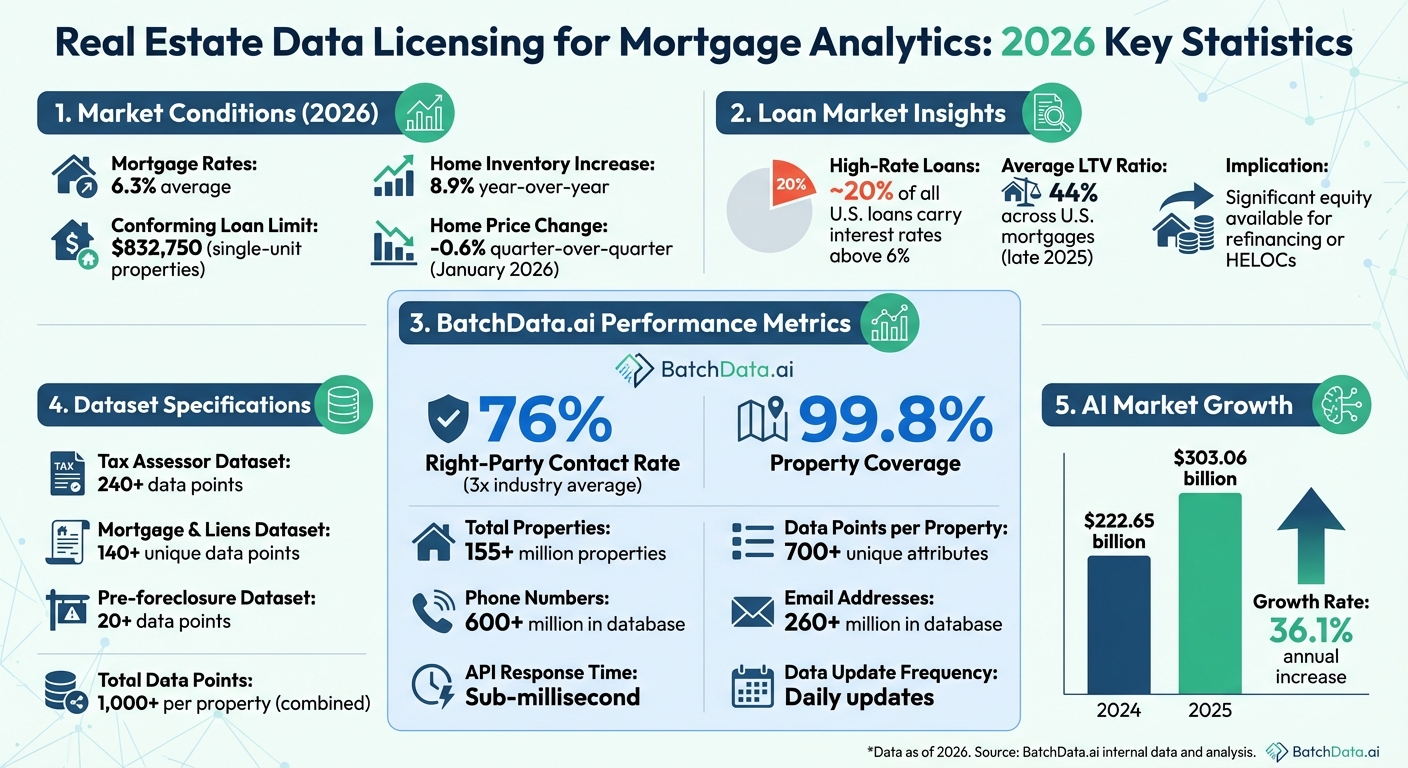

In 2026, mortgage analytics rely on real-time licensed real estate data to drive smarter decisions. This data provides insights into property details, financial metrics, and verified contact information, enabling lenders to identify refinance opportunities, manage risks, and improve homeowner outreach. With mortgage rates at 6.3% and an 8.9% increase in home inventory, staying competitive means leveraging up-to-date, actionable data.

Key takeaways:

- Licensed data offers accurate property, mortgage, and contact information.

- Real-time updates enable better risk assessment and lead targeting.

- Tools like BatchData.ai streamline processes with APIs, verified contact data, and built-in compliance features.

Outdated systems with delayed data delivery can’t keep up. Real-time platforms are now essential for efficient underwriting, portfolio monitoring, and predictive analytics.

