Predictive analytics is changing how real estate professionals buy properties. By using machine learning, regression analysis, and time-series models, it helps forecast property values, market trends, and seller behaviors with high accuracy. Tools like Zillow‘s Zestimate and advanced APIs analyze data such as transaction history, tax records, and even satellite imagery to provide actionable insights. Key benefits include:

- Higher ROI: Companies using predictive tools report 25–30% better returns.

- Improved Accuracy: Machine learning models predict value changes with 87% accuracy, compared to 63% for older methods.

- Faster Decisions: Data-driven insights allow investors to identify opportunities months ahead of competitors.

Predictive analytics also pinpoints off-market leads, evaluates risks, and integrates real-time data for smarter decisions. Whether you’re targeting undervalued properties or assessing market risks, these tools streamline property acquisition strategies.

AI Predictive Analytics for Real Estate Farming How Smart Agents Find Sellers with Rick Fuller

sbb-itb-8058745

Core Techniques in Predictive Analytics for Real Estate

Predictive analytics in real estate revolves around three main methods: regression analysis, machine learning, and time-series analysis. Each tackles a unique aspect of property acquisition – regression helps understand property value factors, machine learning uncovers buyer and seller behaviors, and time-series models track market trends over time. Together, these tools provide sharper insights and more informed decision-making.

Regression Analysis for Property Valuation

Regression analysis creates a mathematical connection between property prices and key influencing factors like size, location, amenities, and economic trends. Unlike traditional appraisals that rely heavily on intuition and a handful of comparable sales, regression models process thousands of transactions to reveal market-wide patterns.

This approach pinpoints exactly how much each factor impacts a property’s value. For example, in King County, Washington, analysts modeled home prices from May 2014 to May 2015. Starting with square footage and house grade explained 55% of the price variation. Adding a waterfront variable raised accuracy to 60.6%, and incorporating spatial features, like proximity to Seattle and Microsoft headquarters, boosted the model’s explanatory power to over 69%.

"Traditional approaches to valuing real estate can lean towards the qualitative side, relying more on intuition over sound rationale. Linear regression analysis, however, can offer a robust model for using past transactions in an area, to provide better guidance on property valuations." – Daniel Barr, CFA, CAIA, Toptal

Another example comes from Allegheny County, Pennsylvania. A regression model using five variables (construction quality, finished living area, air conditioning, lot size, and condition grade) achieved a standard error of $73,091 – far lower than the $160,429 standard deviation of sales prices. However, data cleaning is crucial. Invalid sales, like family transfers, can make up 82% of deed records and must be filtered out to ensure accuracy.

While regression focuses on property valuation, machine learning dives deeper into understanding buyer and seller behaviors.

Machine Learning for Buyer and Seller Behavior Analysis

Machine learning shines in identifying patterns within buyer preferences and seller motivations. By analyzing data from CRM systems, website activity, email engagement, and social media, these algorithms rank leads based on their likelihood to convert and predict which property owners might sell before listing. Adoption of machine learning in real estate has surged, growing from 28% in 2017 to 63% by 2023.

These algorithms group prospects based on purchase history, browsing habits, and lifestyle data, enabling tailored property recommendations. For commercial real estate, machine learning can forecast vacancy risks by examining lease renewal dates, payment histories, and tenant credit scores. Natural Language Processing (NLP) further enriches insights by extracting valuable information from unstructured sources like social media posts, news articles, and listing descriptions.

The results speak for themselves. Zillow’s Zestimate algorithm, which leverages predictive analytics, estimates home values with a median error of just 5.9%. This kind of precision has transformed lead scoring and decision-making in real estate.

While machine learning analyzes behaviors, time-series analysis takes a broader view, tracking how markets evolve over time.

Time-Series Analysis for Market Trends

Time-series models, such as ARIMA (AutoRegressive Integrated Moving Average) and LSTM (Long Short-Term Memory), work with chronological data to forecast future trends and identify patterns in market movements. These tools reveal recurring investment cycles, helping investors time their market entries and exits more effectively.

