Automated Valuation Models (AVMs) estimate property values quickly, but their accuracy depends on the quality and variety of data they use. AVMs relying on a single data source often face issues like outdated or incomplete information. Integrating multiple data streams – such as public records, MLS listings, images, and disaster data – makes these models more reliable and precise. Here’s how:

- Single-Source Data Issues: Public records may miss renovations or unique property features, while tax data can lag behind market trends.

- Benefits of Multi-Source Data:

- MLS data offers up-to-date listings, agent insights, and market trends.

- Image data (photos, satellite imagery) evaluates property condition, curb appeal, and neighborhood details.

- Additional sources like permits and disaster data provide context on renovations and risks.

- Machine Learning Advances: Combining diverse data sources with advanced algorithms improves accuracy, especially in complex markets or non-disclosure states.

Multi-source AVMs are transforming industries like real estate, lending, and insurance by reducing valuation errors and improving decision-making. However, challenges like data licensing, privacy compliance, and system integration require careful management. The future of AVMs lies in leveraging diverse, real-time data for faster, more reliable property valuations.

Build your own Real Estate AVM with AI

Data Sources That Improve AVM Accuracy

The effectiveness of an Automated Valuation Model (AVM) hinges on the variety and quality of its data inputs. Each data source contributes distinct insights, helping AVMs produce more precise property valuations. By addressing specific gaps, these diverse datasets work together to refine the overall accuracy of the model.

Core Structured Data: Public Records and Transaction Histories

Public records and transaction histories form the backbone of AVMs. These structured datasets include key details like property tax records, ownership history, past sales prices, and basic characteristics such as square footage, lot size, and construction year. This information allows AVMs to identify comparable properties and track value trends over time.

