year.

| Distress Type | Primary Signal | Data Source | Investor Action |

|---|---|---|---|

| Financial | Tax Lien | County Tax Assessor Records | Purchase the tax lien or negotiate a direct sale with the owner. |

| Financial | Pre-Foreclosure | County Clerk/Recorder’s Office | Make a pre-auction purchase offer to the owner. |

| Physical | Code Violations | Municipal Code Enforcement | Locate the owner and use the violation as leverage to negotiate a deal. |

These strategies not only improve portfolio management but also pave the way for more advanced tax planning.

Capital Loss Harvesting and Tax Strategy

Real-time tax data doesn’t just help with portfolio decisions – it also sharpens tax strategies. By tracking the unrealized gain or loss for each property lot, investors can combine the original cost basis with current market valuations to refine their tax planning. Using Specific Identification (SpecID), they can sell high-cost lots strategically, maximizing realized losses to offset gains elsewhere in their portfolio.

Harvested losses can offset all capital gains, plus up to $3,000 of ordinary income per year, with any excess carried forward indefinitely. Timing is critical: short-term capital gains are taxed at ordinary income rates (up to 40.8% for high earners), while long-term gains are capped at 23.8%.

Real-time tracking also helps avoid wash-sale rules, which disallow loss deductions if a substantially identical asset is bought within 30 days. Additionally, investors can monitor their Real Estate Professional Status (REPS) hours – exceeding 750 hours annually allows them to deduct unlimited rental losses against ordinary income, bypassing the $25,000 passive activity loss cap.

"Systematically accumulating capital losses can serve as an insurance policy against all future capital gain recognition events, providing investors with enhanced flexibility to accomplish future goals with minimal tax consequences." – Lincoln Fleming, Senior Tax Economist

With bonus depreciation dropping to 20% in 2026, strategic loss harvesting becomes even more important as other deduction options shrink. Long-only direct indexing strategies can also generate significant capital losses, boosting tax efficiency.

BatchData‘s Real-Time Tax Data Solutions

BatchData takes the concept of real-time tax data to the next level, offering a solution that seamlessly integrates daily property updates into your investment processes. Covering an impressive 155 million U.S. properties – essentially 99.9% of the country – the platform provides daily updates for most counties. With access to over 240 data points per property, you can explore details like tax amounts, assessed values, market values, land values, and historical tax records. All of this is delivered through a RESTful JSON API with lightning-fast response times and a 99.99% uptime SLA.

The platform compiles data from over 3,200 county assessor and recorder offices. This extensive database is enhanced with advanced features that give investors deeper insights. For example, it can uncover ownership details hidden within LLCs or Trusts, provide up to five phone numbers and three emails per property through contact enrichment, and leverage 30+ pre-built "Quick Lists" to pinpoint properties with specific characteristics, like distressed owners or high-equity opportunities.

"What used to take 30 minutes now takes 30 seconds. BatchData makes our platform superhuman." – Chris Finck, Director of Product Management

Beyond APIs, BatchData also supports bulk data delivery through S3, Snowflake, or SFTP, making it ideal for large-scale market analysis. Investors can automate CRM enrichment to monitor property statuses and ownership changes, cutting out the need for manual assessor lookups. Designed with developers in mind, the platform allows integration within just a few hours.

Features of BatchData’s Real-Time Tax Data

BatchData’s Real-Time API is built to deliver property intelligence directly into your systems, slashing research time from minutes to seconds. It provides instant access to critical information like legal descriptions, APNs, and tax history, which are essential for due diligence. Key data points, such as "Tax Year" and "Assessed Value", can help identify opportunities for tax appeals or savings.

For those looking to refine their valuation models, the Property Valuation add-on integrates core tax assessor data to calculate loan-to-value (LTV) ratios and equity with greater precision. The Property Owner Profile module offers a comprehensive view of an owner’s portfolio, including equity and total debt, while the Deed History feature verifies ownership rights and purchase history – key for due diligence. These tools allow investors to seamlessly incorporate real-time data into their workflows. For more complex needs, BatchData provides professional services, such as custom data pipelines and "Data Concierge" services, to streamline systems and normalize data for better accuracy.

The platform also ensures data accuracy through address cleansing and normalization to USPS standards, mapping tax data precisely to physical locations. By pulling data directly from county offices, BatchData guarantees standardized and reliable information for compliance and valuation purposes.

Pricing and Custom Solutions

BatchData offers flexible monthly plans based on the volume of records, with options to add specialized datasets. The Lite plan starts at $500 per month and includes 20,000 property records, API access, property search, and core tax data. For higher-volume needs, the Professional plan provides 300,000 records for $2,500 per month, and the Scale plan supports up to 750,000 records for $5,000 per month.

| Plan | Monthly Price | Monthly Records | Key Features |

|---|---|---|---|

| Lite | $500 | 20,000 | API Access, Property Search/Lookup, Core Tax Data |

| Growth | $1,000 | 100,000 | Everything in Lite + Single & Bulk Property Lookup |

| Professional | $2,500 | 300,000 | Everything in Growth + Priority Processing |

| Scale | $5,000 | 750,000 | Everything in Professional + Dedicated Support |

| Enterprise | Custom | Custom | Custom Integration, SLA Guarantees, Account Manager |

Dataset add-ons are priced separately, ranging from $25 to $1,750 per month. For instance, the Property Owner Profile costs $25–$250 per month, Deed History ranges from $50–$1,000 per month, and the Property Valuation (AVM) add-on is priced between $150 and $1,500 per month. The Enterprise plan offers tailored contract terms, custom datasets, and migration support to meet specific business needs. Additionally, skip tracing is available on a pay-per-match basis, separate from the core property data plans.