By accounting for seasonality, market fluctuations, and time-based patterns, these models predict shifts in property values, rental demand, and supply dynamics. For example, they can analyze historical data alongside migration trends and economic indicators to project future price changes. Early warning signs of market corrections – like declining tenant credit scores or oversupply – can be detected well before they become obvious to others.

Investors using predictive timing models have outperformed the market by an average of 15% over a five-year period. Some programs can even predict which properties will sell within the next 18 months with 70% accuracy. Increasingly, time-series models integrate real-time data like Google search trends by zip code, mobile phone movement patterns, and social media sentiment to forecast neighborhood-level changes.

| Feature | Traditional Analysis | Time-Series Predictive Analytics |

|---|---|---|

| Data Basis | Static historical comps and "gut feeling" | Time-ordered data points and real-time variables |

| Market Stance | Reactionary to market changes | Proactive forecasting of future shifts |

| Accuracy | Limited by human bias and small datasets | High precision (e.g., 70% accuracy for 18-month sales) |

| Timing | Often misses market corrections | Identifies early warning signs of corrections |

These methodologies collectively empower real estate professionals to make smarter, data-driven decisions. By combining regression, machine learning, and time-series analysis, predictive analytics offers a powerful toolkit for navigating the complexities of the market.

Data Sources and Tools for Predictive Analytics

Predictive analytics in property acquisition thrives on accurate, enriched data and tools that transform analysis into practical strategies. Real estate professionals who depend on outdated or incomplete property records risk generating unreliable forecasts. The foundation of effective predictive analytics rests on three key data types: historical transactions (covering tenure, price trends, and equity), behavioral signals (such as tax delinquency, listing history, and probate filings), and external indicators (like economic trends and local development projects). Interestingly, unconventional data points – like Google review scores, Airbnb listing density, and social media sentiment – often outperform traditional census data in predictive accuracy.

Cutting-edge tools now utilize high-resolution aerial imagery to assess property conditions, identifying details like roof wear, yard clutter, pools, and solar panels – all without requiring on-site visits. Companies like CAPE Analytics leverage computer vision to evaluate properties at scale. Platforms such as CompStak provide ranked comparable property data via APIs. This evolution, from static filters like "absentee owners with 40% equity" to intent-based scoring that identifies the top 250 properties most likely to sell in a given quarter, is reshaping how investors discover opportunities.

To harness these data types effectively, robust enrichment processes are essential, transforming raw records into actionable insights.

Property and Contact Data Enrichment

Enriched datasets are the backbone of strategic decision-making in real estate. AI-powered skip tracing tools can achieve up to a 95% match rate for property owner contact details, turning incomplete records into verified phone numbers, email addresses, and social media profiles. This level of accuracy is a game-changer, with real estate professionals using predictive analytics reporting a 30–50% increase in ROI on marketing campaigns by focusing on high-probability leads.

BatchData stands out in this space, offering property and contact data enrichment services that deliver verified ownership details alongside in-depth property attributes. By combining multiple data layers – public records, ownership verification, and behavioral indicators – investors can create predictive models that identify intent even before properties are listed on the market.

APIs for Real-Time Data Integration

Real-time API integration is a game-changer for predictive analytics, allowing property data and condition reports to flow seamlessly into underwriting workflows. BatchData’s property search API integrates directly with CRM systems and predictive analytics platforms, ensuring that risk scores and valuations are automatically factored into daily decision-making. For example, when a property is flagged for tax delinquency or probate, API-connected systems can instantly initiate outreach campaigns, significantly reducing the lag between insight and action. This kind of integration supports automated, efficient outreach workflows powered by reliable skip tracing.

Skip Tracing and Bulk Data Delivery

Skip tracing bridges the gap between predictive insights and actionable results. Once analytics identify high-intent prospects, skip tracing delivers verified contact details for immediate follow-up. For instance, in 2025, a Texas investor combined predictive analytics with AI-driven skip tracing and automated outreach campaigns. By targeting 2,000 high-probability prospects, they closed six off-market deals in just 90 days, with an average profit margin of $35,000 per deal – all while spending less than 30% of their usual marketing budget.