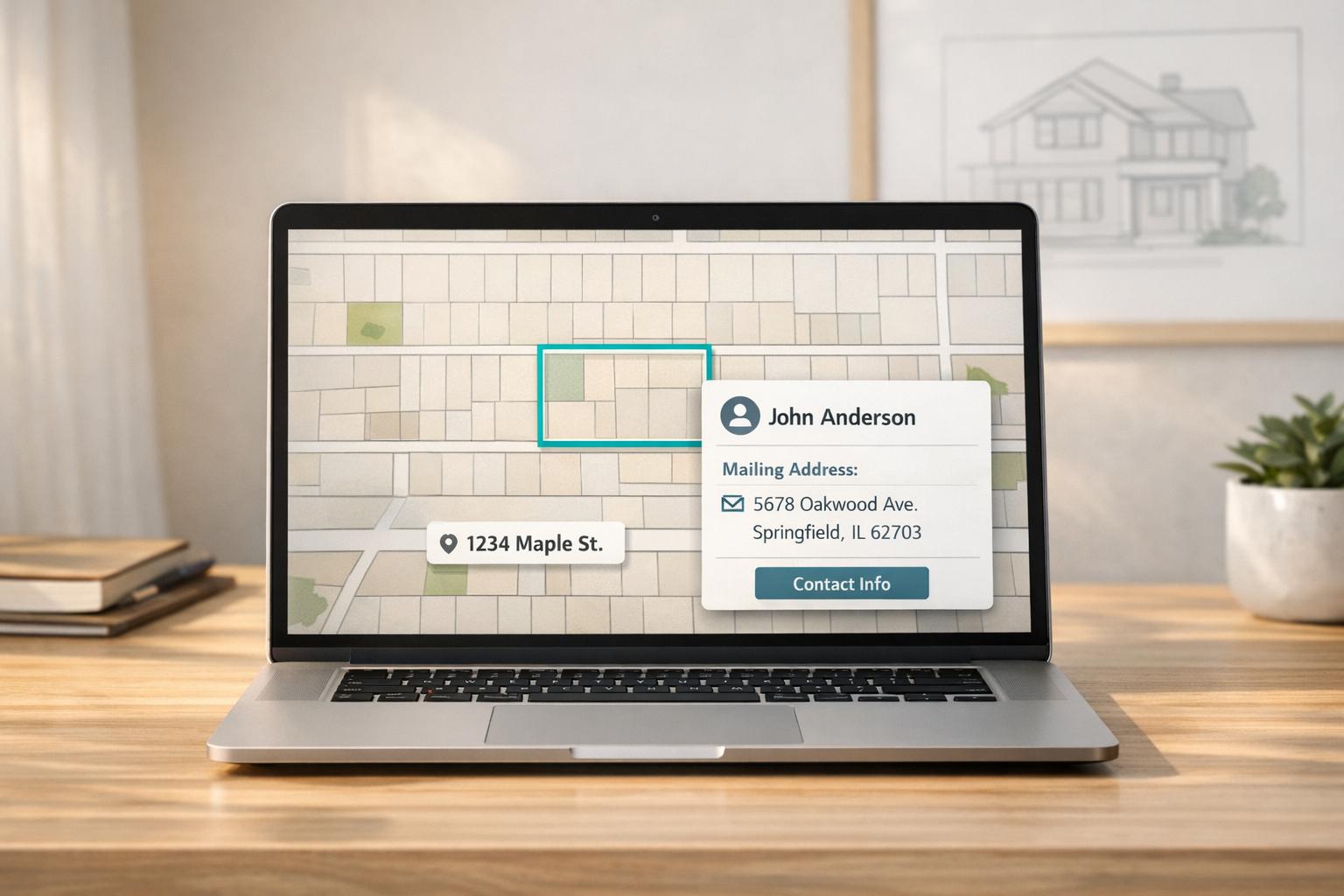

BatchData, for instance, aggregates data on over 155 million properties, offering more than 800 attributes and 221 million homeowner records. Their approach emphasizes data reliability and timeliness:

“We pull from verified sources and use advanced validation to ensure data accuracy. With frequent updates and real-time delivery on select datasets, you’re always working with trusted information”.

This comprehensive strategy combines property details, ownership information, market trends, and analytics, enabling AVMs to deliver smarter property insights in milliseconds.

While structured data provides a solid foundation, it can miss recent updates like renovations, unique property features, or shifts in market dynamics. This is where other data sources come into play.

MLS Data: Listings, Agent Commentary, and Market Trends

Multiple Listing Service (MLS) data adds valuable, real-time market information to the structured data foundation. Active and pending listings reveal current market conditions and pricing trends, while time-on-market metrics indicate how quickly properties are selling. MLS data also includes agent commentary, which often highlights renovations, property conditions, or other unique features that public records might overlook.

This type of data fills critical gaps, offering real-time insights that help AVMs better reflect the current market landscape. By incorporating MLS data, AVMs gain the ability to fine-tune valuations with a more dynamic and detailed view.

Image Data and Satellite Imagery

Visual data has become a game-changer for AVM technology. Photos, street views, and satellite imagery provide context beyond what traditional datasets can offer. These images help models evaluate property condition, curb appeal, neighborhood characteristics, and even environmental factors.

Research has shown the significant impact of integrating image data into AVMs. For instance, a study in Hong Kong demonstrated that combining exterior photos, street views, and remote sensing images with structured data dramatically improved model accuracy. In fact, half of the top 10 features in advanced models were image-based.

Street view images can highlight neighborhood features, while satellite imagery outlines property boundaries and outdoor amenities. Exterior photos capture architectural style, maintenance levels, and landscaping – factors that influence buyer perception and property value. The importance of these image features often varies between urban and suburban areas, emphasizing the need for localized data configurations.

Additional Data Sources: Appraisals, Permits, and Disaster Data

Additional data sources like appraisals, building permits, and disaster data provide further precision. Professional appraisals offer expert valuations that can validate AVM estimates, serving as a valuable benchmark when available.

Building permits reveal recent renovations or additions, such as a new kitchen or extra room, which might not yet appear in public records. These updates can significantly affect property value, offering insights that structured data alone might miss.

Disaster data, including information on fires, floods, or earthquakes, introduces another layer of detail. This data highlights current damage and future risks that could impact a property’s appeal or insurance costs. Additionally, weather and environmental monitoring data help AVMs account for location-based risks, ensuring a more comprehensive valuation.

