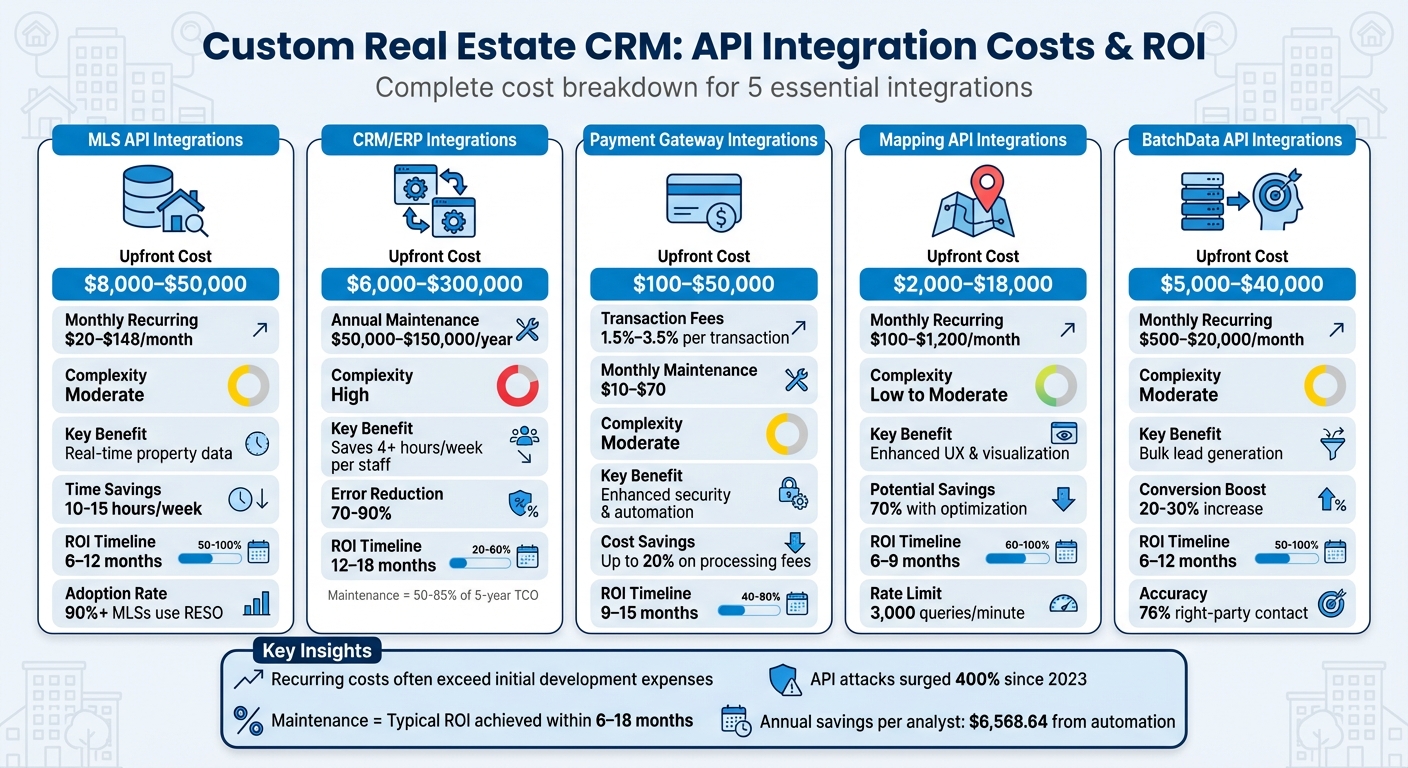

Building a custom real estate CRM is expensive, especially when API integrations are involved. These integrations connect your CRM to systems like MLS databases, payment processors, and mapping tools. Key cost factors include development, ongoing maintenance, and subscription fees. Here’s a quick summary:

- MLS API Integrations: $8,000–$50,000 upfront, $20–$148/month recurring.

- CRM/ERP Sync: $6,000–$300,000 upfront, $50,000–$150,000/year maintenance.

- Payment Gateways: $100–$50,000 upfront, 1.5%–3.5% per transaction.

- Mapping APIs: $2,000–$18,000 upfront, $100–$1,200/month recurring.

- BatchData APIs: $5,000–$40,000 upfront, $500–$20,000/month recurring.