Real Estate Data Licensing Key Statistics for Mortgage Analytics 2026

Real Estate Data Masterclass 2025: AI + Automation

Core Elements of Real Estate Data Licensing

In 2026, effective mortgage analytics relies on three interconnected data layers: property and structural data, financial and mortgage data, and contact data. Together, these layers provide the foundation for accurate valuations, equity assessments, and homeowner outreach. Property data offers key physical characteristics, financial data reveals insights like equity positions and lien statuses, and contact data connects these insights to homeowners, enabling targeted communication for refinancing, loss mitigation, and HELOC opportunities. By combining these layers, mortgage professionals can achieve precise underwriting and better homeowner engagement.

Property and Structural Data

Property and structural data cover essential building details such as the number of bedrooms and bathrooms, square footage, lot size, zoning classifications, and construction features like roof type or HVAC systems. These details are critical for Automated Valuation Models (AVMs) and calculating Loan-to-Value (LTV) ratios. For example, roof type and the year a property was built can help estimate maintenance costs, which impact borrower equity and financial planning.

Permit data adds another layer of insight, revealing upgrades like solar installations, pool additions, or roofing projects. Such improvements often signal that homeowners are actively investing in their properties, which may indicate higher equity or a willingness to pursue further enhancements. BatchData’s Tax Assessor dataset provides over 240 detailed data points, equipping mortgage professionals with the granular information needed for accurate risk assessments and property valuations. While this structural data lays the groundwork, financial data brings equity and risk profiles into sharper focus.

Financial and Mortgage Data

Financial and mortgage data include critical elements like loan amounts, interest rates, lien statuses, and refinance histories. These details help identify refinance opportunities and assess borrower risk. For instance, around 20% of all U.S. loans currently carry interest rates above 6%, making these borrowers prime candidates for refinancing. Additionally, the average Loan-to-Value (LTV) ratio across U.S. mortgages is approximately 44% as of late 2025, indicating that many homeowners have significant equity available for refinancing or HELOCs.

BatchData’s Mortgage & Liens dataset offers over 140 unique data points, including loan maturity dates and interest rate percentages. Pre-foreclosure information, such as notices of default, auction dates, and unpaid balances, enables lenders to identify borrowers who may need immediate loss mitigation services. While these financial details are invaluable, turning them into actionable strategies requires verified homeowner contact data.

Contact Data for Homeowner Outreach

Contact data transforms property and financial insights into actionable leads by providing verified phone numbers, email addresses, and other contact details. Skip tracing plays a key role in linking property records to current homeowner contact information, which often differs from the property’s listed address. BatchData achieves a 76% right-party contact (RPC) rate – about three times the industry average – helping mortgage professionals connect with actual decision-makers, even when properties are owned by LLCs or trusts.

The platform’s Contact Enrichment features include reachability scores, phone number confidence levels, and carrier details, enabling professionals to prioritize outreach efforts effectively. Built-in compliance tools, such as National DNC registry scrubbing and Litigator scrubbing, ensure campaigns stay compliant with TCPA regulations. These safeguards help avoid wasted marketing efforts on disconnected numbers or invalid addresses, optimizing resources and minimizing risk.

How Mortgage Professionals Use Real Estate Data

Licensed data is reshaping how mortgage professionals operate, making their strategies more forward-thinking. By 2026, comprehensive datasets allow them to spot opportunities, manage risks, and anticipate homeowner behavior. Three key applications – refinance targeting, loss mitigation, and AI-driven analytics – all depend on accurate property intelligence paired with verified contact details.

Refinance and HELOC Lead Targeting

Mortgage professionals rely on equity thresholds and Loan-to-Value (LTV) ratios to identify homeowners eligible for refinancing or Home Equity Lines of Credit (HELOCs). With mortgage rates averaging 6.3% in 2026, the refinancing market has grown significantly. Tools like BatchData’s Property Enrichment API provide real-time insights into mortgage balances, interest rates, and adjustable-rate riders, helping professionals pinpoint homeowners who qualify for refinancing.

BatchData also ensures outreach is effective. Its database of over 600 million phone numbers and 260 million emails allows professionals to connect with actual decision-makers instead of outdated contacts. Campaigns often target homeowners who have recently pulled permits for upgrades like solar panels, pools, or roof replacements – signals of increased property investment and equity. Combining this equity data with verified contact details gives mortgage professionals an edge in reaching potential refinance or HELOC candidates early.

While targeting opportunities is key, staying ahead of distressed assets is just as important.

