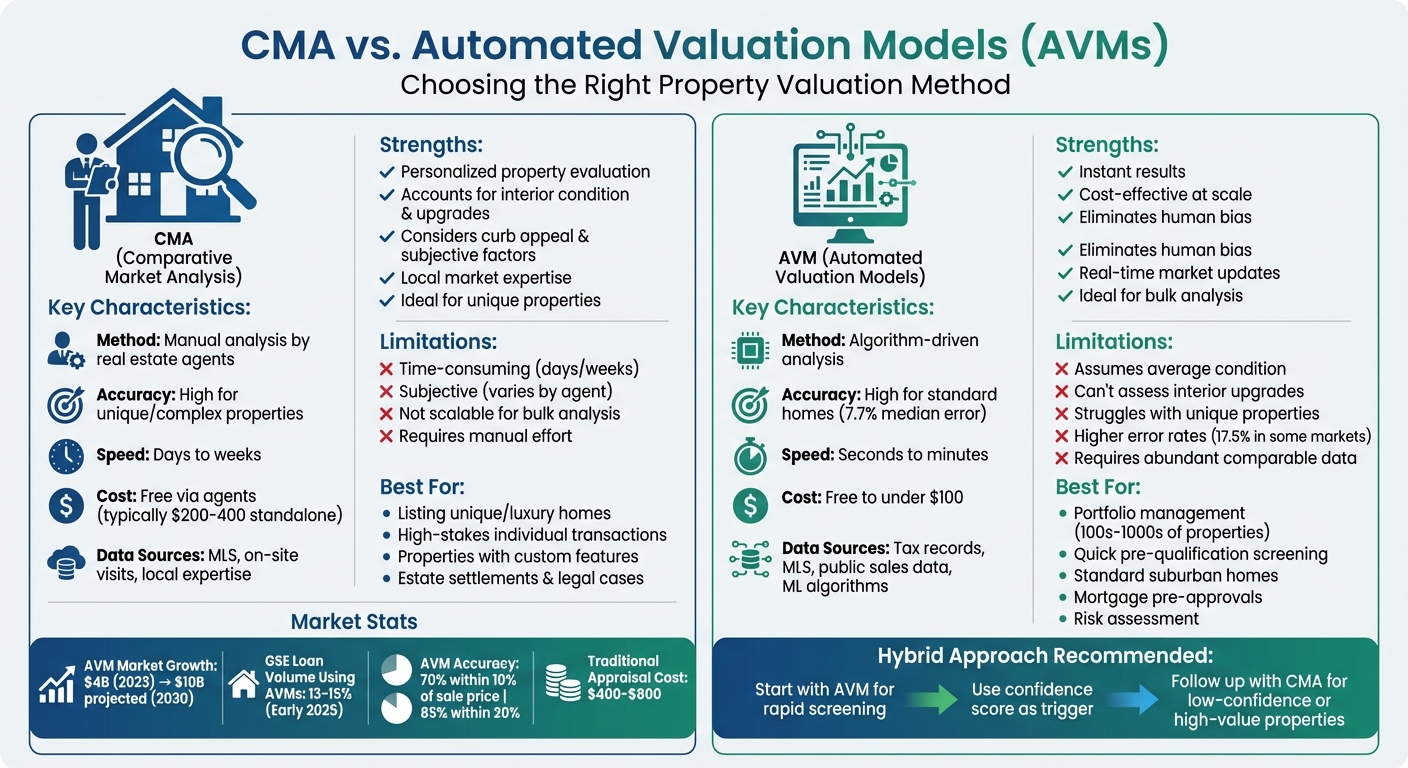

CMA (Comparative Market Analysis) and AVMs (Automated Valuation Models) are two popular methods for estimating property values. Each has its strengths and weaknesses, depending on your needs:

- CMAs: Conducted by real estate agents, CMAs provide detailed, personalized property evaluations by analyzing recent sales, active listings, and property-specific factors like upgrades or curb appeal. They’re best for unique properties or competitive pricing.

