SEO Title: Find Pre Foreclosure Properties (Updated Daily List)

SEO Description: Learn how to find pre foreclosure properties using public records, data platforms, and automated alerts. Get high-intent leads before the auction.

SEO Keywords: how to find pre foreclosure properties, pre foreclosure leads, pre foreclosure listings, pre foreclosure data, find distressed properties

Finding a pre-foreclosure property is a race against time, giving you a chance to negotiate directly with a motivated seller before the bank forecloses. This direct access allows you to secure a deal well below market value and completely sidestep the cutthroat competition of a public auction. To succeed, you must move with speed, precision, and the right data.

Here are the primary methods for finding these opportunities:

- Direct Public Records: Sourcing Notices of Default directly from county offices.

- Online Aggregators: Using websites that compile public foreclosure data.

- MLS Listings: Identifying agent-listed "short sale" or "pre-foreclosure" properties.

- Professional Data Platforms: Leveraging services like BatchData for real-time, filtered leads.

This guide breaks down exactly how to find, analyze, and contact homeowners in pre-foreclosure, giving you a repeatable system for sourcing off-market deals.

What is the Pre-Foreclosure Opportunity?

A pre-foreclosure property is a home where the owner has defaulted on their mortgage but still holds the legal title. This period, which lasts from 90 days to over a year, allows an investor to negotiate directly with the homeowner to purchase the property, clearing the owner's debt and preventing a foreclosure from damaging their credit. The process begins when a homeowner misses mortgage payments for three to six months, prompting the lender to file a public notice of default.

Key Legal Notices You Must Know

Two public documents signal a property has entered pre-foreclosure.

- Notice of Default (NOD): The lender files this document to publicly state the borrower has defaulted and specifies the amount owed to cure the loan. It is the most common signal that the foreclosure process is underway.

- Lis Pendens: Latin for "suit pending," this notice is filed in states requiring judicial foreclosures. It serves the same function as an NOD, alerting the public that a lawsuit has been filed against the property that could affect its title.

Knowing which document is used in your target state is the first step in building a reliable search strategy.