Research Results: Multi-Source Data and AVM Performance

A deep dive into the role of diverse data inputs reveals their significant influence on AVM performance. Studies consistently show that integrating multiple data sources enhances AVM accuracy. For instance, a 2025 study focused on Hong Kong’s residential data evaluated eight machine learning algorithms – such as Random Forest, Extra Tree, XGBoost, LightGBM, KNN, SVR, MLP, and MLR – to assess the impact of incorporating multi-source image data. This research utilized three types of visual data: exterior photos, street view images, and remote sensing images. Exterior photos captured details like building aesthetics and maintenance levels, street view images offered insights into neighborhood context and accessibility, and remote sensing images added a broader perspective on environmental and spatial factors.

Among these algorithms, the Extra Tree model stood out, delivering the best results when multi-source image features were included. The findings highlighted how visual data significantly boosts the predictive power of valuation models, opening up new opportunities to evaluate specific performance improvements.

Performance Metrics of Multi-Source AVMs

Bringing together diverse data sources leads to noticeable improvements in key performance metrics. Multi-source AVMs are particularly effective at resolving conflicts between different data inputs, offering a more detailed and nuanced analysis. For example, the integration of MLS data over the past five to ten years has greatly enhanced model performance, especially in non-disclosure states, by providing more accurate and up-to-date property information compared to traditional public records.

Moreover, the effectiveness of these models often depends on their feature configurations. Successful implementations typically involve multiple machine learning pipelines with varied feature settings. Distributed computing strategies are also employed to optimize both training and evaluation processes, ensuring the models perform at their best.