Recurring costs often exceed initial development expenses, with maintenance alone making up over 50% of the total cost. However, these integrations can save time, reduce errors, and improve efficiency, often delivering ROI within 6–18 months. Security is also critical, as API-related attacks have surged by 400% since 2023. Balancing costs and benefits is key to building a successful CRM.

Custom Real Estate CRM API Integration Costs and ROI Comparison

1. MLS API Integrations

Development Cost

The cost of integrating a basic MLS feed ranges from $8,000 to $20,000, with a timeline of four to six weeks. For more complex multi-MLS enterprise systems, costs can climb to $25,000–$50,000, requiring eight to twelve weeks due to added complexities like data normalization, unique display rules, and advanced security measures such as OAuth 2.0 protocols.

The RESO Web API has become the industry standard, gradually replacing the older RETS (Real Estate Transaction Standard) system, with a full transition expected by 2025. Moving from RETS to the RESO Web API usually takes six to nine months. Currently, over 90% of MLSs have implemented RESO-certified services.

Recurring Fees

Ongoing costs for MLS integrations vary. The Spark API charges around $50 per month per MLS accessed. General MLS access fees typically range from $20 to $50 per month, though larger boards like Bright MLS may charge as much as $148 per month. For additional services, IDX data connections can cost between $10 and $70 monthly, depending on the MLS and connection type.

Third-party API services provide alternative access options, with pricing tiers like:

- SimplyRETS: $49–$199/month

- Rets Rabbit: $150–$699/month

- Estated: $199–$999/month

Integration Complexity

MLS API integration comes with its own set of technical hurdles. Developers need to manage API tokens, implement allowlisting, and efficiently handle OData queries. Frequent updates to MLS restrictions and payload fields demand a defensive programming approach to ensure reliability. For datasets exceeding 10,000 records, dedicated replication endpoints are crucial. Additionally, rate limits – typically 5,000 requests per hour with burst limits of about 334 requests per minute – require strategic planning to avoid disruptions. These technical measures not only ensure seamless integration but also contribute to measurable efficiency gains for real estate professionals.

Real Estate ROI Impact

MLS-fed websites are a go-to resource for 92% of homebuyers. Automating MLS data integration can save agents 10 to 15 hours per week. For example, Keller Williams incorporated MLS feeds into its KW Command CRM, enabling 200,000 agents to automate over 56 million workflows, cutting time spent on tasks by 30%. Similarly, Leap CRM saw a 43% improvement in delivery speed and achieved a 95% on-time sprint completion rate after implementing automated MLS feeds with AI-driven data quality checks and contact enrichment API tools.

sbb-itb-8058745

CRM – API Integrations

2. CRM/ERP Integrations

Integrating CRM or ERP systems with your custom real estate CRM can be a hefty investment, both upfront and over time, and comes with its own set of challenges.

Development Cost

Connecting your custom CRM to existing CRM or ERP platforms involves considerable initial costs. For a basic CRM integration, you’re looking at $6,000 to $24,000, while standard integrations fall between $20,000 and $40,000. If you’re dealing with enterprise-level ERP synchronization, the costs can climb to $150,000 to $300,000 or more.

The complexity of the integration plays a huge role in determining these costs. On average, a typical integration requires around 150 engineering hours to create and an additional 300 hours annually for upkeep. In fact, integration work often makes up 40% to 50% of the total CRM budget. If you’re working with older legacy ERP systems that rely on SOAP/XML protocols, expect even higher costs compared to modern REST/JSON web services, as custom schema adapters are necessary.

You’ll also need to decide between custom development and using an Integration Platform as a Service (iPaaS) solution like Zapier or Make. Custom development gives you full control but comes with annual maintenance costs ranging from $50,000 to $150,000. iPaaS solutions, on the other hand, offer quicker setups and predictable subscription fees of $500 to $2,000 per month. For instance, a private REIT implemented a two-way sync between HubSpot and a property platform for $8,000 to $16,000 upfront, with monthly platform fees of $50 to $200.

Recurring Fees

The costs don’t stop at development. Annual maintenance typically runs 15% to 20% of the initial project cost, with yearly expenses for engineering and support ranging from $50,000 to $150,000. Hosting and runtime for custom middleware adds another $600 to $2,000 or more per month for compute power, logging, and monitoring.

