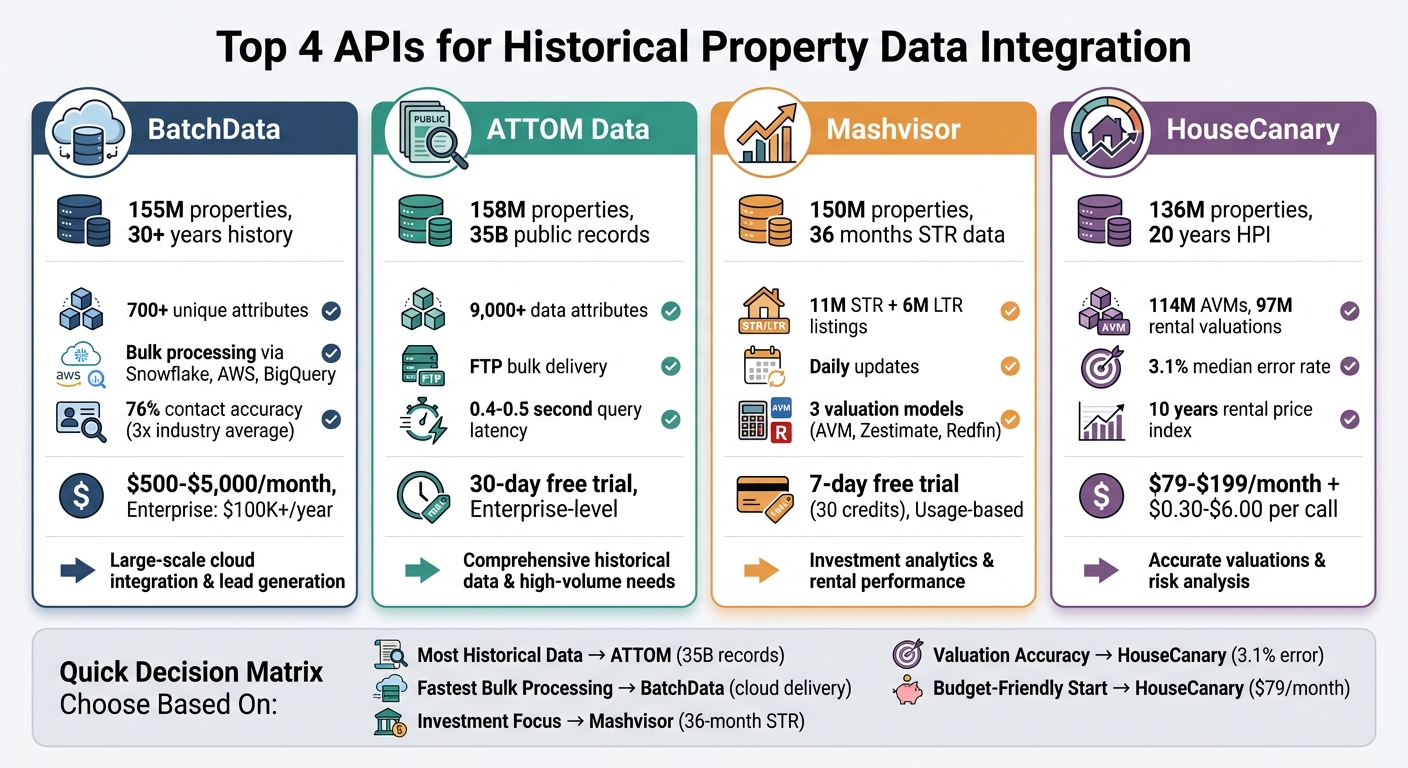

When it comes to integrating historical property data for real estate projects, four APIs stand out: BatchData, ATTOM Data, Mashvisor, and HouseCanary. Each offers unique features tailored to various use cases, from analyzing decades of property transactions to short-term rental trends. Here’s what you need to know:

- BatchData: Covers 155 million U.S. properties with 30+ years of historical data. Offers bulk processing via cloud platforms like Snowflake and AWS. Pricing starts at $500/month, scaling to enterprise plans over $100,000/year.