Default and Loss Mitigation

For borrowers in default, acting quickly is essential. Mortgage servicers use BatchData’s pre-foreclosure dataset to identify distressed properties early. This dataset includes over 20 data points like Notice of Default dates, auction schedules, trustee details, and unpaid balances. With updates provided daily, servicers can monitor risks in real time, including liens, bankruptcy filings, and property value changes. Given that national home prices showed a slight -0.6% quarter-over-quarter decline in January 2026, keeping a close eye on equity levels is critical in deciding between loss mitigation or foreclosure.

BatchData’s skip-tracing tools help locate borrowers who may have moved or become unreachable through standard methods. For properties held in LLCs or trusts, its entity resolution features bypass registered agents to connect directly with decision-makers. Built-in compliance tools ensure adherence to regulations like TCPA and DNC, reducing legal risks while improving contact success rates. By integrating BatchData’s APIs into their systems, mortgage professionals can automate the identification of distressed properties, prioritize cases based on equity and debt levels, and streamline recovery efforts.

But the value of real-time data doesn’t end with immediate responses – it also powers long-term planning.

AI-Powered Predictive Analytics

Beyond addressing current risks, BatchData’s real-time data fuels predictive models that shape future strategies. Machine learning systems thrive on fresh, detailed data, and BatchData delivers with over 1,000 data points per property. These include structural features, mortgage histories, liens, and verified contact details, all accessible through cloud platforms like Snowflake, BigQuery, or S3.

This data enables professionals to calculate propensity scores, which predict behaviors like refinancing, selling, or seeking HELOCs. Behavioral triggers such as equity fluctuations, ownership duration, and financial distress are key inputs. As the gap between low-rate legacy mortgages and current rates narrows in 2026, predictive analytics help professionals identify homeowners likely to refinance or sell before these actions become public.

BatchData’s Smart Search feature simplifies lead generation by auto-creating lists tailored to specific profiles, such as absentee owners with high equity or homeowners nearing adjustable-rate resets. The growing role of AI in real estate is evident, with the market projected to expand from $222.65 billion in 2024 to $303.06 billion in 2025, reflecting a 36.1% annual growth rate. By integrating BatchData’s APIs into CRMs and loan systems, mortgage professionals can prioritize leads and allocate resources based on data-driven insights, replacing guesswork with statistical precision.

sbb-itb-8058745

How to Evaluate Real Estate Data Providers

Selecting the right data provider for mortgage analytics goes beyond flashy promises or surface-level claims. In 2026, mortgage professionals must focus on three key factors: accuracy, speed, and compliance. These elements ensure your refinance campaigns connect with the right people, your risk models stay aligned with market realities, and your outreach adheres to legal standards. BatchData.ai has built its reputation on delivering real-time, compliant, and precise mortgage analytics data, making these criteria essential benchmarks for evaluation.

Data Accuracy and Match Rates

Match rates are a critical measure of how well a provider links property records to verified contact details. For mortgage professionals engaged in refinance campaigns or loss mitigation efforts, a high match rate means reaching the right individuals instead of wasting resources on outdated or incorrect information. BatchData.ai, for instance, achieves a 76% RPC rate through continuous self-enrichment, ensuring accurate and reliable contact data for targeted outreach efforts.

For identifying individual property owners, especially those hidden behind corporate entities, entity resolution becomes crucial. BatchData’s skip tracing technology delivers these insights in milliseconds while remaining fully compliant with TCPA and DNC regulations.

Address quality is another area that deserves attention. Providers should use CASS-certified processing and Delivery Point Validation (DPV) to confirm that addresses are deliverable by USPS. Beyond that, a comprehensive property dataset should offer depth. BatchData provides over 700 unique data points per property, covering a database of more than 155 million properties – a level of detail that supports both digital and physical outreach.

API Performance and Scalability

For enterprise-level operations, real-time access to data is non-negotiable. BatchData’s API-first architecture offers sub-millisecond response times for transactional lookups and integrates seamlessly with platforms like Snowflake, BigQuery, and Databricks. This setup allows mortgage professionals to enrich thousands of records simultaneously while maintaining minimal latency.

Integration flexibility is another must-have. Providers should deliver data in machine-readable formats tailored for AI model training or analytics dashboards. BatchData simplifies this process by offering direct cloud delivery or standardized Parquet files for storage solutions like Amazon S3 and Google Drive, eliminating the need for complex ETL processes.