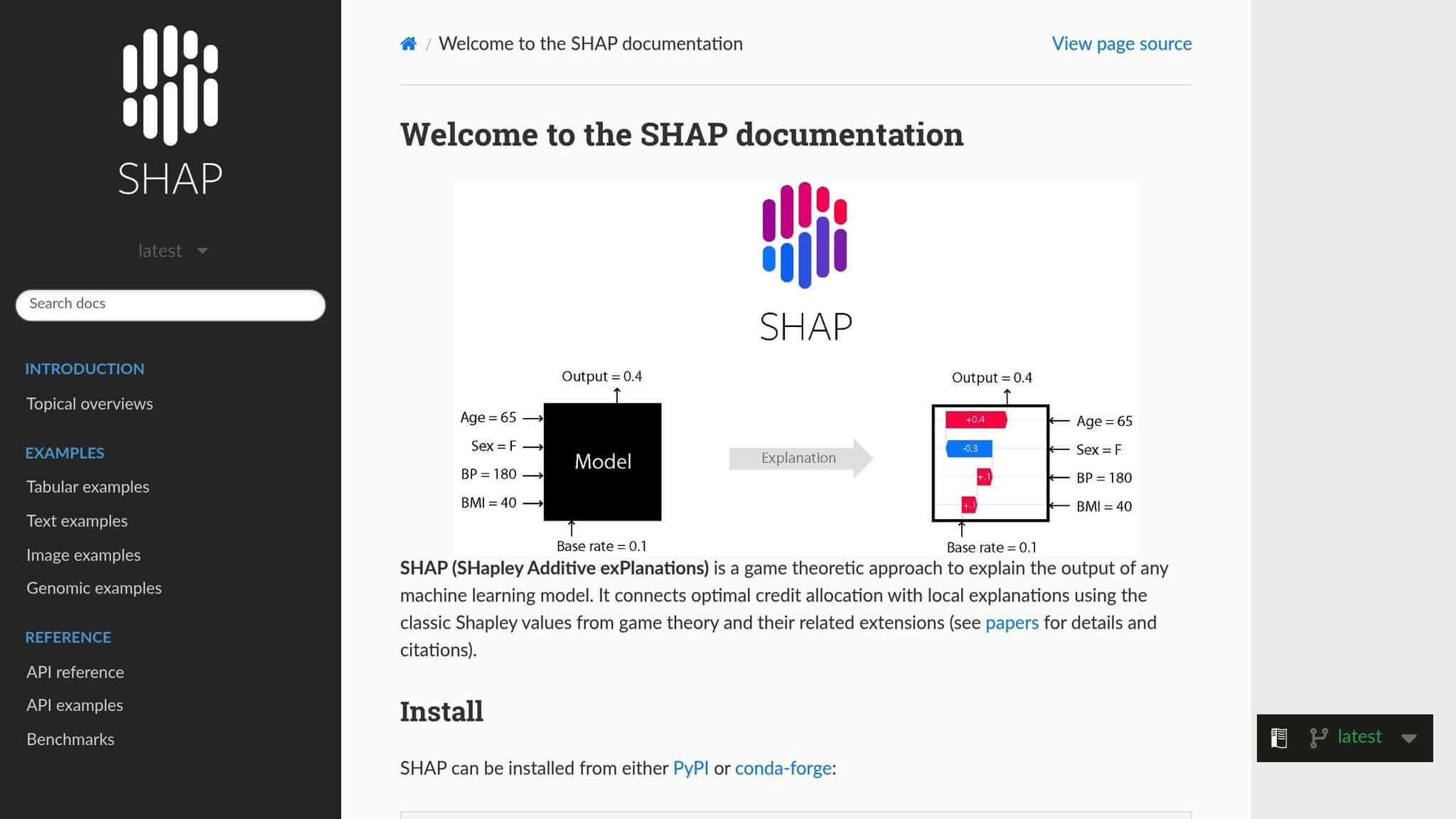

SHAP Analysis: Understanding Feature Importance

To further refine these performance gains, SHAP (SHapley Additive exPlanations) analysis plays a vital role in identifying the importance of individual data features. In the Hong Kong study, SHAP analysis revealed that image-derived features accounted for half of the top 10 factors driving accurate valuations. This finding underscores how visual data impacts models differently depending on whether the properties are in urban or suburban areas. Such detailed insights allow stakeholders to make more informed decisions, pinpointing which data sources are most critical for improving valuation accuracy under varying market conditions.

sbb-itb-8058745

Real-World Applications of Multi-Source AVMs

Multi-source AVMs are no longer just theoretical tools; they’re actively shaping decisions across the real estate industry. From mortgage lenders to insurance providers, these advanced models are helping organizations make smarter choices while lowering risks.

Mortgage Lenders and Government-Sponsored Enterprises

Mortgage lenders and government-sponsored enterprises (GSEs) rely on multi-source AVMs to integrate diverse data sources like MLS, appraisals, and images. This approach ensures up-to-date property valuations and reduces risks during loan underwriting. It’s a game-changer for lenders, especially in non-disclosure states where public transaction data is scarce. With MLS data, lenders gain access to key metrics like list-to-sale price ratios and detailed property characteristics, enabling faster and more accurate loan decisions.

These models also help financial institutions address data inconsistencies, offering a clearer picture of property values. This not only helps meet regulatory standards but also minimizes valuation errors that could affect loan performance. Additionally, the growing geographic reach of AVMs has opened doors to markets that were previously underserved – think rural areas or up-and-coming neighborhoods where traditional valuation methods often fall short.

Real Estate Investors and PropTech Platforms

For real estate investors and PropTech platforms, multi-source AVMs have become indispensable tools. They combine structured data, like transaction records and tax information, with unstructured data, such as property photos and satellite images. This blend offers a richer understanding of market trends and property potential.

PropTech platforms now provide automated valuations and market insights that were once out of reach with single-source data. By analyzing visual elements like property condition and curb appeal, these platforms help investors pinpoint opportunities with greater precision. For example, the relationship between image features and housing prices sheds light on how visual factors – such as neighborhood aesthetics – affect property values in different areas.

Multi-source AVMs also enable predictive modeling, helping investors forecast price trends by factoring in market sentiment and physical property changes over time. Tools like BatchData enhance these capabilities by offering access to over 155 million properties with 800+ attributes. This real-time data enrichment helps investors identify undervalued properties and fine-tune their investment strategies.