- AVMs: Algorithm-driven tools that deliver fast, data-based estimates using large datasets. These are ideal for quick valuations of standard properties in areas with plenty of comparable sales.

Key Differences:

- Accuracy: CMAs are more precise for unique or complex properties, while AVMs work better for standard homes with lots of comparable data.

- Speed: AVMs provide instant estimates; CMAs take days or weeks.

- Cost: AVMs are often free or low-cost; CMAs are usually free when working with an agent but require more manual effort.

Quick Comparison

| Criteria | CMA | AVM |

|---|---|---|

| Accuracy | High for unique homes | High for standard homes |

| Speed | Days to weeks | Seconds |

| Cost | Free via agents | Free or <$100 |

| Use Cases | Pricing unique homes | Bulk valuations |

Both methods have their place. Use CMAs for tailored insights on individual properties. Choose AVMs for quick, large-scale evaluations.

CMA vs AVM Property Valuation Methods Comparison Chart

Real Estate Exam Vocabulary: Valuation Terms Explained Simply

sbb-itb-8058745

How Comparative Market Analysis (CMA) Works

A Comparative Market Analysis (CMA) begins with gathering detailed information about the property in question. This includes factors like the total living area, age, architectural style, number of bedrooms and bathrooms, and any standout features such as solar panels or a pool. Real estate agents then identify 3 to 5 comparable properties – or "comps" – that closely match the subject property. These comps are selected based on attributes like size, condition, and location, typically within a one-mile radius and sold within the past 3 to 6 months. This timeframe ensures the analysis reflects current market conditions instead of outdated trends. These steps lay the groundwork for a more detailed process.

The next phase involves adjusting for differences between the subject property and each comp. For example, if a comp has an extra bedroom, the value of that feature is deducted from its sales price to make it comparable to the subject property. Conversely, if a comp has an outdated kitchen while the subject property has a modern remodel, the comp’s price is adjusted upward. The key rule here is simple: adjust the comp, not the subject property.

CMA Methodology

After collecting data and selecting comps, real estate professionals follow a structured process. They often rely on the Multiple Listing Service (MLS) to access verified sales data, which includes details like financing terms and seller concessions – information that public websites may not provide. To ensure accuracy, agents use polygon mapping tools to define neighborhood boundaries more precisely than a basic radius search.

Agents also conduct on-site visits to assess elements that automated tools can’t capture, like curb appeal, interior finishes, and layout. They verify square footage and the property’s age using public records, such as CoreLogic‘s Realist, and cross-check these details during physical inspections to account for unrecorded renovations.

The analysis also considers qualitative factors that algorithms often overlook. These include proximity to potential nuisances like train tracks, the appeal of specific school districts, or whether a property has a view of a parking lot versus a golf course. Additionally, property rights – whether "fee simple" (full ownership) or "leasehold" (temporary use) – are factored in since they significantly influence value. Other considerations include the local market’s dynamics, such as whether it’s a buyer’s or seller’s market, current inventory levels, and the average time properties spend on the market. For instance, neighborhoods where homes sell in under three months often indicate a strong seller’s market.

Role in Property Benchmarking

CMAs aren’t just about calculating a property’s price – they also help track market trends. For investors, CMAs provide insights beyond sold properties. Agents examine active listings to gauge current competition and review expired listings to identify cases where overpricing led to a failure to sell. This approach – analyzing sold, active, and expired listings – offers a more comprehensive view of market dynamics. It helps investors understand not only property values but also pricing strategies and market trends.

Homeowners can also use CMAs to decide whether certain renovations will add value in their neighborhood. While standalone CMAs usually cost between $200 and $400, many agents offer them free to active clients.

"The key difference is a CMA establishes a home’s price, whereas an appraisal establishes its value – price is what you pay for something while value is what it is worth." – Investopedia

This thorough and personalized process stands in contrast to Automated Valuation Models (AVMs), which offer quicker but less detailed analyses, as we’ll explore in the next section.

