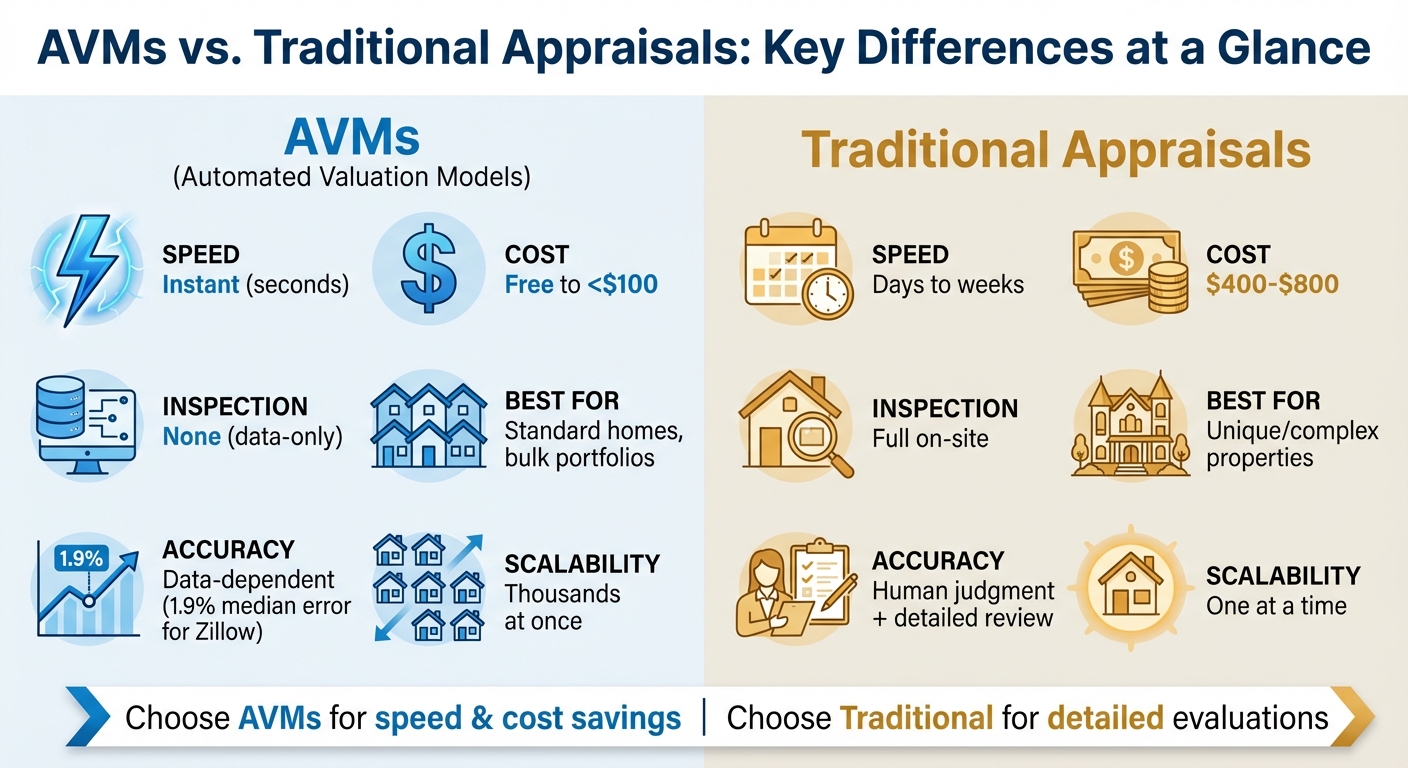

When determining property value, you have two primary options: Automated Valuation Models (AVMs) and traditional appraisals. Here’s what you need to know:

- AVMs: Use algorithms and large datasets to calculate property values instantly. They’re fast, affordable (often under $100), and great for standard homes in areas with ample data. However, they assume "average" property conditions and may struggle with unique or complex properties.

- Traditional Appraisals: Conducted by licensed professionals, these involve in-person inspections and detailed analysis. They account for property condition, upgrades, and unique features but are slower (days to weeks) and costlier ($400–$800).

Quick Comparison:

| Aspect | AVMs | Traditional Appraisals |

|---|---|---|

| Speed | Instant | Days to weeks |

| Cost | Free to <$100 | $400–$800 |

| Inspection | None | Full on-site |

| Best For | Standard homes | Unique or complex properties |

| Accuracy | Data-dependent | Human judgment + detailed review |

Bottom Line: Choose AVMs for speed and cost savings in straightforward scenarios. Opt for traditional appraisals when a detailed, in-person evaluation is necessary.