BatchData’s bulk data delivery service, paired with its pay-as-you-go pricing model, helps investors scale their acquisition efforts without requiring long-term subscription commitments. The platform’s phone and address verification tools ensure contact data is accurate before outreach begins, reducing wasted marketing spend on disconnected numbers or outdated leads.

"The competitive edge no longer comes from who can pull the biggest list… It comes from who can predict intent first." – Goliath Data

How to Implement Predictive Analytics: Step-by-Step

You don’t need to completely overhaul your process to start using predictive analytics. Many successful real estate professionals begin by focusing on one impactful use case – like scoring off-market leads or predicting neighborhood growth – before expanding into other areas. With over 72% of real estate firms leveraging predictive analytics to identify opportunities and manage risks, the real key is a step-by-step approach rather than jumping into overly complex systems.

Here’s a practical, three-step guide to implementing predictive analytics effectively.

Step 1: Data Collection and Cleaning

Predictive analytics thrives on clean, accurate data. Start by gathering diverse datasets, such as property details (age, square footage), transaction histories, tax records, and neighborhood metrics like crime rates and school ratings. Cleaning this data is critical: standardize formats, cross-check prices with official records, and validate coordinates to avoid errors.

BatchData’s property and contact data enrichment services can simplify this process by consolidating fragmented sources – like MLS records, government databases, and private datasets – into a single, verified dataset. Their address and phone verification tools help eliminate duplicates and geocoding mistakes before they affect your forecasts.

Step 2: Building Predictive Models

Use clean historical data to train machine learning algorithms that can identify future opportunities. For example, regression analysis can predict price trends based on factors like location and square footage, while neural networks can uncover complex patterns, such as the relationship between job growth and property appreciation. Research from the MIT Center for Real Estate shows that machine learning models are far more accurate at predicting property value changes than traditional valuation methods.

The rise of alternative data sources is also boosting model performance. Information like satellite imagery, mobile phone foot traffic, and social media sentiment is now outperforming traditional census data in predictive accuracy. For instance, in 2022, a mid-sized residential developer used a predictive model with 140 variables to pinpoint three suburban locations that traditional analysis overlooked. The result? These projects sold 43% faster and at 18% higher price points compared to similar developments.

Step 3: Integrating Predictive Tools into Acquisition Workflows

Once your model is ready, the next step is to weave it into your daily operations so you can turn insights into actions. API-first integration allows your predictive models to connect directly with CRMs like Salesforce, ensuring that risk scores and valuations are automatically factored into decisions. For example, BatchData’s property search API enables real-time data integration, triggering automated outreach campaigns when a property meets a specific "motivation threshold", such as a new probate filing or tax delinquency.

To keep your models up-to-date, set up automated data pipelines to eliminate manual data entry. For high-stakes acquisitions, consider adding a human-in-the-loop validation step where experts review and refine predictive recommendations before finalizing decisions. Firms that integrate predictive capabilities into their workflows have seen 25-30% higher ROI compared to those using traditional decision-making methods.

Real-World Applications in Property Acquisition

Predictive analytics addresses specific challenges in property acquisition by enhancing three key areas: forecasting market trends, evaluating property risks, and prioritizing off-market leads.

Market Forecasting and Opportunity Identification

Predictive models are changing how investors identify emerging markets. By analyzing unconventional data – like coffee shop permit filings, Google search trends by zip code, Airbnb listing density, and even social media sentiment – these models can uncover market shifts that traditional methods often miss.

For example, a major REIT used machine learning to analyze factors like mobility data, lease renewal trends, and remote work adoption rates. Acting on these insights, the firm divested from vulnerable office markets two quarters ahead of the broader trend, avoiding nearly $320 million in potential losses.