How Automated Valuation Models (AVMs) Work

Automated Valuation Models (AVMs) calculate property values by combining mathematical models with extensive property data and transaction records. Unlike traditional comparative market analyses, which rely on manual input from real estate agents, AVMs provide almost instant evaluations by analyzing property details alongside current market trends.

The process starts by identifying comparable sales within a specific area – like a neighborhood or school district. Next, the model applies various valuation techniques and assigns a confidence score based on historical accuracy. AVMs pull data from multiple real estate data sources, including tax records, public sales data, mortgage information, and the Multiple Listing Service (MLS). Advanced systems may even factor in hyperlocal elements, such as crime rates, school quality, and nearby amenities like parks or public transit.

"An automated valuation model (AVM) is a service that combines mathematical or statistical modeling with databases of existing properties and transactions to calculate real estate values." – Investopedia

For example, ATTOM’s AVM covers 99% of the U.S. population, excluding primarily mobile homes and farmland. In accuracy testing, about 70% of AVM estimates fall within 10% of actual sale prices, and 85% fall within 20%. In contrast, traditional appraisals, which cost $400–$800 and take days or weeks, offer similar accuracy.

AVM Calculation Methods

AVMs rely on three primary methods: hedonic pricing models, repeat sales indices, and machine learning algorithms.

- Hedonic Pricing Models: These use statistical regression to assign value to specific property features like square footage, age, and amenities.

- Repeat Sales Indices: This method tracks the price changes of the same property over time, offering insights into market trends without adjusting for differences between properties.

- Machine Learning Algorithms: The most advanced approach, machine learning uses neural networks, such as random forests or gradient boosting, to integrate complex market data. These models improve valuation accuracy by 8–9% compared to older methods. Some AVMs also use natural language processing to analyze listing descriptions.

The global AVM market was valued at over $4 billion in 2023, with projections suggesting it could grow to $10 billion by 2030. These calculation techniques underpin many real estate applications.

Use Cases for AVMs

Thanks to their advanced methodologies, AVMs are widely used for property valuation and portfolio management. For investors and lenders, AVMs enable bulk property benchmarking, allowing entire portfolios to be valued instantly without commissioning individual appraisals. By early 2025, appraisal waivers supported by AVMs accounted for 13–15% of GSE (Fannie Mae and Freddie Mac) loan volume.

Mortgage lenders frequently use AVMs for home equity loans and loss mitigation, while investment firms rely on them for daily portfolio valuation and performance tracking. Real estate professionals also turn to AVMs for quick pre-qualification estimates before deciding whether to proceed with a full comparative market analysis or traditional appraisal. Many firms automate property searches and valuation workflows by integrating these data streams directly into their CRMs.

"AVMs are particularly useful in assessing the worth of an entire real estate portfolio. Once set up, AVMs can be operated with little expense." – Investopedia

However, AVMs have limitations. They can’t perform physical inspections, so they assume properties are in average condition. This means they can’t account for interior upgrades, deferred maintenance, or subjective factors like curb appeal. AVMs are most effective in markets with high transaction volumes and similar properties but may struggle with unique, luxury, or new-build homes where comparable data is limited.

Strengths and Limitations of CMA

Strengths of CMA

A Comparative Market Analysis (CMA) provides a personalized approach to property valuation that automated systems just can’t match. Unlike algorithms, a CMA often includes an in-person visit where the agent evaluates property details that automated models might overlook [10, 23]. This makes CMAs especially helpful for properties with unique features – like waterfront homes or those on golf courses – where comparable data might be sparse.

Real estate professionals bring a level of local expertise that automated models simply don’t have. For example, agents can make precise adjustments based on unique property traits, such as assigning dollar values to a finished basement, a renovated kitchen, or a newer roof [2, 23]. They also review pending and expired transactions to create a pricing range that’s defensible and well-informed.