"Personnel costs to maintain on-premise systems can represent 50% to 85% of the total 5-year TCO." – Gartner

API maintenance alone can account for over 50% of the total software development lifecycle costs. This highlights the importance of factoring in the total cost of ownership when planning CRM/ERP integration.

Integration Complexity

Advanced features like bidirectional synchronization, which includes conflict resolution and timestamp-based "source-of-truth" logic, require significantly more engineering effort compared to simpler one-way data transfers. Handling large data volumes – such as 150,000 order rows per night – adds layers of complexity with queuing, backoff logic, and bulk endpoints.

Security is another major consideration. For systems handling sensitive data, you’ll need to implement PII encryption, maintain audit logs, and ensure compliance with SOC 2 standards. A fund administration platform integrating with a legacy ERP via SOAP endpoints allocated $80,000 to $150,000 for the initial build and $600 to $2,000 monthly for compute and monitoring, largely due to stringent 99.9% uptime requirements.

Real Estate ROI Impact

Despite the high costs, CRM/ERP integrations often pay off quickly by improving efficiency and reducing errors. Custom API-driven integrations typically deliver ROI within 6 to 12 months. Automating manual data entry can save around 40 hours of labor per week, translating to annual savings of approximately $78,000 based on a $37.50 hourly rate. Most businesses recover their investment within 18 to 36 months through better lead conversion and reduced administrative work.

Additionally, these integrations can lower data error rates by 70% to 90%, cutting down on costly manual reconciliations and preventing revenue loss from billing errors. Moving from manual processes to real-time synchronization reduces data delays from days to seconds, enabling faster, more informed decisions on pricing and inventory.

3. Payment Gateway Integrations

Payment gateway integrations link your CRM to payment processors for handling rent, security deposits, and commission payments. Depending on the approach – either hosted solutions that redirect users or API-based solutions that embed payment forms – the costs and complexity can vary widely.

Development Cost

Setting up a basic hosted payment gateway costs between $100 and $300 and typically takes 2–4 weeks to complete. On the other hand, API-based integrations start at $500 and can go as high as $1,500. For more intricate implementations, such as custom API adaptations, connecting to legacy systems, or mobile-specific solutions, costs can climb to $10,000–$50,000. Additional testing and optimization may add another $2,000–$5,000 to the bill.

The timeline for development also varies. Moderate projects, like custom workflows or multi-step data synchronization, may take 4–8 months. Larger, enterprise-level systems with advanced security protocols can extend the development period to 6–12 months.

These upfront costs are only part of the equation, as ongoing expenses will also influence the total cost of ownership.

Recurring Fees

Payment gateways come with recurring expenses. Transaction fees typically range from 1.5% to 3.5% per transaction. For larger rent payments, ACH transfers often provide a more cost-effective option, capping fees at $5–$10 per transaction. Monthly maintenance fees for payment gateways range between $10 and $70, while maintaining PCI-DSS compliance adds an annual cost of $100–$500. If you opt for advanced fraud protection tools, you might spend an extra $50–$500 per month.

"Engineering maintenance compounds over time. APIs change, security patches roll out, and new payment methods launch. Every gateway integration requires ongoing testing, updates, and monitoring, and that labor cost never shows up in a standard gateway fee comparison."

– Nick Daley, Writer, Spreedly

Ongoing engineering maintenance – sometimes called the "engineering time tax" – includes labor for testing, updates, and applying security patches as APIs evolve. Additional costs include chargeback fees, which run $15–$25 per disputed transaction, and international card processing fees, which add 1%–1.5% over domestic rates.

These recurring costs highlight the importance of managing integrations effectively, especially when considering the challenges of implementation.

Integration Complexity

The level of complexity in payment gateway integrations depends on your specific needs. Hosted gateways are simpler to implement, as they handle compliance and security on the provider’s end. However, they redirect users away from your CRM, which limits customization options. In contrast, API-based gateways offer full design flexibility and support a branded checkout experience, but they require your development team to handle PCI DSS compliance, encryption, and authentication protocols like OAuth 2.0.

While one-way data synchronization is relatively straightforward, real-time two-way sync – updating your CRM with payment statuses, refunds, and failures – requires advanced logic and constant monitoring. Without strong monitoring systems, troubleshooting APIs can consume as much as 60% of the integration time.