This approach goes beyond broad zip code analysis. With city-block-level insights, investors can detect hyper-local appreciation trends early, gaining a competitive edge. But identifying opportunities is just the beginning – predictive analytics also refines risk evaluation and lead targeting.

Risk Assessment in Property Valuation

When it comes to property risk, predictive analytics shifts the process from guesswork to data-driven precision. These models evaluate factors like market volatility, tenant default risks, and environmental hazards, creating detailed risk profiles. Investors can even simulate various scenarios – such as interest rate hikes or the closure of a major local employer – to identify at-risk assets.

One commercial appraisal firm integrated machine learning into its valuation process, drastically improving accuracy. Across 215 properties, the model reduced average valuation errors from 12.4% to 4.7%, boosting confidence in acquisition decisions. Additionally, the model correctly predicted property value changes 87% of the time, compared to just 63% for traditional methods.

Climate risk modeling is another area where predictive analytics shines. Advanced systems now incorporate projections for risks like sea-level rise and wildfires, helping investors avoid properties likely to face steep devaluation over the next decade or two. These insights naturally feed into strategies for targeting high-priority off-market leads.

Lead Prioritization for Off-Market Deals

Predictive analytics also transforms how investors identify off-market opportunities. Instead of casting a wide net (e.g., targeting all absentee owners), these tools focus on behavioral triggers like tax delinquencies, utility shutoffs, probate filings, and divorce records. This narrows the pool to the top 200–300 properties with the highest likelihood of a sale.

Investors using predictive scoring have reported 30–50% higher ROI on marketing campaigns. By focusing on high-probability leads, they save time and money compared to broader, less-targeted outreach. Some platforms even take it further, using computer vision and satellite imagery to identify physical signs of distress – like roof damage or overgrown lawns – giving investors a head start on motivated sellers.

BatchData’s property search API enhances this process by integrating real-time data directly into CRMs. When a property hits a specific motivation threshold, like a new probate filing or tax delinquency, the system can automatically trigger outreach campaigns. Their skip tracing and contact enrichment features also provide verified contact details, ensuring quick and effective communication with potential sellers.

This proactive approach to lead targeting is changing the game. As McKinsey stated in 2023:

"The most successful real estate investors of the next decade will likely be those who most effectively harness predictive capabilities to anticipate market shifts before they become apparent to conventional analysis."