"A CMA is not a formula-driven estimate like a Zestimate or automated valuation model (AVM). Instead, it is a professional evaluation requiring expertise, judgment, and local knowledge." – Kyle Hiscock, Realtor, Hiscock Homes at REMAX Realty Group

For example, in Northeast Florida, an AVM valued a 4-bedroom home at $345,000, but a local Realtor’s CMA placed it at $385,000. The $40,000 difference was due to adjustments for a new roof, remodeled kitchen, and updated landscaping – details the AVM failed to account for. Another plus? Most agents provide CMAs free of charge to potential clients, making it an accessible tool for sellers [2, 5].

However, this detailed, expert-driven process isn’t without its challenges.

Limitations of CMA

While CMAs offer many advantages, they also come with some drawbacks, particularly in terms of scalability and consistency. Unlike automated valuation models (AVMs), which generate results almost instantly, CMAs require a manual process that can take days or even weeks. Collecting data, conducting on-site visits, and analyzing findings takes time, which may delay decisions [3, 24].

Another challenge is the reliance on human judgment. Different agents might interpret the same property differently, leading to varying valuations based on their assumptions and perspectives. This subjectivity can sometimes introduce biases, such as anchoring or excessive optimism [24, 25]. For instance, studies show that appraisals – similar in methodology to CMAs – often align with agreed-upon contract prices, suggesting professionals may sometimes lean on existing sales prices rather than conducting fully independent evaluations.

Cost is another factor to consider. While CMAs are usually free, formal appraisals – which are more standardized – can cost between $400 and $800. Manual processes also tend to be more error-prone compared to automated systems [1, 26]. Lastly, CMAs lack the regulatory weight needed for mortgage approvals. Lenders require formal appraisals, which include certifications from licensed professionals, for underwriting and high-stakes financial decisions [3, 24].

Strengths and Limitations of AVMs

Strengths of AVMs

Automated Valuation Models (AVMs) provide property value estimates in seconds, a stark contrast to the days or weeks required for traditional appraisals. This speed makes them particularly useful for investors and institutions managing large-scale property evaluations, sometimes numbering in the hundreds or thousands.

Because AVMs rely on algorithms, they reduce human bias and avoid subjective "gut feelings" in property valuations. Research shows that about 90% of traditional appraisals align with or exceed the contract price, hinting that appraisers may sometimes lean on agreed-upon sales figures instead of conducting fully independent assessments. AVMs, on the other hand, strictly use real estate data and mathematical patterns, continually updating as new market data becomes available. This ensures real-time benchmarking.

The global AVM market has grown rapidly, valued at over $4 billion in 2023, with projections suggesting it could surpass $10 billion by 2030. Modern AVMs leverage advanced machine learning techniques like Random Forests and Gradient Boosting. They even incorporate tools like computer vision to analyze satellite imagery and street-view photos. While these features offer clear advantages, AVMs are not without their challenges.

Limitations of AVMs

Despite their efficiency and scalability, AVMs come with notable limitations. Since they don’t involve physical property inspections, they often assume all properties are in "average" condition. This can lead to inaccuracies, as AVMs may overlook interior upgrades, renovations, maintenance issues, or unique characteristics that could significantly influence a property’s value.

"AVMs work best with widely traded, homogenous assets. Their performance degrades with increasingly heterogenous assets or assets that are thinly traded."

- Andrew Knight, AI, Data and Tech Lead, RICS

For example, Zillow‘s Zestimate has shown a 7.7% median absolute error on initial list prices, improving to 3.6% closer to the sale date. However, in a 2025 New York City study, Zestimates had a median absolute percentage error of 17.5%. These errors are often more pronounced for unique properties like custom-built homes, historic houses, or luxury estates, where comparable sales data may be scarce.

A high-profile example of AVM limitations occurred in November 2021, when Zillow shut down its "Zillow Offers" iBuyer program. The program’s heavy reliance on AVMs led to overpaying for thousands of homes in a volatile market, resulting in significant financial losses.