Real Estate ROI Impact

Like MLS and CRM/ERP integrations, payment gateway integrations demand a careful look at ROI. Despite the upfront investment, a well-executed integration can lead to significant savings. For example, custom payment setups can lower processing fees by up to 20% through optimized fee structures. Additionally, API-based financial integrations can reduce reconciliation time by 40% each month. For companies handling thousands of transactions, even a $1 fee reduction on a $100 transaction can result in substantial savings over time. Switching from percentage-based card fees to ACH transfers for large payments, like rent or deposits, can make the integration cost-effective within the first year.

4. Mapping API Integrations

After payment gateways, mapping integrations can further enhance your CRM by improving search and navigation features. These integrations bring tools like visual property searches, neighborhood overlays, and route planning to your real estate CRM. While these features improve user experience, they come with hidden development and recurring fees that often exceed the advertised API rates.

Development Cost

Integrating mapping APIs isn’t as simple as plugging in a key. It involves custom styling, geofence optimization, and cache management to keep recurring costs under control. For example, in 2025, the engineering team at CityTrack spent two sprints optimizing geofences, costing $18,000 in labor but saving only $6,400 annually. Similarly, migrating to Mapbox with custom styling came with a $12,000 price tag.

Real estate CRMs often face higher costs because features like Street View and dynamic overlays increase billing rates during user interactions, such as scrolling through a page. To avoid unexpected charges, setting quota limits in Google Cloud Console can prevent runaway scripts or accidental loops. Separating staging and production environments with distinct API keys is another smart move to ensure testing doesn’t eat into your production budget.

Recurring Fees

As of March 1, 2025, Google Maps Platform switched from a $200 monthly credit to fixed free usage caps per SKU. For example, Dynamic Maps allows up to 10,000 free calls per month, after which it charges $7.00 per 1,000 loads. For consistent traffic, subscription plans like Starter ($100/month for 50,000 calls), Essentials ($275/month for 100,000 calls), or Pro ($1,200/month for 250,000 calls) can help manage costs.

Some companies have found creative ways to reduce recurring fees. In June 2025, BentoRoute saved $5,700 per month by switching their home screen from Dynamic to Static maps for a ten-truck fleet. Pattern Labs cut their Places API costs from $2,100 to $460 per month by using a Redis cache to store geocoded addresses locally, avoiding redundant lookups. Even extending route refresh intervals from 1 to 5 minutes can slash expenses by up to 80%.

"Plenty of teams hit a hidden spike when clients scroll endlessly. Every scroll triggers fresh tile pulls. A lazy-load script that pauses after two screens cut our total Dynamic Maps charge by 22 percent." – Yara Al-Mansour, Pricing Analyst, CartoFlow

Integration Complexity

Mapping integrations require expertise across the tech stack. Front-end developers handle map displays and user interactions, while back-end developers manage secure API keys and data processing. For example, the Maps JavaScript API typically enforces rate limits of 3,000 queries per minute.

Maintenance is just as critical as initial setup. Developers need to monitor for version updates and deprecations to prevent malfunctions. In May 2024, a real estate website in its staging phase racked up over $400 in unexpected monthly fees due to higher-than-anticipated API calls during testing. Using field masks in Place Details requests can help reduce costs by requesting only the necessary data.

Strategic planning and ongoing cost management are key to balancing the benefits and expenses of mapping features in your CRM.

Real Estate ROI Impact

When done right, mapping integrations can boost ROI for real estate CRMs. Switching from Dynamic to Static maps for non-interactive features can cut costs by 70%. Google Maps offers volume-based discounts, with Dynamic Maps pricing dropping from $7.00 to $4.20 per 1,000 loads after 500,000 monthly events. For even higher usage, costs can go as low as $0.53 per 1,000 loads for over 5 million events. Using session tokens for property search bars can group multiple keystrokes into a single billable event, further reducing costs. Setting up budget alerts and daily quotas ensures that sudden traffic spikes don’t lead to unexpected overages.

5. BatchData API Integrations

BatchData APIs go beyond mapping and payment tools by offering advanced features like property search, skip tracing, phone verification, and data enrichment. These capabilities can be directly integrated into your platform, providing a robust solution for real estate data needs. While the setup process involves some complexity, the pricing model is straightforward.

Development Cost

The initial development cost for integrating BatchData’s APIs typically ranges from $15,000 to $40,000. This includes essential tasks like API authentication, endpoint mapping, data normalization, and quality assurance testing. For smaller-scale operations, costs can drop to $5,000 to $15,000 when leveraging BatchData’s professional services. These services are designed to simplify the integration process, reducing the need for extensive manual coding and helping teams with limited technical expertise manage expenses effectively.