Benefits and ROI of Predictive Analytics

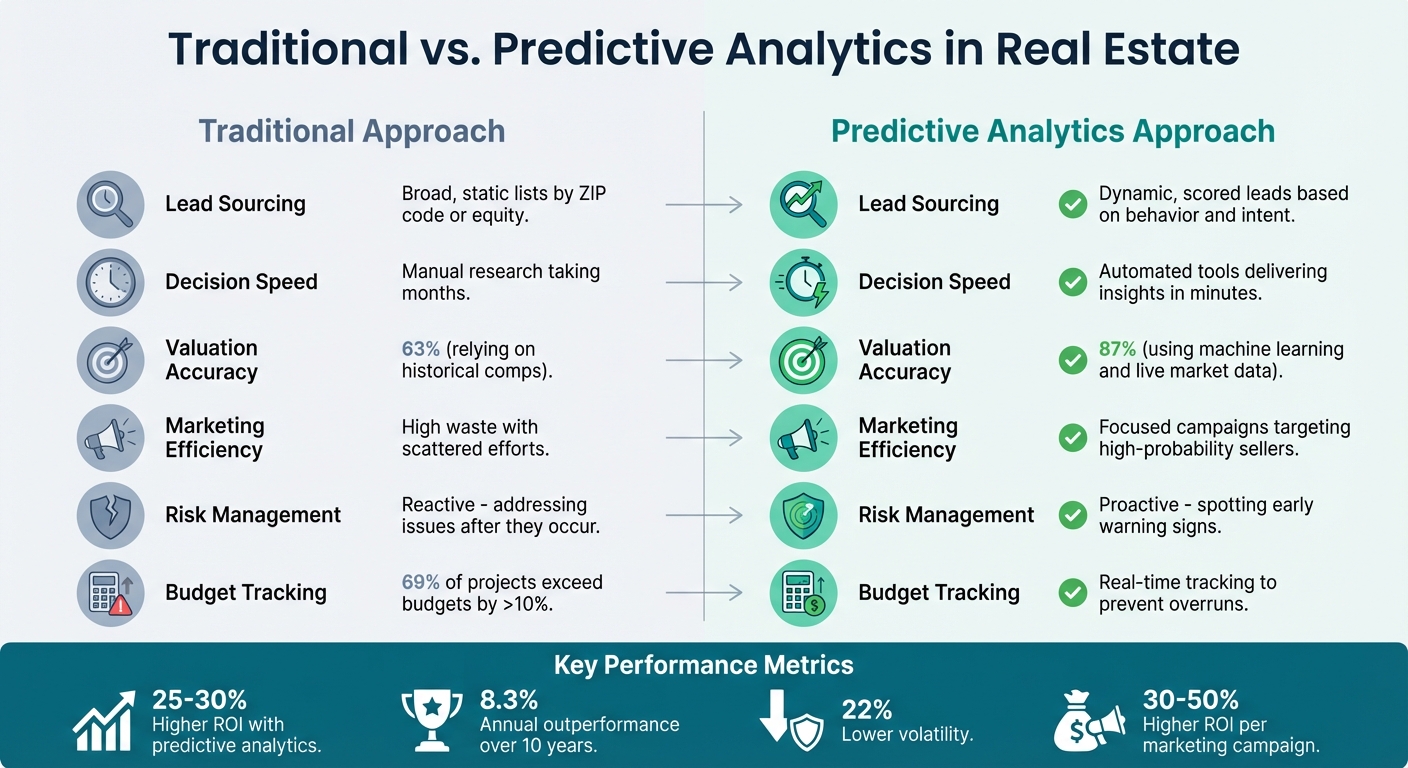

Traditional vs Predictive Analytics in Real Estate: Performance Comparison

Predictive analytics isn’t just a buzzword – it delivers measurable financial and operational benefits. For instance, portfolios managed with predictive analytics see a 25–30% higher ROI and achieve an 8.3% annual outperformance with 22% lower volatility over ten years compared to traditional methods. These numbers highlight how data-driven strategies can significantly impact outcomes.

The key to these results lies in precision, speed, and proactive planning. Instead of wasting resources on broad, generic campaigns, predictive systems pinpoint high-probability leads. For example, they can identify the top 250 properties most likely to sell in the next quarter, leading to 30–50% higher ROI per marketing campaign. This targeted approach cuts costs on skip tracing, mailers, and cold calls while improving conversion rates.

Timing is another critical factor. Predictive tools can uncover off-market opportunities up to 12 months before they hit the market. This gives investors a significant head start to build relationships with sellers before competitors even know the properties are available. A case study in Decatur, Illinois, illustrates this perfectly: a predictive model analyzed 35,000 properties and flagged 2,024 likely to list within a year. Remarkably, 23% of those homes were eventually listed.

Traditional vs. Predictive Approaches

The contrast between traditional methods and predictive analytics is striking. Here’s how the two stack up:

| Metric | Traditional Approach | Predictive Analytics Approach |

|---|---|---|

| Lead Sourcing | Broad, static lists (e.g., by ZIP code or equity) | Dynamic, scored leads based on behavior and intent |

| Decision Speed | Manual research taking months | Automated tools delivering insights in minutes |

| Valuation Accuracy | ~63%, relying on historical comps | ~87%, using machine learning and live market data |

| Marketing Efficiency | High waste with scattered efforts | Focused campaigns targeting high-probability sellers |

| Risk Management | Reactive, addressing issues post-occurrence | Proactive, spotting early signs of underperformance |

| Budget Tracking | 69% of projects exceed budgets by >10% | Real-time tracking to preempt overruns |

These differences underline why predictive analytics is a game-changer for real estate professionals.