Data quality is another critical issue. Even small inaccuracies – such as a misplaced zero in a sales price – can drastically distort valuations. A human analyst might catch and correct such errors, but AVMs lack that capability. Additionally, AVMs cannot account for intangible factors like neighborhood appeal, architectural uniqueness, or changes in buyer sentiment, all of which can influence property values. This is why it’s essential to consider the confidence score included in an AVM report. A low confidence score often signals insufficient comparable data, making a traditional appraisal a more reliable option.

CMA vs. AVMs: Direct Comparison

Both CMAs (Comparative Market Analyses) and AVMs (Automated Valuation Models) bring distinct advantages to the table. Let’s break down their differences in accuracy, speed, and cost to help you decide which method suits your property valuation needs.

Accuracy Comparison

When it comes to accuracy, the right choice depends on the property type and the data available. AVMs are highly effective for standard properties in suburban areas with plenty of comparable sales data. For example, Zillow’s Zestimate has shown a 7.7% median absolute error on initial list prices, improving to 3.6% closer to the sale date. These tools thrive in markets where homes are similar and transactions are frequent.

However, AVMs struggle with unique or uncommon properties. As the Royal Institution of Chartered Surveyors (RICS) explains:

"AVMs work best with widely traded, homogeneous assets; their performance degrades with increasingly heterogeneous assets or assets that are thinly traded".

This means properties like custom-built homes, historic residences, luxury estates, or those with extensive renovations often fall outside an AVM’s capabilities. Algorithms can’t account for interior upgrades, maintenance conditions, or architectural quirks. In these cases, CMAs stand out. A real estate agent conducting a CMA evaluates the property in person, considering factors like condition, curb appeal, and unique features – elements no algorithm can fully measure.

Interestingly, traditional appraisals and CMAs often lean toward higher valuations, aligning with market expectations. Research shows that 90% of traditional appraisals confirm or exceed the contract price. However, as George Andrew Matysiak from Krakow University of Economics warns:

"Despite high average accuracy levels, statistically based valuations may be widely off the mark and need to be augmented by professional judgment".

This is why confidence scores in professional AVMs are essential – they signal when comparable data is lacking and a human-led valuation may be more appropriate. Beyond accuracy, the differences in speed and cost further influence how these methods are used.

Speed and Cost Comparison

Speed and cost are where AVMs and CMAs diverge sharply. AVMs deliver property estimates in seconds or minutes, making them ideal for investors managing large portfolios or lenders reviewing numerous loan applications. In contrast, CMAs require days of detailed research to produce a comprehensive report.

Cost differences are just as notable. AVMs are often free for consumers on platforms like Zillow or Redfin, while professional AVM reports typically cost under $100. On the other hand, CMAs are usually offered as a complimentary service by real estate agents, though they require significant time and expertise to prepare. For comparison, traditional appraisals – another labor-intensive process – range from $300 to $800 for residential properties.

This cost-effectiveness makes AVMs a smart choice for bulk analysis, such as reviewing thousands of properties at once. However, CMAs, being more detailed and property-specific, are better suited for setting competitive listing prices on individual homes. While they’re not practical for large-scale evaluations, they’re invaluable when precision and local market knowledge are key.

When to Use CMA vs. AVMs for Property Benchmarking

Choosing between a CMA (Comparative Market Analysis) and an AVM (Automated Valuation Model) depends on factors like property type, transaction volume, budget, and the level of precision required. The right choice hinges on how much detail is needed and the scale of the evaluation.

Best Use Cases for CMA

CMAs shine when dealing with high-stakes decisions for individual properties, especially those where unique features or physical condition play a major role in determining value. For example, custom-built homes or historic residences often require in-person evaluations to account for interior upgrades, deferred maintenance, or distinctive architectural details – factors that algorithms simply can’t measure.

CMAs are also essential for setting competitive listing prices in complex markets. If you’re selling a property with income-generating potential, the local expertise and physical inspection that come with a CMA provide insights far beyond what automated estimates can offer. In legal scenarios like estate settlements or divorce cases, the detailed documentation and professional judgment of a CMA carry significant weight.