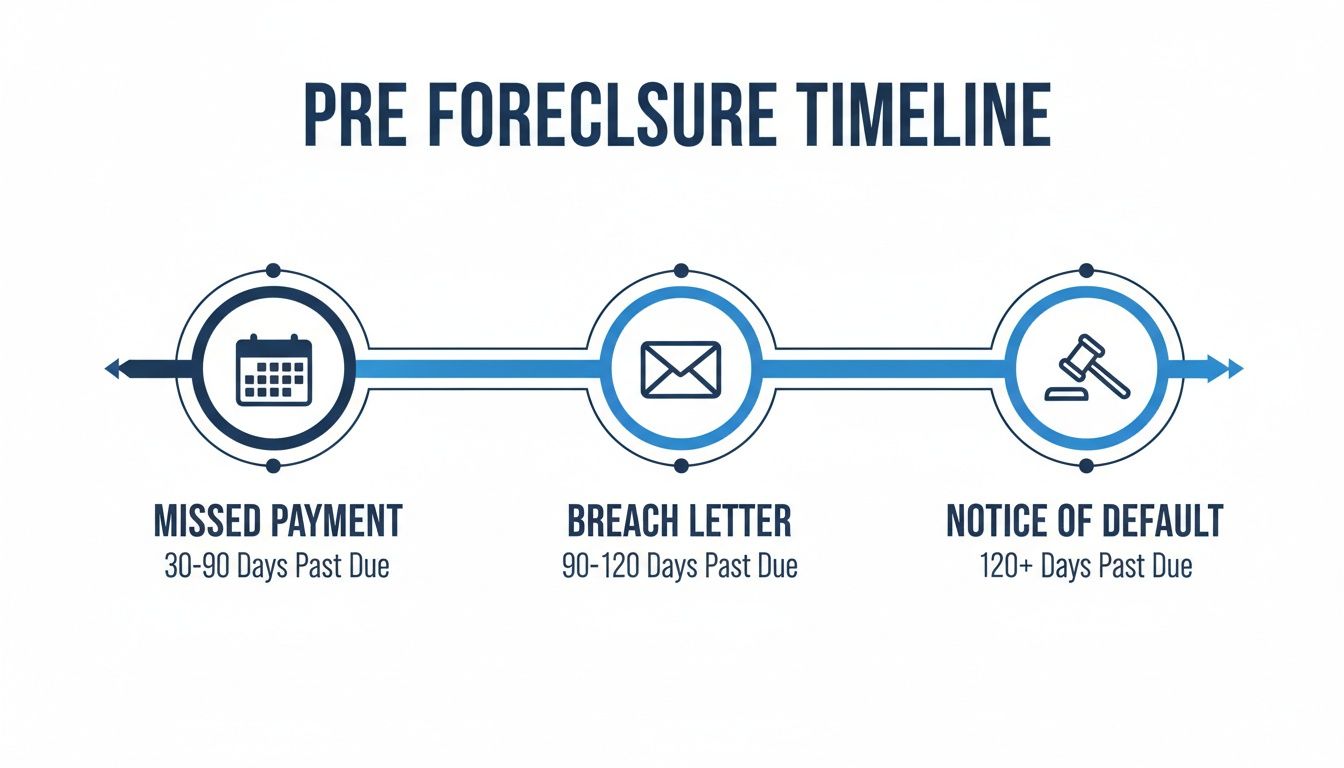

The Pre-Foreclosure Timeline and Key Stages

The table below outlines the foreclosure journey, highlighting the critical window for investor intervention.

| Stage | Typical Timeframe | Key Document or Action | Investor Opportunity |

|---|---|---|---|

| Missed Payments | 30-90 Days | Homeowner misses 1-3 mortgage payments. | None. This stage is private between the owner and lender. |

| Breach Letter | 90-120 Days | Lender sends a formal "breach letter" demanding payment. | Private. No public record has been filed. |

| Notice of Default (NOD) | 120+ Days | Lender files an NOD or Lis Pendens with the county. | Entry point. The notice is now public record. |

| Reinstatement Period | 90 days to 1 year | Homeowner has a set time to pay the outstanding debt. | Prime negotiation window. Direct owner contact is possible. |

| Notice of Trustee Sale | 20-30 days before auction | A public notice is issued with the auction date and time. | Window is closing fast. Competition increases. |

The process effectively begins for an investor once the Notice of Default is filed and becomes public record.

This visual reinforces that the investor opportunity window opens only after the official Notice of Default is filed.

Why This Stage is Ideal for Investors

Investing during pre-foreclosure provides a significant advantage over waiting for a property to become bank-owned (REO) or hit auction. You negotiate directly with the homeowner, not a bank's asset manager, enabling more creative and flexible deal structures.

The core advantage of pre-foreclosure investing is negotiating from a problem-solving standpoint. You aren't just buying a house; you are providing a viable exit strategy for a homeowner in a difficult financial situation.

Competition is a fraction of what exists at public auctions. While hundreds of bidders may compete at a courthouse, only a few investors actively and ethically engage homeowners during the pre-foreclosure phase. This direct access allows for proper due diligence and rapport-building, dramatically increasing the odds of closing a deal before the property is ever listed publicly.

How Do You Source High-Quality Pre-Foreclosure Leads?

Sourcing pre-foreclosure properties is a search for financial distress signals buried in public and private data. With foreclosure starts on 289,441 properties in the last year—a 14% jump from the prior year—the market is filled with opportunities for investors who can find them first. A data-driven strategy is the only way to get ahead of the competition.

Traditional Methods

- Public Records: Manually searching for Notices of Default (NODs) or Lis Pendens filings at county courthouses and recorder's offices. This method provides raw, unfiltered data but is extremely time-consuming and geographically limited.

- Multiple Listing Service (MLS): Identifying properties listed as "pre-foreclosure" or "short sale." These are already on the market, meaning you face maximum competition from other buyers and agents.

Digital Methods

- Online Aggregators: These websites compile public record data into searchable databases, saving a trip to the courthouse. However, their data can be delayed by weeks, incomplete, or inaccurate, meaning the best opportunities are often gone before they appear.

- Real Estate Data Platforms: These services consolidate nationwide public records, lien information, mortgage data, and property characteristics into a single, unified system. They are the most efficient and scalable method for finding pre-foreclosure properties.

Platforms like BatchData provide instant access to records updated daily, allowing you to build automated searches with precise filters for speed, data depth, and scalability. A critical part of this is mastering outbound lead generation, which these platforms are designed to support.

The goal isn't just to find pre-foreclosure leads; it's to find the right ones. This means identifying homeowners who have enough equity to make a deal work, which requires layering multiple data points beyond the initial default notice.

Comparing Pre-Foreclosure Lead Sourcing Methods

The right method balances cost, speed, and data quality. This table compares the primary approaches.

| Method | Efficiency | Cost | Data Quality | Scalability |

|---|---|---|---|---|

| County Courthouse | Very Low | Low (Time) | High (Raw) | Very Low |

| MLS Listings | Low | Medium (Fees) | Medium | Low |

| Online Aggregators | Medium | Low-Medium | Variable | Medium |

| Data Platforms | Very High | High (Subscription) | Very High | Very High |

For scaling an investment business, a comprehensive data platform is not an advantage—it's a requirement for staying competitive.

How Do You Build a High-Intent Pre-Foreclosure Watchlist?

A raw list of pre-foreclosures is 99% noise. Effective filtering separates professional investors from amateurs by isolating homeowners who are both distressed and have a viable path to a deal. The first step is applying foundational filters to eliminate low-potential leads immediately.