AVMs vs Traditional Appraisals: Speed, Cost, and Accuracy Comparison

Difference in Appraised Value, Assessed Value, AVM, and Market Value? | Burning Questions RE Series

sbb-itb-8058745

How AVMs Work

Automated Valuation Models (AVMs) crunch massive amounts of real estate data through mathematical and machine learning models to deliver property valuations almost instantly. Unlike traditional appraisers who physically examine properties, AVMs rely entirely on digital data and algorithms to estimate value. The process boils down to three key steps: gathering data from various sources via a real estate API, processing it through advanced models, and producing a value estimate.

Data Sources for AVMs

AVMs pull data from a mix of public and proprietary databases. The main inputs include property-specific details like square footage, number of bedrooms and bathrooms, lot size, and year built, typically sourced from tax assessor records or county offices. Historical sales data and Multiple Listing Service (MLS) records provide insights into recent transaction prices and market trends. On top of that, AVMs use geospatial data – such as proximity to schools, parks, transit hubs, flood zones, and even neighborhood crime rates or school district rankings.

More advanced models go a step further by incorporating alternative data sources like satellite images, street-view photos, foot traffic metrics, and even real estate listing descriptions analyzed with natural language processing (NLP). To ensure accuracy, AVMs use confidence scoring, which measures the reliability of the estimate based on the quality and number of comparable properties. They also employ back-testing, comparing their estimates to actual sale prices to refine performance.

Algorithms Used in AVMs

AVMs typically combine multiple modeling techniques rather than relying on a single calculation. Commonly, they use a mix of hedonic models – which assign value to specific property attributes – and repeat sales indexes, which track price changes over time. Together, these methods provide a more comprehensive valuation.

Modern AVMs have pushed beyond traditional regression models by adopting machine learning algorithms like Random Forests, XGBoost, and LightGBM. These tools can identify complex, non-linear relationships in data that older statistical methods might overlook. Some AVMs even mimic human appraisers by dynamically selecting comparable recent sales. For instance, Zillow’s algorithm has significantly improved over time, reducing its median error rate from 14% in 2007 to about 1.9% for actively listed homes today. Additionally, integrating computer vision with property data has been shown to lower valuation errors by around 13% compared to using property attributes alone.

Speed and Scalability Advantages

Thanks to these advanced algorithms, AVMs can deliver valuations in seconds or minutes, a stark contrast to the days or weeks required for manual appraisals. This speed is crucial in competitive real estate markets, where quick decisions often make or break deals. AVMs also shine in their ability to evaluate thousands of properties at once, making them ideal for institutional investors and bulk risk assessments.

Their automation and low cost also allow for frequent updates – daily, weekly, or monthly – to monitor market shifts in real time. This level of efficiency would be nearly impossible with traditional appraisals. By early 2025, appraisal waivers powered by AVMs accounted for 13% to 15% of Fannie Mae and Freddie Mac loan volumes, with 13.5% of their loan balances relying on AVM-based valuations as of March 2025. Avestar Credit Union, for example, reduced its Home Equity Line of Credit (HELOC) closing time to under two weeks in 2024 by using Coviance’s automated systems instead of traditional appraisals.

How Traditional Appraisals Work

Traditional appraisals involve licensed professionals who visit properties in person to determine their market value. These appraisals are typically ordered by lenders through an Appraisal Management Company (AMC). While Automated Valuation Models (AVMs) can provide quick estimates, traditional appraisals take more time – usually about a week – with the on-site inspection lasting around an hour.

The appraisal process includes several key steps. First, the appraiser conducts a detailed property inspection, noting important details. Next, they analyze comparable sales in the area. All findings are compiled into a standardized report, often the Uniform Residential Appraisal Report (URAR). This seven-page document includes the appraiser’s final valuation, an exterior sketch of the property with dimensions, and a street map showing its location. Costs for appraisals vary based on the loan type: conventional loan appraisals generally cost between $300 and $400, while VA loan appraisals can range from $500 to $1,500.