- ATTOM Data: Provides access to 158 million properties and 35 billion public records. Ideal for high-volume data needs with options for bulk FTP delivery. Enterprise-level pricing applies.

- Mashvisor: Focused on investment analytics, including 36 months of short-term rental data. Offers insights into both property and rental performance. Pricing includes a 7-day free trial and usage-based plans.

- HouseCanary: Known for valuation accuracy, with 20 years of price trends and 10 years of rental data. Best for risk analysis and property valuations. Subscription plans start at $79/month, with additional per-call fees.

Quick Comparison

| API | Data Coverage | Key Features | Pricing |

|---|---|---|---|

| BatchData | 155M properties, 30+ years | Bulk processing, cloud delivery | $500–$5,000/month, custom |

| ATTOM | 158M properties, 35B records | FTP bulk delivery, 9,000+ attributes | Free trial, enterprise |

| Mashvisor | 150M properties, 36 months STR | Rental analytics, investment focus | 7-day trial, usage-based |

| HouseCanary | 136M properties, 20 years HPI | Accurate AVMs, risk analysis | $79+/month, per-call fees |

Each API has strengths tailored to different real estate needs. Choose based on your project’s focus, whether it’s historical trends, rental analytics, or bulk data integration.

Historical Property Data APIs Comparison: Features, Coverage, and Pricing

Get Real Estate Property Data using Estated‘s API | Python Tutorial Part 2

1. BatchData API

The BatchData API serves as a key tool for integrating historical property data, offering an expansive and detailed dataset.

Historical Data Coverage

BatchData boasts a database of over 155 million U.S. property records, covering about 99% of the U.S. population. This extensive coverage is made possible by aggregating data from more than 3,200 sources, ensuring reliable access even during local disruptions.

The API provides access to 15+ data points related to deed history, including sales prices, recording dates, and buyer/seller information. Beyond basic sales data, it also includes ownership history, mortgage and refinance details (such as loan amounts and interest rates), tax assessment trends, and historical listing information, including sold and expired statuses. For improved properties, it offers permit summaries detailing job values, types (e.g., solar installations, pool constructions, roofing), and dates across the property’s improvement history.

This rich dataset is further enhanced by time-series endpoints that provide a deeper look into historical trends.

Time-Series Endpoints

BatchData tracks over 700 unique attributes for each record across its 155 million properties. In many markets, historical data spans more than 30 years. These records allow for detailed analysis of price trends, market duration, and status changes. The platform processes millions of documents daily, ensuring up-to-date and reliable insights.

Bulk Processing Support

The API supports two robust methods for bulk data integration. The Bulk Property Lookup feature within the REST API allows users to query multiple properties simultaneously using addresses or parcel numbers. For larger-scale analytics or machine learning projects, the Cloud Delivery option integrates seamlessly with platforms like Snowflake, BigQuery, Databricks, or AWS S3. This option eliminates the need for traditional ETL processes, delivering billions of records in Parquet or CSV formats.

These capabilities are paired with flexible pricing options, making it easier to tailor the service to your specific requirements.

Pricing Models

BatchData operates on a tiered monthly subscription model starting at $500 per month for the Lite plan, which includes 20,000 records. At the higher end, the Scale plan costs $5,000 per month and supports up to 750,000 records. Historical data access requires additional add-ons: the History (Deed) add-on starts at $50 per month for Lite users and scales up to $1,000 per month for Scale subscribers. The Listing History add-on ranges from $150 per month to $1,500 per month, depending on the plan tier. For larger enterprise needs, contracts can exceed $100,000 annually.

| Plan Tier | Monthly Price | Monthly Record Limit | History (Deed) Add-on | Listing History Add-on |

|---|---|---|---|---|

| Lite | $500 | 20,000 | $50 | $150 |

| Growth | $1,000 | 100,000 | $100 | $400 |

| Professional | $2,500 | 300,000 | $500 | $600 |

| Scale | $5,000 | 750,000 | $1,000 | $1,500 |

| Enterprise | Custom | Custom | Custom | Custom |

2. ATTOM Data API

The ATTOM Data API provides access to an impressive 158 million U.S. residential and commercial properties, covering over 3,000 counties across the country. This vast reach is made possible by a 30TB data warehouse packed with 9,000 data attributes.