Applying Foundational Filters

These filters screen for the basic financial and physical viability of a deal.

- Estimated Equity: Target properties with a minimum of 20-30% equity. Without it, a sale that covers the mortgage, liens, and closing costs is mathematically impossible.

- Property Type: Focus on specific asset classes, such as single-family residences (SFRs), to align with your investment model.

- Geographic Focus: Limit searches to specific counties or ZIP codes to concentrate your marketing efforts and develop market expertise.

- Ownership Status: Exclude corporate-owned or bank-owned properties to ensure you are contacting individual, motivated homeowners.

Layering Advanced Data for High Intent

With a clean baseline list, layer on nuanced data to shift from identifying potential leads to pinpointing motivated sellers. This advanced analysis uncovers the story behind the default. With U.S. foreclosure starts hitting 103,000 in Q3 alone (a 23% year-over-year increase), you need deep insights to capitalize on the growing opportunity.

A Notice of Default only tells you a homeowner is in financial trouble. It doesn't tell you if they have the ability or the desire to sell. Layering data is how you uncover that intent.

Key data points for advanced analysis include:

- Mortgage and Lien Data: Identify properties with multiple liens (e.g., tax, mechanic's), which increases financial pressure and motivation.

- Occupancy Status: Prioritize vacant properties. An owner of a vacant pre-foreclosure is paying for a non-performing asset and is highly motivated to sell.

- Property History: Look for trigger events like divorce, probate, or relocation that often correlate with financial distress and a higher motivation to sell.

Using Predictive Analytics to Score Leads

Modern data platforms use machine learning to assign a "propensity to sell" score to each property. These models analyze thousands of data points—equity, market trends, homeowner demographics—to rank your prospects by their likelihood to sell. This predictive approach ensures your marketing budget is focused on leads with the highest probability of converting. You can learn more about how likelihood to sell data transforms real estate investing.

How Can You Contact Distressed Homeowners Ethically?

Outreach is the most delicate stage of the process. It is not about high-pressure sales; it is about making a human connection and offering a credible solution during a homeowner's financial crisis. Your communication must be empathetic, compliant, and framed as a helpful resource.

Finding Accurate Contact Information

Accurate contact information is the foundation of any outreach campaign. Skip tracing is the process of finding verified, up-to-date phone numbers and addresses for property owners. Professional skip tracing services are essential for any serious investor, as they provide high-quality data and scrub lists against the National Do Not Call (DNC) Registry to ensure compliance with the Telephone Consumer Protection Act (TCPA).

Choosing Your Outreach Channel

A multi-channel approach is most effective, as different homeowners respond to different communication methods.

- Direct Mail: A well-designed letter or postcard is non-intrusive and allows the homeowner to consider your offer on their own time.

- Cold Calling: This is the most direct method and requires the most skill. The script and tone must be framed around problem-solving, not selling.

- Email: Less invasive than a call, email allows you to provide more detailed information and is effective for follow-up.

The most successful outreach campaigns don't sound like campaigns at all. They're framed as solutions. Your message should quickly convey that you understand their situation and are offering a legitimate way out—whether that’s a fair cash offer, help with moving costs, or another creative option.

Crafting a Message with Empathy and Compliance

Your script must be sensitive and legally compliant. A great guide to empathy in customer service can provide valuable insights.

Sample Cold Call Opening:

"Hi, [Homeowner Name]. My name is [Your Name]. I know this call is out of the blue, but I'm a local property owner and came across the public notice regarding your property at [Property Address]. I specialize in helping homeowners in these exact situations, and I just wanted to see if you might be open to hearing about a few options that could help."

This opening is direct, transparent, and immediately frames you as an ally. It acknowledges the public nature of their situation without being predatory. Strict adherence to TCPA guidelines is non-negotiable.

How Do You Underwrite a Pre-Foreclosure Deal?

Underwriting a pre-foreclosure deal requires a cold, emotionless analysis of the numbers to determine if a profitable and ethical solution is possible. The entire process hinges on one number: the total debt secured against the property.

Run a Preliminary Title Search

The first and most critical step is running a preliminary title search. This is non-negotiable, as it is the only way to uncover every lien and judgment attached to the property, including second mortgages, HELOCs, IRS tax liens, mechanic's liens, and unpaid HOA dues. Missing a single lien will kill the deal. This search provides the total payoff amount needed to secure a clear title.

Calculate Your Maximum Allowable Offer (MAO)

The Maximum Allowable Offer (MAO) is the highest price you can pay while still achieving your profit target. The formula requires accurate, conservative inputs.

- After Repair Value (ARV): The property's market value after all renovations are complete, determined by analyzing recent comparable sales (comps).

- Estimated Repair Costs: A realistic budget for all labor and materials needed to reach the ARV, including a contingency buffer for unexpected issues.