Recurring Fees

BatchData uses a tiered subscription model for its APIs. For instance, the Property Data API starts at $500 per month for 20,000 records (Lite plan) and scales up to $5,000 per month for 750,000 records. Skip tracing subscriptions begin at $2,000 per month for 100,000 records and can reach $20,000 per month for 3 million records. Additional services, such as property valuations, demographic data, and contact enrichment, range from $25 to $10,000 per month. For mid-sized operations handling around 1,000 leads monthly, recurring costs average approximately $500 per month after the initial setup.

Integration Complexity

Integrating BatchData APIs requires 100–300 developer hours, with hourly rates ranging from $150 to $250. This adds about 15–30% to the base CRM costs due to the need for real-time syncing. BatchData’s unified API simplifies the process by combining property intelligence, verified contacts, and geocoding into a single platform, reducing the hassle of managing multiple vendors. Front-end teams focus on displaying data, while back-end teams handle tasks like API keys, rate limits, and error management. Comprehensive API documentation and onboarding resources help teams navigate the integration process efficiently. Enterprise plans also include dedicated account managers and custom support for high-volume operations.

Real Estate ROI Impact

Integrating BatchData significantly enhances CRM performance, increasing lead conversion rates by 20–30% through accurate skip tracing and enriched contact data. This allows for more targeted outreach and faster deal closures. For CRMs with total investments between $40,000 and $100,000, the payback period typically falls within 6–12 months. With a 76% right-party contact accuracy – three times the industry average – teams can spend less time on data research and more time closing deals.

"What used to take 30 minutes now takes 30 seconds. BatchData makes our platform superhuman." – Chris Finck, Director of Product Management

Over a three-year period, the total cost of ownership for a mid-sized firm generally ranges from $70,000 to $150,000. This estimate includes the initial development, monthly subscription fees, and annual maintenance costs (10–20% of the total). To manage expenses, firms can strategically use add-ons like demographic or property valuation data for specific user segments rather than applying them universally.

Pros and Cons

When it comes to custom real estate CRM development, finding the right balance between integration costs and operational benefits is crucial. Let’s break down the key points for each API integration type and how they influence your CRM’s total cost of ownership (TCO).

MLS APIs are indispensable for providing real-time property data, which can automate lead generation and improve efficiency. However, handling large data volumes and managing tiered licensing fees can stretch your budget.

CRM/ERP integrations can save each staff member around 4 hours a week by eliminating repetitive data entry across disconnected systems. That said, integrating older legacy systems can increase development costs by 30% to 50% – a significant consideration for budgeting.

Payment gateway integrations simplify transactions while boosting security. These integrations typically start with an upfront cost of $10,000 to $25,000. However, compliance with PCI DSS standards and ongoing transaction fees (2.9% + $0.30 per transaction) can add layers of complexity.

Mapping APIs enhance user experience by adding geolocation and visual search capabilities. While less technically challenging than some other integrations, their usage-based pricing model can lead to fluctuating monthly costs as your platform grows.

BatchData API integrations are excellent for bulk lead generation and data enrichment, helping close deals faster. The downside? Recurring subscription fees, which can range from $500 to $5,000 per month depending on your data needs.

Here’s a quick comparison of the initial costs, complexity, benefits, drawbacks, and ROI timelines for each type:

| Integration Type | Initial Cost | Complexity | Primary Benefit | Primary Drawback | ROI Timeline |

|---|---|---|---|---|---|

| MLS API | $5,000 – $15,000+ | Moderate | Real-time property data | Managing large data volumes | 6–12 months |

| CRM/ERP | $20,000 – $40,000 | High | 4+ hours/week saved | Legacy system incompatibility | 12–18 months |

| Payment Gateway | $10,000 – $25,000 | Moderate | Enhanced security | PCI compliance and transaction fees | 9–15 months |

| Mapping API | $2,000 – $10,000 | Low/Moderate | Enhanced UX & visualization | Usage-based pricing | 6–9 months |

| BatchData API | $5,000 – $15,000 | Moderate | Bulk lead generation | Recurring subscription costs | 6–12 months |

It’s also worth noting that adding advanced security features can increase API development costs by 20% to 40%. Meanwhile, staff working with non-integrated systems may lose up to 4 hours weekly just switching between applications.

