Analyzing historical property trends helps you make smarter real estate decisions by identifying market patterns, timing investments, and predicting future changes. Here’s how you can do it:

- Understand Market Cycles: Study long-term (20 years) and short-term (5–10 years) data to spot economic booms, recessions, and seasonal patterns.

- Track Key Metrics: Focus on median home prices, sales volume, inventory levels, and Days on Market (DOM) to gauge market health and buyer-seller dynamics.

- Use Reliable Data Sources: Leverage platforms like Zillow, Realtor.com, and ATTOM for detailed property records and economic insights.

- Clean and Prepare Data: Standardize and verify datasets to ensure accuracy for analysis.

- Spot Seasonal Trends: Monitor sales activity and inventory changes across seasons, especially spring and summer peaks.

- Factor in Economic Indicators: Keep an eye on interest rates, employment levels, and local economic shifts to predict market behavior.

- Apply Predictive Tools: Use Automated Valuation Models (AVMs) and machine learning for forecasting property values and market trends.

Collecting and Organizing Historical Property Data

Where to Find Reliable Property Data

When it comes to historical property data, finding dependable sources is crucial. The Federal Housing Finance Agency (FHFA) offers House Price Index datasets that span all 50 states and over 400 U.S. cities, with records going back to the mid-1970s. For a broader economic overview, the U.S. Census Bureau and the Department of Housing and Urban Development (HUD) provide demographic and housing statistics. Local public records from counties and cities are another excellent resource, offering transaction details such as deeds, mortgages, foreclosures, and tax assessments.

For more specific data, platforms like Realtor.com provide residential data down to the ZIP code level, based on MLS listings. Zillow also maintains historical real estate metrics dating back to the late 1990s. If you’re looking for extensive datasets, commercial providers like ATTOM have you covered, with records that include over 70 billion rows of transactional data and 9,000 distinct attributes, covering 99% of the U.S. population. Similarly, BatchData offers enriched datasets with standardized property details – like property age, lot size, tax delinquency, and foreclosure history – making it particularly useful for identifying undervalued properties or motivated sellers.

Important Data Points to Track

Tracking the right metrics can reveal a lot about market trends. Pricing metrics, such as median and average sale prices, price per square foot (PPSF), and the sale-to-list price ratio, are essential for understanding property values. Inventory metrics, including active listings, new monthly listings, total inventory, and weeks of supply, help you gauge market saturation levels. Demand indicators, like median Days on Market (DOM), pending sales, and price reductions, can offer insight into buyer interest.

On a property-specific level, data such as square footage, property type (e.g., single-family or condo), year built, and maintenance costs are invaluable for determining value. Broader economic factors – such as mortgage interest rates, local unemployment levels, median household income, and population migration trends – also play a significant role in shaping housing demand. Additionally, newer datasets now incorporate climate risk metrics, like flood, wildfire, and heat indices, offering insights into a property’s long-term viability.

Once you’ve identified these critical metrics, the next step is to prepare your dataset for analysis.

Cleaning and Preparing Your Data

Raw property data often needs a lot of cleaning before it can be used effectively. This process involves fixing errors, removing duplicates, and addressing format inconsistencies. For example, standardizing data entry – like breaking down addresses into components such as street name, city, state, and ZIP code – can make matching and analysis much easier. ATTOM, for instance, uses a 20-step Enterprise Data Management Program that includes tasks like address standardization, parsing owner names, and assigning unique IDs to each record.

It’s also important to cross-check property details, such as square footage and lot size, against assessor records and permits. Sales prices and dates should be verified using official county documents, transfer tax records, or title data. Irrelevant entries – like commercial or multi-family units when analyzing single-family homes – should be removed to improve the dataset’s focus. Consistency is key; for instance, standardize entries like "N/A" and "Not Applicable" into a single format. Watch out for technical glitches, such as backslashes in text fields or improperly formatted dates (e.g., "20160000" instead of "2016").

Handling missing data is another important step. If data is missing completely at random, simple imputation methods like using the mean or median can work. For data missing in a patterned way, applying domain knowledge is often more effective. Statistical tools like the Median Absolute Deviation (MAD) can help identify outliers that may need manual review. Keep in mind, data cleaning isn’t a one-time task – real estate markets evolve constantly, so datasets should be updated regularly to ensure accuracy.

A clean, well-organized dataset is the starting point for uncovering meaningful property trends and making informed decisions.