- Your Desired Profit: A fixed dollar amount that protects your business's profitability.

Your MAO formula is the financial compass for every deal:

ARV x (Your Target Percentage) – Repair Costs = MAOFor fix-and-flip investors, the "70% Rule" is a common standard: (ARV x 0.70) – Repairs = MAO. The 30% buffer covers profit, holding costs, closing fees, and unexpected expenses.

This calculation prevents emotional decision-making. If your MAO is less than the property's total debt, a standard purchase is not viable.

Verify Ownership and Mortgage Details

Finally, use your data to cross-reference ownership history and confirm you are negotiating with the actual decision-maker. Double-check the original mortgage amount and recording date to get a clear picture of the homeowner's equity position. This level of diligence ensures that when you make an offer, it is realistic, well-researched, and solves the homeowner's problem while securing a sound investment.

How Can You Automate and Scale Your Investment Strategy?

Manual deal hunting imposes a hard ceiling on growth. To build a scalable operation, you must implement a systematic, tech-driven engine that sources pre-foreclosure properties automatically. Recent market data underscores this need: a 26% month-over-month spike in U.S. foreclosure filings, reaching 44,990 properties, highlights the volume of opportunities available. To consistently capture these deals, you need an automated lead flow. You can get more context on this trend from the latest ATTOM foreclosure report.

Implement Smart Searches and Automated Alerts

Replace manual list-pulling with dynamic, persistent searches. Create a "smart search" with your ideal investment criteria (e.g., equity, property type, location, lien status) and enable automated alerts. Your system will then monitor the market 24/7 and send an instant notification via email or webhook the moment a new property matching your profile enters pre-foreclosure. This guarantees you are first to know and act.

Use APIs for CRM Integration

An Application Programming Interface (API) connects your lead generation platform directly to your Customer Relationship Management (CRM) software. This automates the entire workflow: a new lead is identified, its data is instantly pushed to your CRM, a new record is created, and your marketing sequence is triggered. This eliminates manual data entry, reduces human error, and dramatically shortens the time from lead discovery to first contact.

Leverage Bulk Data for Advanced Analytics

For sophisticated operations like proptech firms or hedge funds, bulk data delivery via cloud storage (e.g., Amazon S3) or a data warehouse is the final piece of the puzzle. This level of access enables data science teams to:

- Train custom machine learning models to predict foreclosure risk.

- Power large-scale portfolio monitoring and risk analysis.

- Enrich proprietary datasets with real-time pre-foreclosure flags.

This transforms your strategy from reactive searching to proactive, predictive acquisition.

What Are the Top Pre-Foreclosure Questions?

Navigating the world of pre-foreclosures requires understanding the legal landscape, risks, and potential returns. Here are direct answers to the most common questions.

Is It Legal to Contact a Homeowner in Pre-Foreclosure?

Yes, it is 100% legal to contact a homeowner in pre-foreclosure. The Notice of Default or Lis Pendens is a public record, making the information accessible to anyone. However, how you communicate is strictly regulated. You must comply with the Telephone Consumer Protection Act (TCPA) by scrubbing against the National Do Not Call registry.

Legal compliance is the baseline. The key to success is approaching homeowners with genuine empathy to offer a solution, not to pressure them into a sale. Always consult with a legal professional to ensure your outreach strategy is compliant in your state.

What Are the Biggest Risks of Buying Pre-Foreclosure Properties?

The primary risks involved in buying pre-foreclosure properties include:

| Risk Category | Specific Examples | Mitigation Strategy |

|---|---|---|

| Financial Risks | Hidden Liens: Last-minute mechanic's or IRS liens not on the preliminary title report. | Comprehensive final title search; holdback funds in escrow. |

| Logistical Risks | Uncooperative Homeowner: Owner refuses access, stops communicating, or files for bankruptcy. | Build strong rapport; have clear contract terms; be prepared to walk away. |

| Property Risks | Unknown Condition: Inability to conduct a full interior inspection, leading to surprise repair costs. | Use a large contingency buffer in your underwriting; inspect exterior thoroughly. |

Meticulous due diligence is the only defense against these financial and logistical landmines.

How Much of a Discount Can I Realistically Expect?

A realistic discount typically falls in the 20-30% below current market value range. This is not a fixed rule; the final price depends on the homeowner's equity, the property's condition, and local market demand. The purchase price must cover the outstanding mortgage, all liens, and closing costs, while still leaving the homeowner with cash to relocate. Attempting to structure a deal on a property with low or no equity is almost always a losing battle.

Ready to build a scalable, automated system for finding high-equity pre-foreclosure deals before your competition? With BatchData, you can access daily-updated pre-foreclosure records, nationwide property data, and verified owner contact information to build your high-intent watchlist in minutes. Stop searching and start closing by visiting https://batchdata.io.