Historical Data Coverage

ATTOM’s database includes detailed property histories, such as sales, mortgage, and foreclosure records. These records feature essential details like dates, transfer types, and loan specifics. The platform also tracks tax assessment trends and offers market analytics, including flipping reports, vacancy rates, and home affordability metrics over time. To simplify data integration, each property is assigned a unique ATTOM ID, enabling seamless connections across different datasets without manual reconciliation. This comprehensive historical data forms the backbone of ATTOM’s time-series endpoints.

"The depth and breadth of ATTOM’s data warehouse supports these real estate APIs, and powers your software, websites, and apps with best of breed property and neighborhood data." – ATTOM

Time-Series Endpoints

The API offers dedicated endpoints like "Sales Trends", "Foreclosure Activity", and "Market Analytics." These endpoints allow users to query data using addresses, parcel numbers, ATTOM IDs, or geographic coordinates. They deliver yearly aggregates of key metrics for the past five years, making it easy to analyze trends.

Bulk Processing Support

For large-scale data needs, ATTOM provides a bulk data solution. This service delivers FTP-based .csv files on a schedule – weekly, monthly, quarterly, or annually. It bypasses the typical 24-hour caching limit on API calls, allowing users to store data permanently for extensive analysis. For those working with cloud-based systems, ATTOM also supports data delivery through Snowflake. These bulk options align with a flexible, transaction-based pricing model.

Pricing Models

ATTOM’s pricing structure is designed to accommodate a wide range of users. They offer a 30-day free trial, affordable start-up plans, and enterprise-level contracts for high-volume clients. The API boasts an average query latency of just 0.4–0.5 seconds.

| Pricing Tier | Target Audience | Description |

|---|---|---|

| Free Trial | Developers/Evaluators | 30-day sandbox access |

| Start-up Plan | New Businesses | Affordable option for initial projects |

| Transaction-Based | Scalable Projects | Flexible pay-per-call model |

| Enterprise | Large Corporations | High-volume data access, often exceeding $100,000 annually |

3. Mashvisor API

The Mashvisor API takes a unique investment-focused approach, combining property records with rental analytics. It monitors an impressive 11 million short-term rental listings, 6 million long-term rental listings, and 20 million MLS listings across all 50 states. With nationwide coverage, it provides insights on over 150 million properties. This API enhances historical property data access by integrating detailed rental analytics.

Historical Data Coverage

Mashvisor offers 36 months of historical data for short-term rentals, covering both neighborhood and property-specific levels. This data includes monthly occupancy rates, average daily rates (ADR), monthly revenue, revenue per available rental (RevPAR), and active listing counts. Additionally, the API provides complete tax history, assessment records, and sales transaction data. Updates are frequent, with STR metrics refreshed daily and MLS data updated multiple times a day.

"Mashvisor delivers the only fully comprehensive real estate dataset covering property attributes, tax and assessment history, transaction records, STR and LTR analytics, comps, valuations, neighborhood scores, and 36-month performance trends under one unified API." – Daniela Andreevska, Mashvisor

Time-Series Endpoints

To complement its extensive data coverage, Mashvisor offers time-series endpoints for tracking performance trends. Developers can access historical trends through endpoints like /client/historical_performance and /client/rento-calculator/historical-performance, which provide monthly performance data spanning three years. The API also features three valuation models – Mashvisor AVM, Zestimate-equivalent, and Redfin-equivalent – as well as neighborhood-level cap rates and cash-on-cash returns. This comprehensive integration combines STR, LTR, and property data into a single solution.