Finding Patterns and Trends in Historical Data

Understanding Market Cycles

To analyze market cycles effectively, it’s helpful to examine trends over different time frames. Look at 20 years of data to identify long-term cycles and focus on the past 5–10 years for more recent trends. By correlating price movements with key economic events, such as the 2008 recession, you can better understand how markets react to significant disruptions.

Sales volume is another critical metric to track alongside pricing data. For instance, spikes in sales volume often indicate rising demand, which can lead to price increases. Economic expansion or population growth frequently drives these trends. A good example: U.S. home sales dropped sharply by 30% from their 2021 peak of 6.9 million to 4.8 million in 2023. Similarly, investor activity surged, with investors accounting for 26.8% of all residential property sales in Q1 2025, marking the highest share in at least five years.

Inventory levels also play a significant role in market dynamics. Low inventory often shortens Days on Market (DOM), favoring sellers, while higher inventory levels and longer DOM typically benefit buyers. Visualization tools like line graphs and bar charts can make it easier to spot patterns over time – plotting median home prices over decades or comparing yearly sales volumes can help highlight cyclical trends.

For deeper analysis, tools like Python and R are invaluable. Python can be used for regression analysis, while R is excellent for time series forecasting, helping you explore relationships between variables like interest rates, sales, and inventory levels.

Seasonal variations also influence market behavior, adding another layer of complexity to these cycles.

Spotting Seasonal Trends

The real estate market follows clear seasonal patterns. Home sales tend to peak between April and August, driven by better weather and family moves timed around the school year. Conversely, sales activity typically slows in the fall and winter months, affected by holidays and less favorable moving conditions.

To identify these trends, track multiple data points over time. For example, monitor monthly home sales over several years to establish a baseline for seasonal activity. Days on Market (DOM) often decreases during the spring and summer, reflecting faster sales, while inventory levels usually rise as the selling season approaches.

Organizing data with pivot tables in Excel or Google Sheets can help you spot these patterns more easily. Additionally, cross-referencing seasonal trends with economic indicators – like interest rates and unemployment – can help you determine whether a slowdown is seasonal or tied to broader economic factors. For instance, 30-year mortgage rates climbed above 6.5% as of April 1, 2025, compared to under 3% in 2020, which has significantly altered typical seasonal buying behaviors.

Geographic factors also contribute to seasonal variations. For example, markets driven by tourism, such as Hawaii (39.9% investor ownership concentration) and Alaska (35.5%), exhibit different seasonal dynamics compared to more traditional residential markets. Using time series analysis tools in R or Python can help forecast these seasonal fluctuations based on historical data, aiding in better market timing.

These seasonal patterns work alongside broader economic factors, which also shape property trends.

How Economic Indicators Affect Property Trends

Economic indicators like interest rates and employment figures are key drivers of property trends. Interest rates, for example, directly influence borrowing costs. When the Federal Reserve adjusts the federal funds rate, mortgage rates shift as well, impacting monthly payments. Lower rates generally boost demand and push prices higher, while higher rates reduce buyer purchasing power. This dynamic has contributed to persistently low housing inventory over the past decade, which has kept upward pressure on prices.

Employment data is another crucial factor. For instance, residential construction employment rose to approximately 958,000 by November 2024, up from a low of 560,000 in May 2011, signaling sustained market activity. Local employment changes – such as a major employer closing or a new company opening – can significantly influence housing demand in specific markets. Tracking U.S. Bureau of Labor Statistics data can provide insights into job quality and availability before making investment decisions.

The housing market plays a significant role in the broader economy. In 2024, housing-related spending accounted for 16.2% of U.S. GDP, while owner-occupied real estate made up over 25% of U.S. household net worth in 2023. Rising home prices can create a "wealth effect", increasing homeowner confidence and home equity, which in turn boosts consumer spending – a key driver of the U.S. economy.

| Economic Indicator | Impact on Property Trends |

|---|---|

| Higher Interest Rates | Increases monthly payments; reduces buyer purchasing power |

| Lower Interest Rates | Boosts demand; typically drives property prices upward |

| Low Housing Inventory | Creates upward pressure on home prices |

| Rising Employment | Increases purchasing power and housing demand |

| Recession | Leads to tighter credit, higher unemployment, and slower construction |

(Source: Congressional Research Service, Investopedia)

During recessions, higher unemployment, reduced credit availability, and slower construction activity often dominate the market. However, these periods can also present opportunities for investors, as falling prices and lower interest rates make properties more accessible. Notably, average nominal housing prices have consistently risen nationally since 2012, surpassing their 2006 peak by the first quarter of 2016.