Compliance and Data Freshness

Compliance with regulatory standards and maintaining up-to-date data are critical for mortgage marketing. Providers should incorporate built-in protections like TCPA and DNC scrubbing to safeguard against legal risks. BatchData, for example, automatically checks phone numbers against the National Do Not Call Registry and uses Litigator Scrubbing to flag individuals known for filing predatory TCPA lawsuits. The platform is designed with "TCPA-safe data, CCPA-ready endpoints, and enterprise-grade security".

Keeping data fresh is equally important. While some providers rely on outdated 30-day update cycles, modern mortgage professionals need daily or even real-time updates to stay ahead. BatchData updates its records daily, capturing changes in homeowner equity, new liens, or contact information, ensuring analytics reflect current market conditions. Features like audit trails and version controls also provide transparency, documenting data lineage to meet evolving regulatory standards. With the Federal Housing Finance Agency setting the 2026 conforming loan limit at $832,750 for single-unit properties, staying compliant and current has never been more crucial.

Conclusion: Modern Mortgage Analytics with BatchData.ai

The mortgage industry in 2026 revolves around live, actionable data. With mortgage rates averaging 6.3% and existing-home inventory increasing by 8.9% year-over-year, institutions must rely on real-time insights to link property risk with homeowner engagement. Modern real estate data licensing makes this possible, offering daily updates and API-first infrastructure designed for instant, large-scale decision-making.

BatchData.ai sets a new standard for mortgage analytics, delivering unparalleled data coverage. With 99.8% coverage of U.S. properties, access to over 600 million phone numbers, 260 million emails, and a 76% right-party contact rate, the platform ensures refinance campaigns and loss mitigation efforts connect with actual decision-makers – not outdated records.

Whether you’re developing AI-powered underwriting models, targeting high-equity homeowners for HELOC products, or monitoring portfolio risks in real time, BatchData.ai provides the tools to execute effectively. Its sub-millisecond API responses, combined with built-in TCPA and DNC compliance features, enable instant and compliant decision-making across platforms like Snowflake, BigQuery, and Databricks. With the 2026 conforming loan limit set at $832,750 for single-unit properties, staying updated on property values and homeowner contact details is critical to maintaining a competitive advantage.

For institutions seeking to move beyond outdated data feeds, BatchData.ai offers the most comprehensive property and contact data licensing solution available. With daily updates covering over 700 unique property attributes and seamless cloud delivery, the platform empowers data-driven decisions that define modern mortgage analytics.

FAQs

How does real-time data transform mortgage analytics in 2026?

In 2026, real-time data transforms mortgage analytics, offering instant insights into property details and homeowner behavior. This shift empowers lenders and analysts to make quicker, more precise decisions while staying aligned with a rapidly changing market.

With constantly updated datasets, mortgage professionals can refine risk assessments, spot refinancing opportunities, and improve how they connect with customers. By relying on the latest information, they can avoid the setbacks caused by outdated records and make decisions with confidence.

What are the essential features of real estate data licensing for mortgage professionals?

By 2026, real estate data licensing for mortgage professionals has become all about delivering real-time, detailed property and homeowner contact information to fuel advanced analytics and outreach strategies. Here’s what stands out:

- Property and structural details: Access to specifics like the year a property was built, square footage, roof type, and HVAC system status allows for precise property profiling.

- Financial and lien information: Data on current mortgage balances, interest rates, loan-to-value (LTV) ratios, and tax delinquency status helps assess risk and manage portfolios effectively.

- Verified homeowner contact information: Accurate mobile numbers, landlines, and active email addresses enable targeted campaigns for refinancing, loss mitigation, or lead generation.

A key feature of modern licensing is real-time API access, which ensures instant data retrieval with high match rates and minimal delays. This approach not only keeps professionals compliant with regulations like TCPA and DNC scrubbing but also ensures the data remains up-to-date with daily refreshes. With this level of accuracy and immediacy, mortgage professionals can make well-informed decisions and execute their strategies with confidence.

How does BatchData.ai comply with regulations like TCPA and DNC?

BatchData.ai takes the guesswork out of compliance with key regulations like the Telephone Consumer Protection Act (TCPA) and Do Not Call (DNC) requirements. Its platform includes built-in, advanced scrubbing tools that automatically detect and remove contacts listed on federal and state DNC registries. It also flags numbers that could potentially violate TCPA rules.

With real-time updates and strict verification methods, BatchData.ai allows businesses to connect with homeowners confidently. This approach minimizes legal risks and ensures outreach efforts remain both ethical and fully compliant with industry regulations.