Bulk Processing Support

For large-scale data needs, Mashvisor supports bulk processing through the /client/marketplace-listings-search endpoint. This feature handles both MLS and off-market property data. Enterprise plans cater to high-volume integrations, offering increased rate limits and predictable monthly costs. Developers have praised the platform’s flexibility and responsiveness. As Kyle Horton, Owner and Co-Founder at Kelix, shared:

"Honestly from a developer’s perspective, I really like working with you guys… you guys had preemptively identified the issues we wanted to raise and were already considering solutions for them".

Pricing Models

Mashvisor uses a tiered, usage-based pricing model. For testing purposes, it offers a 7-day free trial with 30 credits for API calls. A single subscription provides access to all datasets – spanning STR, LTR, property attributes, and market analytics – without requiring upfront licensing fees.

sbb-itb-8058745

4. HouseCanary API

HouseCanary offers access to a vast reservoir of historical property data, covering over 136 million properties across 19,000 ZIP codes. What sets HouseCanary apart is its integration of historical property records with advanced analytics, creating a comprehensive resource for property data. The platform combines transaction records, tax assessments, and proprietary market indices with 114 million AVMs and 97 million rental valuations. To ensure data accuracy, HouseCanary uses proprietary pipelines to normalize its multi-sourced data, providing consistency across all geographic levels.

Historical Data Coverage

HouseCanary’s API delivers a wealth of historical data, including sales history, tax assessments, and mortgage lien information. Its Home Price Index (HPI) offers insights spanning 20 years, while the Rental Price Index (RPI) provides 10 years of rental trends. These indices complement traditional property data, offering deeper insights into market dynamics. The historical time-series data is available at six levels of detail: property, block, block group, ZIP code, MSA, and state. Impressively, the platform reports a 3.1% median absolute percentage error for its valuations, showcasing its accuracy.

Time-Series Endpoints

Developers can easily access monthly trends in property values and price-per-square-foot through endpoints like block/value_ts_historical, zip/hpi_ts_historical, and msa/affordability_ts_historical. The API supports flexible timeframes, offering 1-year and 20-year views for HPI data, and 1, 5, and 10-year increments for RPI data.

Bulk Processing Support

For organizations with high-volume data needs, HouseCanary provides bulk processing options. It supports POST requests that batch up to 100 items, helping optimize rate limits. Self-serve customers can process up to 250 components per minute. For even larger datasets, HouseCanary offers a Bulk Property Data service, which delivers normalized data in CSV format or through cloud platforms like Snowflake and AWS. These datasets are updated monthly and can cover nationwide or state-specific data, catering to businesses that require extensive property data.

Pricing Models

HouseCanary uses a hybrid pricing structure, combining monthly subscription plans with usage-based fees. The Pro plan starts at $79/month, while the Teams plan begins at $199/month. Enterprise-level solutions are available with custom pricing. API calls are charged per successful request: $0.30 to $0.50 for basic endpoints, $2.50 to $4.00 for premium endpoints, and $4.00 to $6.00 for premium plus endpoints. Annual subscriptions offer a 17% discount compared to monthly billing. Developers can test API functionality using a whitelist of addresses, allowing them to experiment without incurring production costs.

Advantages and Limitations

When integrating historical property data, understanding each API’s strengths and trade-offs is crucial. Developers need to weigh these factors to determine the best fit for their specific use case.

BatchData boasts an impressive 76% right-party contact accuracy – nearly three times the industry standard. It supports bulk delivery via major cloud platforms, making it a solid choice for large-scale operations. However, enterprise-level plans can exceed $100,000 annually, and real-time trend analysis often requires custom professional services.

ATTOM Data API shines with its extensive dataset – over 9,000 attributes covering 155 million parcels, representing 99% of the U.S. population. Its partnership with CoreLogic ensures high-quality AVMs and tax assessments. That said, its vast data (70 billion rows) can overwhelm smaller teams lacking advanced infrastructure. Additionally, with a latency of 0.4–0.5 seconds, it’s better suited for bulk data pulls rather than real-time applications.

Mashvisor API is tailored for investment-focused use cases, offering up to 36 months of historical Airbnb performance data alongside traditional property records. This makes it ideal for analyzing both short-term (STR) and long-term rental (LTR) opportunities. However, its specialized investment features may be overkill for basic property lookups, and it doesn’t provide detailed neighborhood-level data.