Better Decision-Making and Competitive Edge

Predictive analytics doesn’t just improve decision-making – it redefines the competitive landscape. Companies that excel at predictive strategies don’t merely follow market trends; they shape them by identifying opportunities before competitors even notice. As Goliath Data aptly put it:

"In 2025, the competitive edge no longer comes from who can pull the biggest list… It comes from who can predict intent first."

BatchData’s property search API and bulk data services are seamlessly integrated into this predictive ecosystem. By delivering real-time property data, verified contact details through skip tracing, and automated data enrichment, BatchData ensures that when predictive tools flag opportunities, investors have everything they need to act swiftly and with confidence.

Conclusion

Predictive analytics has reshaped property acquisition, turning it from a guessing game into a data-driven strategy. Instead of relying on outdated comps or gut feelings, professionals now have the tools to pinpoint properties likely to sell, prioritize leads based on behavior, and achieve ROI increases of 25–30%. As Goliath Data aptly put it:

"The competitive edge no longer comes from who can pull the biggest list… It comes from who can predict intent first".

The numbers speak volumes: 72% of real estate firms already leverage predictive analytics to mitigate risks and seize opportunities, and predictive models boast an 87% accuracy rate for forecasting property value changes – far surpassing the 63% accuracy of traditional methods. With AI-driven efficiency gains expected to reach $34 billion by 2030, the real question is how fast you can incorporate predictive analytics into your workflow.

To harness this potential, you need clean, diverse datasets, strong model architecture, and seamless integration into your processes. Platforms like BatchData are instrumental here, providing real-time property data via APIs, verified contact details through skip tracing, and automated data enrichment. When predictive models highlight high-value opportunities, BatchData ensures you’re ready to act with speed and confidence.

The real estate industry is shifting rapidly. By adopting predictive analytics now, you set yourself up to lead tomorrow’s market. Start with a focused use case – whether it’s lead scoring, dynamic pricing, or risk management – and build from there. The tools and data are already available. The only thing left is your move.

FAQs

How can predictive analytics help maximize ROI in property acquisition?

Predictive analytics empowers real estate professionals to make smarter investment choices by leveraging data-driven insights. By examining both historical and real-time data, predictive models can estimate property values, spot market trends, and even predict the likelihood of a sale. This means investors can uncover promising opportunities before they hit the mainstream radar.

It’s also a powerful tool for fine-tuning pricing, evaluating risks, and identifying high-potential leads. For example, predictive analytics can point out neighborhoods where demand is climbing or flag properties that might lose value, helping investors take strategic action. By minimizing risks, streamlining processes, and improving decision-making, predictive analytics plays a key role in boosting profitability and supporting long-term success in real estate investments.

What types of data are used in predictive analytics for real estate?

Predictive analytics in real estate combines various data sources – traditional, external, and alternative – to deliver insights that guide property acquisition and investment strategies.

Traditional data includes essentials like property transaction records, rental income, expenses, and historical market trends. These elements are key to assessing a property’s value and performance over time.

External data sources bring added context, pulling from tools like geographic information systems (GIS), census data, and economic indicators. This information paints a broader picture of market conditions and opportunities.

Alternative data is gaining traction as a powerful tool. It covers insights from social media activity, online reviews, and tenant behavior, offering a closer look at property demand and emerging trends.

By blending these diverse datasets, professionals in real estate can make smarter decisions that align with their specific objectives.

How does predictive analytics help find off-market properties?

Predictive analytics plays a key role in spotting off-market properties by diving into massive datasets to pinpoint homes likely to sell before they’re officially listed. By looking at factors like homeowner behavior, major life changes (such as retirement or job relocations), and broader market trends, it identifies patterns that might indicate a property owner is gearing up to sell.

Some advanced tools take it a step further by factoring in details like utility shutoffs or activities tied to moving. This kind of data-driven strategy helps real estate professionals focus on motivated sellers, streamlining their efforts and staying ahead of the competition compared to more traditional approaches.