Best Use Cases for AVMs

AVMs are ideal for large-scale portfolio analysis, where speed and cost efficiency are critical. Institutional investors managing hundreds or thousands of properties often rely on AVMs for tasks like risk management or marking-to-market, as these models can process entire portfolios in seconds. They’re especially useful for initial property screening, helping to pinpoint undervalued assets in competitive markets before committing to the expense of a full professional valuation.

For tasks like mortgage pre-qualification or routine portfolio monitoring, AVMs work best with standardized properties in areas with plenty of transaction data. Think of suburban single-family homes in well-established neighborhoods. By early 2025, about 13.5% of GSE loan balances were delivered using AVM-based appraisal waivers, illustrating their growing role in regulated lending.

The Hybrid Approach

While CMAs and AVMs each have their strengths, combining the two can improve both accuracy and cost efficiency. Many investors are adopting a "triage" approach that leverages the best of both methods. This involves starting with AVMs for rapid, bulk screening across portfolios or property lists, then using the AVM’s confidence score as a trigger – when the score is low, it flags the need for a more detailed evaluation via a CMA or traditional appraisal.

This hybrid strategy is particularly effective for high-value investments. Use an AVM to establish a quick, data-driven baseline, and then refine that estimate with a CMA to account for local market nuances and property-specific details. As George Andrew Matysiak from Krakow University of Economics explains:

"Despite high average accuracy levels, statistically based valuations may be widely off the mark and need to be augmented by professional judgment".

Conclusion

When it comes to property benchmarking, CMAs and AVMs work hand in hand rather than competing with each other. AVMs offer quick, data-driven estimates across entire portfolios, processing vast amounts of information in seconds – something that would take days to accomplish manually. This makes them perfect for tasks like large-scale screening, risk assessment, and market tracking, all without the hefty $400 to $800 cost typically associated with traditional appraisals. While AVMs excel in speed and efficiency, they lack the personalized insights that human analysis provides.

On the other hand, CMAs bring the human touch and local know-how that algorithms can’t match. Real estate professionals consider factors like a property’s condition, recent updates, neighborhood trends, and even subjective elements like curb appeal – details that significantly influence sale prices. As Dr. Sean W. Jordan from the University of Wisconsin-Stevens Point puts it:

"The study highlights the importance of treating AVMs, appraisals, and administrative assessments as complementary valuation signals in modern housing markets".

FAQs

How do I know if an AVM estimate is trustworthy?

To determine how reliable an AVM is, start by examining the quality and freshness of its data – this includes sources like MLS listings and public records. AVMs that rely on accurate and up-to-date information tend to produce estimates with fewer errors.

It’s also important to look at metrics like the AVM’s error rate and confidence score, as well as how well it aligns with industry standards. For instance, estimates for on-market properties that use updated MLS data are typically more precise compared to those based on outdated or incomplete information.

When is a CMA worth the extra time versus an AVM?

A Comparative Market Analysis (CMA) is worth the investment of extra time when you need a more thorough and accurate property valuation. This is especially true for tasks like setting a competitive listing price, negotiating deals, or assessing properties with unique features. While Automated Valuation Models (AVMs) deliver quick, algorithm-driven estimates, they often overlook critical factors such as local market trends or specific property details. For high-value transactions or situations that demand deeper insights, a CMA provides the level of detail and professional expertise that AVMs simply can’t match.

Should I use both a CMA and an AVM before setting a price?

When it comes to setting a price, it’s smart to use both a CMA (Comparative Market Analysis) and an AVM (Automated Valuation Model). Here’s why:

- AVMs rely on algorithms to deliver quick, data-based property value estimates. They’re fast and efficient but may lack the nuance of local market conditions.

- CMAs, on the other hand, are created by real estate professionals who take a deeper dive into local trends, comparable sales, and other factors that algorithms might miss.

By combining these two approaches, you can cross-check the results and develop a pricing strategy that’s both accurate and well-informed. It’s the best way to balance data-driven insights with local expertise.