To gain a competitive edge, leveraging real estate data platforms like BatchData can provide enriched, accurate property insights, helping you make informed decisions based on comprehensive analysis.

Using Predictive Tools for Future Market Insights

How Automated Valuation Models (AVMs) Work

Automated Valuation Models (AVMs) transform historical property data into quick valuations by pulling information from public records, MLS listings, and past sales. They standardize this data, apply statistical or machine learning algorithms to identify patterns, and generate valuations complete with confidence scores.

These models consider factors like square footage, location, and market dynamics to estimate property values. Compared to traditional appraisals, which can cost between $400 and $800, AVMs offer a more cost-effective solution.

Some advanced AVMs go even further, incorporating metrics like market tightness – the ratio of active buyers to available inventory – to predict price trends. They update valuations daily, adapting to market changes in near real-time. For instance, Zillow’s forecasting model showed a 20.5% improvement in accuracy over simpler random walk models during back-testing.

By using machine learning, AVMs can dig deeper into market signals, refining their predictions even further.

Using Machine Learning for Forecasting

Machine learning models take property forecasting to the next level by uncovering patterns that traditional methods might miss. Algorithms like Linear Regression, Random Forest, and Gradient Boosting are commonly used to analyze data.

The accuracy of these forecasts often depends on feature engineering – the process of converting raw data into meaningful inputs. This might involve handling categorical data or accounting for non-linear relationships. Adding spatial factors, like proximity to major employers, also sharpens these predictions.

One cutting-edge approach involves separating national economic trends from regional data to highlight local market movements. This method allows for more precise neighborhood-level forecasting, helping investors identify areas where local factors drive price increases rather than broader market trends. Machine learning models also adapt to changing conditions, such as shifts in interest rates or local demand, making them more flexible than fixed-formula approaches.

While these tools are powerful, pairing them with human expertise can make predictions even more reliable.

Combining Predictions with Professional Expertise

Blending data-driven insights with professional expertise ensures that historical trends turn into actionable decisions. For instance, while AVMs can provide quick valuations, professional appraisers can add valuable context – like the impact of planned infrastructure projects – that might not appear in the data.

A hybrid strategy works best: use AVMs to quickly screen large portfolios or standard properties, and bring in professionals for high-value or unique assets. Pay attention to the confidence score of an AVM valuation – a low score suggests limited comparable data, signaling the need for human review. A 2020 case in Marin County, California, showed how traditional appraisals for the same property could vary by as much as $500,000, highlighting the importance of combining automated tools with expert validation.

For those analyzing historical property trends, platforms like BatchData offer enriched property data that supports both automated models and expert analysis. With the AI real estate market growing at a 35% CAGR and projected to reach $975 billion to $978 billion by 2029, now is an excellent time to integrate these tools into your investment approach.