HouseCanary API excels in valuation accuracy, offering 114 million AVMs and 97 million rental valuations with a 3.1% median absolute percentage error. Its 20-year Home Price Index and 10-year Rental Price Index provide valuable historical insights. Yet, its focus on valuation and risk analysis means it lacks comprehensive data on lifestyle factors like crime rates or school ratings.

To summarize the key advantages and limitations of these APIs, here’s a quick comparison:

| API | Primary Advantage | Key Limitation |

|---|---|---|

| BatchData | High contact accuracy (76%); cloud delivery | Expensive enterprise plans; custom services needed for real-time trends |

| ATTOM | Extensive dataset (9,000+ attributes); broad U.S. coverage | Complex integration; latency of 0.4–0.5 seconds; costly |

| Mashvisor | STR/LTR data with 36-month history | Investment-focused; lacks detailed neighborhood data |

| HouseCanary | Accurate valuations (3.1% error); long-term price indices | Limited lifestyle data; valuation-centric focus |

Each API offers distinct benefits, but their limitations highlight the importance of aligning features with your specific integration needs.

Conclusion

Choose the API that aligns with your specific needs – whether it’s access to extensive historical data, high-speed bulk processing, or affordability.

If your priority is comprehensive historical data, the ATTOM Data API is a strong contender. With a staggering archive of over 35 billion public records spanning decades, it offers unmatched depth in property data. Through its partnership with CoreLogic, it also delivers premium AVMs and tax assessments covering 155 million parcels. However, be prepared for enterprise-level costs, which can climb into six figures annually.

For projects requiring rapid, large-scale data integration, BatchData is a standout option. It simplifies workflows with direct cloud delivery to platforms like Snowflake, BigQuery, and Databricks, eliminating the need for ETL processes. This efficiency speeds up operations dramatically – tasks that used to take 30 minutes can now be completed in just 30 seconds. Its ability to handle large-scale machine learning without rate limits further enhances its appeal for data-heavy applications.

On the cost-efficiency front, BatchData offers flexible pricing options. Plans start at $500 per month for 20,000 records and scale up to $5,000 for 750,000 records. For businesses focused on lead generation, its verified owner contact accuracy of 76% – three times the industry average – adds significant value.

FAQs

What sets the top historical property data APIs apart in terms of coverage and features?

The key distinctions among top historical property data APIs revolve around market coverage, data depth, and update frequency. Some prioritize covering as many properties as possible across the U.S., while others focus on delivering detailed historical records or granular property attributes.

Take BatchData, for instance. It offers information on over 155 million U.S. properties, complete with more than 700 attributes like valuations, tax records, and sales history. Plus, its dataset is refreshed daily, ensuring users have access to the most current information. This makes it a great option for those who need a reliable and frequently updated property data source.

Choosing the right API comes down to your priorities – whether you need broad coverage, detailed historical insights, or consistently fresh data. BatchData shines with its vast property database, extensive attribute selection, and dependable updates, making it a strong contender for integrating comprehensive historical property data.

How do API pricing models adjust based on data usage and integration requirements?

API pricing usually operates on a tiered system, where the cost rises with the volume of property records accessed monthly. For instance, entry-level tiers might begin at $500 per month for 20,000 records, while higher tiers can climb to $5,000 per month for access to 750,000 records.

For businesses with larger-scale data demands or unique needs, custom enterprise plans are often an option. These can include features like bulk data delivery or dedicated API endpoints, providing tailored solutions to fit specific integration goals.

What is the best API for analyzing rental trends in real estate projects?

For real estate projects centered on rental analytics, having an API that delivers real-time rent estimates, active rental listings, and market trend insights is a game-changer. These tools allow you to gauge rental demand, set competitive pricing, and get a clear picture of local market dynamics.

When selecting an API, focus on one that provides accurate data, integrates seamlessly, and aligns with your project’s objectives. The right choice can sharpen your decision-making and lead to better results for your projects.