To get a clear picture of your three-year TCO, you’ll need to add up build costs, annual maintenance fees (multiplied by three), vendor fees, and infrastructure expenses. This will help you identify which integrations can deliver the best long-term returns for your business.

Conclusion

Creating a custom real estate CRM with API integrations involves weighing upfront development expenses against the benefits of long-term operational efficiency. Notably, maintenance costs can account for over half of the total expenses throughout the software’s lifecycle.

A smart approach is to adopt a hybrid integration strategy: rely on native marketplace apps for about 80% of standard workflows, and use custom code to address any unique requirements. This method helps keep initial build costs manageable – ranging from $5,000 to $25,000 – while also reducing ongoing maintenance efforts. For rapidly growing businesses, integration platforms like Zapier or Make can complement this strategy. These tools provide moderate logic capabilities at an upfront cost of $3,000 to $15,000, with monthly fees between $20 and $300. This combination not only lowers initial investment but also helps control recurring expenses.

Selecting the right data provider is another critical factor in maximizing your CRM’s potential. For real estate data, scalability is key. Providers like BatchData offer flexible pricing plans that grow alongside your business, starting at $500/month for 20,000 records and scaling up to $5,000/month for 750,000 records. With a 99.9% uptime guarantee and lightning-fast response times, BatchData ensures your CRM runs smoothly, even during peak demand.

Security measures must be prioritized from the start. API-focused attacks surged by 400% in early 2023, making robust security features – such as authentication, input validation, and encryption – essential. Addressing these concerns during the design phase is far more cost-effective than fixing vulnerabilities later. Evaluating the long-term financial impact of these measures is crucial for sustainable operations.

To determine your three-year total cost of ownership, calculate initial development costs, multiply annual maintenance fees by three, and factor in vendor subscriptions and infrastructure expenses. Many organizations allocate $50,000 to $150,000 annually for staffing and partnership costs. However, the return on investment is compelling: API automation can save each data analyst approximately $6,568.64 annually by eliminating manual data entry, while integrated systems help employees reclaim nearly 4 hours per week previously spent switching between apps.

FAQs

What factors determine the cost of API integrations for a custom real estate CRM?

The cost of integrating APIs into a custom real estate CRM hinges on several important factors. These include the complexity of the project, the number and type of integrations needed, and the amount of data the system will handle. Customization requirements and implementing strong security protocols also significantly influence the final price.

Other considerations, like scalability and ongoing maintenance or support, can further affect costs. For instance, adding advanced features such as property search tools, contact data enrichment, or skip tracing often demands specialized expertise and additional resources. Being aware of these elements can help you better gauge the investment required for your customized CRM solution.

How do API integrations in a custom real estate CRM improve efficiency and ROI?

API integrations in a custom real estate CRM can make operations smoother and improve return on investment (ROI) by automating how data flows between systems. This eliminates much of the manual work, cuts down on errors, and keeps property details, customer contacts, and transaction statuses updated in real time. The result? More efficient workflows that free up teams to focus on strategic priorities and make quicker, informed decisions.

Yes, there’s an upfront cost. Development expenses can range from a few thousand dollars for basic integrations to over $30,000 for more complex setups. However, these costs often pay for themselves quickly. Businesses save money by reducing labor, avoiding costly errors, and speeding up processes – many see ROI within 6 to 12 months. Over time, API integrations help build a system that’s not only scalable but also improves data accuracy and keeps customers happier.

What are the key security practices for integrating APIs into a real estate CRM?

When integrating APIs into a real estate CRM, keeping sensitive data secure should be a top priority. Start by using secure authentication methods like OAuth 2.0, API keys, or JSON Web Tokens (JWT). Store these credentials safely – tools like environment variables can help – and make it a habit to rotate them regularly to minimize potential risks.

Set up role-based access controls and stick to the principle of least privilege. This ensures users and systems only have access to the specific functions they need, reducing the chance of unauthorized actions. Always encrypt data – both while it’s being transmitted and when it’s stored – to guard against interception or unauthorized access.

To stay ahead of potential issues, monitor API activity for anything unusual and conduct regular reviews to uncover and address vulnerabilities. By following these practices, you’ll build a strong layer of protection, keeping your CRM integrations secure and your data safe.