Insurance and Risk Assessment Use Cases

Insurance companies are also tapping into the power of multi-source AVMs to refine how they calculate premiums and evaluate property risks. By incorporating disaster data and imagery, insurers can uncover risks that traditional methods might miss. For instance, satellite and street view images reveal unpermitted structures, environmental hazards, and maintenance issues that could impact a property’s risk profile.

These tools also help insurers identify properties in high-risk zones, such as flood-prone or wildfire areas, ensuring premiums are aligned with actual risk levels. This data-driven approach minimizes exposure to underpriced risks while enhancing customer satisfaction through fairer pricing. Insurers also benefit from the expanded geographic reach of AVMs, which allows them to confidently underwrite policies in areas that were once considered too complex or risky to assess.

Challenges in Implementing Multi-Source AVMs

Multi-source AVMs bring a new level of precision to property valuations, but their implementation isn’t without hurdles. From navigating licensing agreements to managing technical complexities, the challenges can be daunting and directly impact the success of any AVM initiative.

Data Licensing, Quality, and Privacy

At the heart of a reliable multi-source AVM is high-quality, properly licensed data – but securing this data is no small feat. Licensing agreements often come with strict conditions. For example, MLS data typically includes restrictions on how it can be used, stored, or shared. A misstep here could lead to legal trouble or even losing access to critical data.

Data quality poses another significant issue. Public records often lag behind the actual market, sometimes by months. On the other hand, MLS data is more up-to-date but may include errors introduced by agents. If these inconsistencies aren’t addressed, they can lead to flawed valuations, eroding trust in the AVM’s accuracy.

Privacy regulations add yet another layer of complexity. With access to data on over 155 million properties and 221 million homeowner records, organizations must adhere to laws like the Gramm-Leach-Bliley Act and the California Consumer Privacy Act (CCPA). This becomes even more challenging when handling sensitive details such as owner names, contact information, and financial records.

To navigate these challenges, organizations need robust data governance practices. This includes regular audits, thorough documentation of data origins, and staff training on compliance standards. Partnering with trusted data providers that prioritize privacy and legal compliance can help mitigate risks and ensure uninterrupted access to essential data streams. Once these governance issues are managed, the focus shifts to tackling technical obstacles.

Technical Complexity: Integration and Maintenance

Developing a multi-source AVM means building systems that can handle massive amounts of diverse data in real time. The challenges begin with integrating data from various formats – structured databases, XML feeds, JSON APIs, and even image files. These different formats must seamlessly work together.

Maintaining multiple data feeds is no easy task. Each source may have its own API, update frequency, and schema. A single change in one source can disrupt the entire system. To address this, ETL (extract, transform, load) processes must be flexible enough to adapt to schema changes and handle unexpected anomalies without breaking down.

The computational demands are equally intense. Processing millions of property records, along with high-resolution images and satellite data, requires distributed computing systems capable of handling errors and ensuring minimal downtime. Automated monitoring and recovery systems are critical to maintaining operations when technical failures occur.

Modern platforms help simplify this process by consolidating data access. Instead of juggling dozens of integrations, organizations can use a single API to access comprehensive property data. This reduces the time and effort spent on development and ongoing maintenance. However, even with technical integration in place, reconciling conflicting data remains a significant challenge.

Cross-Source Data Reconciliation

After integrating data, the next hurdle is resolving discrepancies between sources. This is especially tricky when sources disagree on key property details. For instance, public records might list a home as 2,400 square feet, MLS data might show 2,600 square feet, and an appraisal could indicate 2,500 square feet. Which figure should the AVM rely on?

These inconsistencies are common and can impact valuation accuracy. Simple rules, like always prioritizing one source over another, might not capture the full picture. For example, MLS data might include finished basement space that public records exclude, meaning both figures could be correct in different contexts.

To address these conflicts, organizations often turn to machine learning algorithms. These tools analyze patterns in data discrepancies and make informed decisions about which source to prioritize based on the situation. Some systems use statistical models to flag outliers for manual review, while others apply weighted scoring systems that take the historical reliability of each source into account.