sbb-itb-8058745

Real Estate Appraiser Market Analysis Tutorial | Full RStudio Workflow

Turning Data Insights into Action

Real Estate Market Conditions: Seller’s vs Balanced vs Buyer’s Markets

Timing Your Investments Using Historical Trends

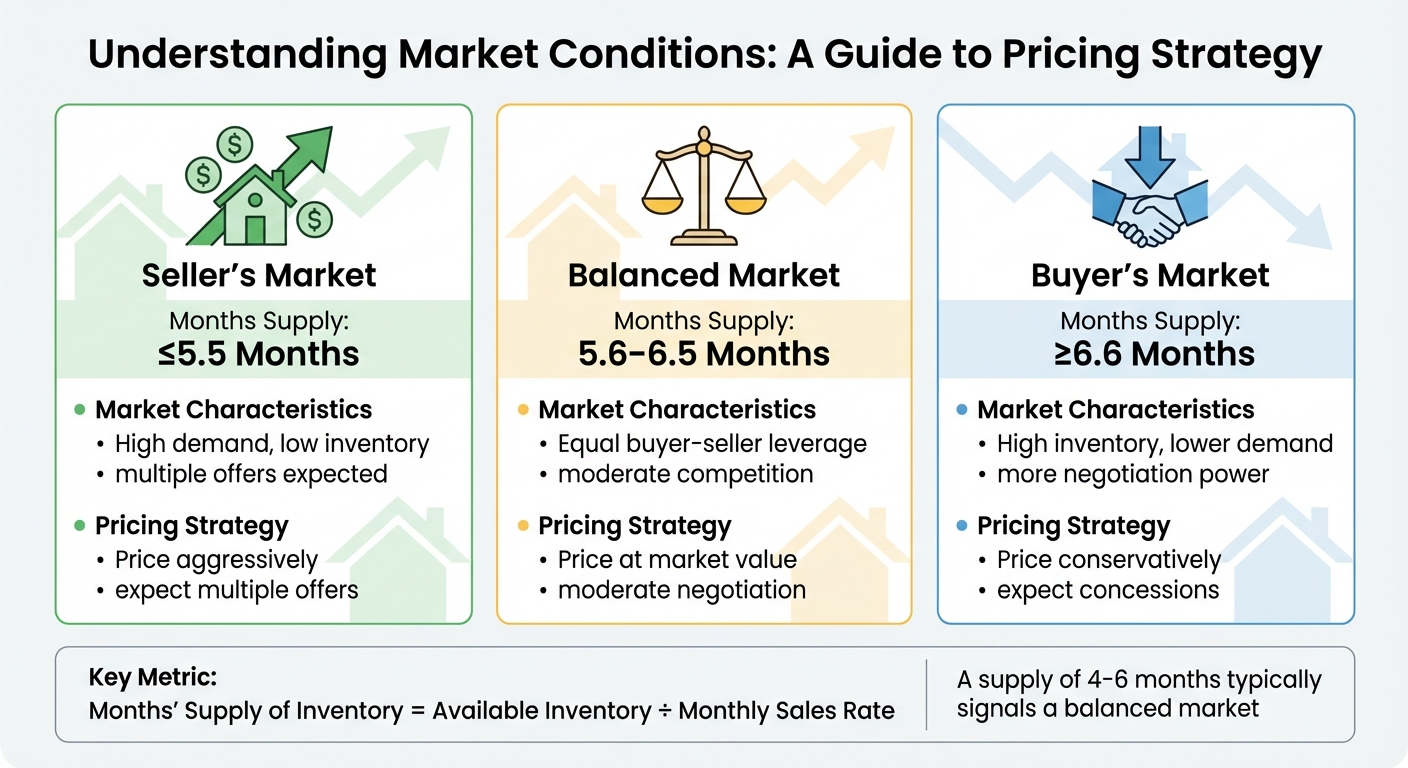

When it comes to timing investments, historical trends offer a wealth of valuable insights. A key metric to watch is the Months’ Supply of Inventory. A supply of 4 to 6 months typically signals a balanced market, while anything below 4 months indicates a seller’s market where prices are likely to climb. For example, in August 2025, the U.S. housing market had nearly 500,000 more sellers than buyers, giving buyers extra leverage during negotiations.

Interest rates also play a crucial role. A 1% drop in interest rates can increase buyer purchasing power by 10%. Professionals in Austin, Texas, who tracked this trend early, noticed that tech industry migration from Silicon Valley led to property value growth outpacing national averages by nearly 60% over five years.

"The fact that listings are rising while sales are falling points to loosening demand and more room for negotiation." – Redfin

Seasonality matters too. Fall and winter often present opportunities for buyers, as competition tends to be lower and inventory sits on the market longer.

Setting Prices Based on Historical Data

Pricing a property competitively starts with a Comparative Market Analysis (CMA). This involves evaluating recently sold properties within a 1-mile radius and a 3–6 month timeframe. Adjustments should be made for specifics like square footage, the number of bedrooms and bathrooms, lot size, property age, and upgrades like remodeled kitchens or pools.

Market conditions also influence pricing. For instance, in King County, Washington, home sale prices ranged from $75,000 to $7,700,000. A linear regression model that considered living space, property grade, and proximity to major employers explained over 69% of price variations. Time adjustments are essential too, as prices can shift between a comparable sale’s contract date and the current market.

The Months’ Supply of Inventory further refines pricing strategies. In a seller’s market (≤5.5 months), aggressive pricing often works, while a buyer’s market (≥6.6 months) calls for a more conservative approach. In August 2025, only 28% of homes sold above asking price, down from 32% the year before, reflecting evolving negotiation dynamics.

| Market Condition | Months Supply | Pricing Strategy |

|---|---|---|

| Seller’s Market | ≤5.5 Months | Price aggressively; expect multiple offers |

| Balanced Market | 5.6–6.5 Months | Price at market value; moderate negotiation |

| Buyer’s Market | ≥6.6 Months | Price conservatively; expect concessions |

Another useful metric is the Price-to-Rent Ratio, calculated by dividing the median home price by the median annual rent. Ratios well below historical norms may indicate undervalued markets with strong buying potential.