How to Access and Use Real-Time Tax Data

Adding Real-Time Data to Your Workflow

BatchData’s RESTful JSON API makes it easy for developers to get started quickly. You can initiate API calls in just minutes, and full integration is typically wrapped up within a few hours or days. The platform is built for speed and reliability, offering sub-second response times and a 99.99% uptime SLA, ensuring your operations run smoothly.

For those who need more than real-time API access, BatchData also provides bulk delivery options. Data can be delivered through Amazon S3, Snowflake, FTP/SFTP, CSV, and Parquet formats. This flexibility is ideal for tasks like training machine learning models, performing large-scale market analyses, or populating databases with historical tax data. The platform sources data from over 3,200 locations, ensuring a steady flow of information even when individual county systems face outages.

Here’s a breakdown of the available delivery methods to help you choose the best fit for your needs:

| Delivery Method | Best For | Technical Format |

|---|---|---|

| Real-Time API | Instant property lookups, CRM enrichment, live applications | RESTful JSON API with sub-second response |

| Bulk Data Delivery | Database backfilling, ML model training, market analysis | Amazon S3, Snowflake, FTP/SFTP, CSV, Parquet |

| Professional Services | Custom matching, legacy vendor migration, bespoke datasets | White-glove support and custom integrations |

BatchData also offers professional services to customize data integration according to your specific needs. For example, automated CRM enrichment keeps tabs on property statuses and ownership changes in real time, eliminating the need for manual assessor lookups and saving significant time. Investors can even sign up for free API keys to test live data in their development environments before committing to a paid plan.

This streamlined integration doesn’t just improve your workflow – it also sets the stage for stronger compliance, as explained below.

Compliance and Operational Efficiency

Real-time tax data offers a transformative way for investors to manage compliance and streamline operations. BatchData ensures enterprise-grade data quality through automated testing, supplemented by human oversight for edge cases.

Automating tax data processes delivers measurable benefits. Research shows that automation saves lenders an average of 1.24 hours per loan transaction, translating to $53.77 saved per loan and a return on investment of 10.76x. Mortgage servicers also benefit, as automated updates provide staff and homeowners with timely insights into payment statuses and due dates, significantly reducing call center inquiries. With daily updates, BatchData ensures your records remain compliant with the latest tax data.

The platform also supports compliance during outreach campaigns. Integrated tools like DNC scrubbing help mitigate TCPA risks, while address and phone verification APIs remove invalid or duplicate contact details, saving marketing dollars and improving customer interactions. With a 76% right-party contact accuracy – nearly three times the industry average – BatchData helps ensure your outreach efforts connect with the right decision-makers.

Conclusion

Access to real-time tax data has become a game-changer for investors looking to boost returns and reduce risks. With up-to-date insights into tax assessments, lien statuses, and depreciation schedules, investors can make more informed decisions about property valuations and portfolio strategies. Without such data, decision-making risks being based on outdated information, potentially missing out on key distress indicators that highlight motivated sellers.

The numbers speak for themselves: automated property tax data provides a 10.76x return on investment and saves an average of $53.77 per loan transaction. But the benefits go beyond cost savings. Real-time data unlocks advanced strategies like capital loss harvesting, cost segregation for faster depreciation, and precise after-tax cash flow modeling. For instance, acquiring a rental property could lower an effective tax rate from 25% to 24.6%, while depreciation deductions of $13,091 on a $400,000 property could lead to $3,273 in tax savings annually.

Platforms like BatchData make these advantages even more accessible. By offering rapid API delivery, bulk data options, and nearly flawless uptime, BatchData ensures seamless integration into existing workflows. Their comprehensive datasets cover millions of properties, while professional services help with custom integrations and CRM enrichment when needed.

These tools empower investors to pinpoint distress signals, verify equity positions, and maintain compliance – all essential for optimizing after-tax returns. For example, the U.S. commercial real estate market currently holds $116.4 billion in distressed property value, with private owners accounting for 37% of that total. Capturing these opportunities requires immediate, accurate data. Investors who leverage real-time tax data gain a competitive edge, enabling faster due diligence and the ability to structure deals that maximize returns while staying audit-ready.

Incorporating real-time tax data isn’t just about improving processes – it’s a strategic necessity in today’s fast-paced market.

FAQs

How can I use real-time tax data to identify distressed deals early?

Real-time tax data is a powerful tool for investors looking to identify distressed properties. Overdue taxes often indicate financial trouble, creating opportunities to target undervalued real estate. By tapping into up-to-date tax delinquency records – like notices of default or tax liens – investors can move quickly to connect with property owners before foreclosure or market listing occurs.

Platforms like BatchData simplify this process by providing enriched data, making it easier to reach motivated sellers and act on these opportunities efficiently.

Which tax data fields matter most for ROI and valuation models?

When it comes to ROI and valuation models, certain tax data fields play a crucial role. These include:

- Assessed property value: This directly impacts a property’s market value and helps estimate potential returns.

- Tax amount: A key factor in calculating property expenses and determining net operating income (NOI).

- Ownership records: Essential for verifying property ownership and ensuring accurate analysis.

Another important element is the Assessor’s Parcel Number (APN), which acts as a unique identifier for properties, ensuring consistency across data sets.

Having real-time access to precise tax data isn’t just helpful – it’s necessary for conducting thorough financial analyses and making reliable ROI and valuation predictions.

What’s the fastest way to integrate BatchData into my workflow (API vs bulk)?

The quickest way to start using BatchData is through its API. This approach offers real-time data access and automation, making it perfect for dynamic workflows. With the API, you can instantly perform property searches and retrieve tax data without delays.

If your needs involve processing large datasets periodically, bulk data delivery might be a better fit. While it requires less upfront setup, it doesn’t offer the same speed or flexibility as the API.

For those prioritizing efficiency and adaptability, the API integration is the way to go.