Timing discrepancies add another layer of complexity. MLS data might update daily, while public records refresh quarterly. This can lead to situations where different parts of a property record reflect different time periods. A successful AVM must account for these timing issues to maintain consistency.

Reconciliation isn’t a one-and-done process. As market conditions evolve and data sources change, the rules and algorithms used to resolve conflicts must also adapt. Organizations that invest in dynamic reconciliation frameworks can significantly improve the accuracy of their AVMs, boosting user trust and confidence in the process.

Conclusion: The Future of Multi-Source Data in AVMs

The integration of multiple data sources is shaping the next generation of automated valuation models (AVMs). Studies consistently demonstrate that AVMs leveraging diverse data streams outperform those relying on a single source, with nearly half of the top predictive features now coming from image data. This evolution isn’t just about boosting accuracy – it’s redefining how property valuation is approached.

The advantages go well beyond hitting performance benchmarks. Multi-source AVMs offer wider geographic reach, making accurate valuations possible in rural and underserved markets where single-source models often fall short. They also improve reliability by using cross-validation to address issues like outdated public records or incomplete MLS data. These advancements are not only refining valuation methods but also paving the way for broader technological shifts.

Machine learning is a key driver of this transformation. Techniques like SHAP analysis are uncovering how various data sources impact valuations, showing that image-based features often have nonlinear and location-specific effects on property values. This increased transparency helps build trust with stakeholders and allows organizations to fine-tune their models for different markets and property types.

Modern data platforms are also simplifying the integration process. They enable organizations to access and combine multiple data streams without the technical hurdles of the past. A great example is BatchData, which delivers real-time, comprehensive property data through a single API. This approach eliminates the need for managing separate integrations, offering seamless updates and validated data streams that streamline operations.

Looking ahead, AVMs will increasingly rely on real-time data and unstructured inputs. The push toward real-time integration and unstructured data processing will continue to fuel innovation in this space. As platforms become more advanced and data ecosystems mature, AVMs will grow more adaptable and transparent. Organizations that adopt multi-source data strategies today, supported by robust integration tools, will be well-positioned to deliver accurate, scalable, and reliable property valuations.

FAQs

How does using data from multiple sources improve the accuracy of Automated Valuation Models (AVMs)?

Using data from various sources can significantly improve the precision and dependability of Automated Valuation Models (AVMs). This approach offers a more well-rounded perspective on a property and the market it exists in. By incorporating details like property features, recent sales, neighborhood patterns, and even broader economic trends, AVMs can generate valuations that are both detailed and reliable.

When data is pulled from multiple independent sources, it allows AVMs to cross-check information, minimize inaccuracies, and account for elements that a single source might miss. This results in more accurate property valuations – an essential factor for making smart decisions in real estate transactions and investments.

What challenges arise when incorporating multiple data sources into AVMs, and how can they be addressed?

Integrating data from various sources into Automated Valuation Models (AVMs) isn’t always straightforward. Differences in data formats, accuracy, and completeness can create inconsistencies that affect how reliable the valuations are.

One way to tackle these issues is by using advanced data tools designed for enrichment and integration. These tools help standardize and verify property data across multiple sources, ensuring the inputs are consistent and accurate. This process plays a crucial role in boosting the reliability and overall performance of AVMs.

How do image data and satellite imagery improve the accuracy of automated valuation models (AVMs) in determining property values?

The use of image data and satellite imagery takes automated valuation models (AVMs) to the next level by giving a fuller picture of a property and its surroundings. High-resolution images make it possible to evaluate a property’s condition, spot upgrades or damage, and pick up on details like landscaping or building materials – things that traditional data sources might miss entirely.

Satellite imagery, on the other hand, provides critical context about the area. It helps AVMs account for factors like nearby amenities, neighborhood layout, and risks such as flood zones or urban density. When combined, these tools make property valuations much more precise, enabling real estate professionals and investors to make smarter, data-driven decisions.