Predicting Inventory and Demand

Anticipating inventory levels and demand shifts is key to staying ahead in the market. Start with the absorption rate, which measures the ratio of sold properties to available inventory. This acts as a leading indicator of potential shortages. The Market Tightness Ratio (Θ) is another helpful tool. When this ratio – active buyers to active sellers – is significantly above 1, it suggests strong demand and potential price growth.

Building permit data also provides clues about future supply. By analyzing the lag between permits issued and project completions, you can forecast when new inventory will hit the market. Comparing new household formation rates with building permits can highlight long-term gaps in supply and demand. If household formation consistently outpaces new construction, inventory shortages are likely.

"Multifamily is entering a ‘very different world’ than recent years… she calls this period a potential ‘sweet spot’ in the cycle for investors." – Kathy Fettke, Founder, RealWealth.com

In August 2025, active U.S. listings rose by 10.1%, while home sales dropped by 2.5%, signaling a shift toward higher inventory levels. Meanwhile, small and mid-size investors made up 25–30% of market activity, providing a steady demand floor even as the market cooled.

To fine-tune your strategies, use tools like BatchData for property data enrichment and forecasting. Their APIs allow you to monitor multiple markets simultaneously, helping you identify emerging inventory trends and plan your next move with confidence.

Conclusion

Analyzing historical property trends takes real estate from guesswork to a data-driven approach. By examining metrics like Days on Market, inventory levels, and appreciation rates over 5–10 years, professionals can uncover market cycles, recognize seasonal trends, and make more precise investment decisions. In fact, advanced analytics have been shown to deliver 5–7% higher returns compared to traditional methods.

This shift toward data-driven strategies is already transforming the industry. In 2025, 34% of property managers used predictive analytics, up from just 21% in 2024. Machine learning models now forecast rental rates with over 90% accuracy, cutting forecasting errors by 68%. Optimized portfolios also show better performance, delivering 2.7% higher annual returns with 1.5% lower volatility compared to traditional approaches.

However, historical data doesn’t replace professional judgment – it enhances it. Data may provide the roadmap, but successful execution still depends on local knowledge. Factors like neighborhood dynamics, market regulations, and unique characteristics require human interpretation. The best investors pair quantitative insights with on-the-ground expertise, often spotting opportunities 18–24 months before they become widely apparent.

Whether you’re leveraging Months’ Supply of Inventory to time a purchase, using CMAs to set competitive pricing, or tracking absorption rates to forecast demand, historical trends are an invaluable guide. Platforms like BatchData make this process easier by offering property data enrichment and APIs capable of monitoring multiple markets at once. These tools can help refine your strategy, no matter the market cycle.

FAQs

What are the best practices for cleaning and preparing property data for analysis?

To get property data ready for analysis, start by ensuring it’s complete. Double-check that all critical details – like property addresses, square footage, and ownership records – are present and accurate. Compare this information against reliable sources, such as county records or MLS databases, to catch and fix any inconsistencies.

Once the data is verified, clean it up. This means removing duplicates, standardizing formats (like dates, currency, and measurement units), and correcting errors. Using tools like APIs or address standardization systems can streamline this process and minimize mistakes.

Finally, maintain accuracy by scheduling regular updates and monitoring for any changes. These steps will help keep your property data dependable and ready for analysis.

What economic factors should you consider when analyzing property trends?

When diving into property trends, it’s crucial to pay attention to a few key economic factors that shape the real estate market. These include housing prices, mortgage rates, and sales volume – together, these metrics paint a picture of market health and buyer behavior. For instance, when home prices climb, it often signals strong demand. On the flip side, rising mortgage rates can make homes less affordable and slow down buyer activity.

Beyond these, employment rates and income levels are powerful indicators of purchasing power and housing demand. Meanwhile, metrics like pre-foreclosure rates and open liens can reveal financial stress in certain areas, shedding light on potential risks in the market. By keeping these factors in mind, you can gain a clearer understanding of trends and make smarter decisions when it comes to property investments.

How do Automated Valuation Models (AVMs) improve property value estimates?

Automated Valuation Models (AVMs) provide quick and objective property value estimates by analyzing extensive datasets with advanced algorithms. These tools evaluate critical factors like property details, recent sales, rental history, neighborhood patterns, and spatial data, delivering valuations in mere seconds – far quicker than traditional manual appraisals.

Modern AVMs take things a step further by incorporating machine learning, AI, and geospatial data to improve accuracy and stay responsive to shifting market dynamics. By blending historical data with real-time trends, they often produce valuations that closely match those of human appraisers. Their ability to process high-quality information from sources like MLS and public records ensures reliable insights for lenders, investors, and homeowners, helping them make faster, well-informed decisions.