"The appraiser is the independent, impartial, and objective professional in the mortgage transaction." – National Association of REALTORS®

Once the report is completed, the lender reviews it to assess loan eligibility. Borrowers are entitled to a free copy of the report at least three days before closing. If the appraisal value is lower than the purchase price, buyers can request a Reconsideration of Value (ROV) if they believe certain property details or comparable sales were overlooked. Below, we’ll break down the main steps of the traditional appraisal process.

On-Site Property Inspections

During the inspection, appraisers document key physical features of the property, such as the number of bedrooms and bathrooms, total square footage, and overall design. They also evaluate the property’s condition, noting any visible issues like roof damage, foundation cracks, or plumbing and electrical problems. Permanent upgrades, such as new flooring, energy-efficient windows, or other improvements, are also recorded.

The inspection isn’t limited to the interior. Appraisers assess the lot size, landscaping, topography, and any external factors like easements or nearby structures that could affect the property’s value. They create an exterior sketch with precise measurements to calculate the gross living area and take high-resolution photos of key features.

Market Analysis and Adjustments

After the inspection, appraisers research public records, county data, and the Multiple Listing Service (MLS) to find comparable properties – recently sold homes with similar features. They usually look for at least three properties sold within the past 90 days. Using the sales comparison approach, the appraiser adjusts for differences in features like the number of bedrooms, lot size, or amenities. For instance, if a comparable property has an extra bathroom, its value is adjusted downward compared to the subject property. Similarly, unique features like a finished basement may result in an upward adjustment. This process ensures the final valuation reflects the property’s true market value.

Expert Judgment for Complex Properties

For properties that don’t fit the mold – like luxury estates, rural homes, or those with unique architectural designs – data can be sparse. In such cases, appraisers rely heavily on their expertise to fill in the gaps that digital models can’t address. They perform a "highest and best use" analysis and evaluate the property’s "reasonable exposure time" to arrive at an informed valuation.

"AVMs often fail to generate adequate comparables for unique properties." – Investopedia

Unlike AVMs, which often assume properties are in average condition, appraisers account for the actual state of the home. This includes factoring in significant upgrades or deferred maintenance. Their professional judgment ensures that unique features and subtle market trends are properly reflected in the final valuation, offering a level of accuracy that automated systems simply can’t match.

AVMs vs. Traditional Appraisals: Main Differences

Comparison: Speed, Cost, and Accuracy

When it comes to speed, AVMs (Automated Valuation Models) and traditional appraisals couldn’t be more different. AVMs provide results almost instantly – literally in seconds – while traditional appraisals require days or even weeks to schedule and complete. This makes AVMs a go-to option for fast-paced transactions or bulk property evaluations.

The cost difference is just as striking. AVMs are either free or cost less than $100. On the other hand, traditional appraisals typically range between $400 and $800 for residential properties. For investors handling large property portfolios, these savings can be substantial.

Accuracy, however, is where things get a little more complex. Traditional appraisals excel with unique or complex properties because they include a full on-site inspection. This allows appraisers to evaluate property condition, upgrades, and deferred maintenance – all factors AVMs can’t assess. AVMs, by contrast, assume properties are in "average" condition and rely entirely on the quality and freshness of their data. For example, Zillow’s Zestimate boasts a median error rate of about 1.9% nationwide. And by 2017, AI-driven algorithms had improved their accuracy to within 5% of sale prices, a big leap from a 14% error rate a decade earlier.

| Factor | Automated Valuation Model (AVM) | Traditional Appraisal |

|---|---|---|

| Speed | Instant (seconds) | Days to weeks |

| Cost | Free or less than $100 | $400–$800 (Residential) |

| Scalability | Can process thousands at once | One property at a time |

| Accuracy | High for standard homes | High for unique properties |

| Inspection | None | Full on-site inspection |

These differences highlight the strengths and limitations of each method, depending on the type of property and the purpose of the valuation.

Bias and Objectivity

Beyond speed and cost, the reliability of valuation methods also depends on bias and objectivity. AVMs use consistent formulas, which help avoid human biases like anchoring or deliberate overpricing. Traditional appraisals, however, have been shown to lean toward optimism. Studies reveal that 90% of traditional appraisals meet or exceed the sale price, often due to pressure to align with contract requirements. This "optimism bias" can sometimes result from appraisers feeling obligated to confirm a deal price to ensure loan approval.

"An objective, cost-effective solution would be to use [a professional AVM] to check if appraised values are in agreement and, if so, deem them low risk for bias." – Freddie Mac

That said, AVMs aren’t entirely free of bias either. Instead of human judgment, they can reflect "algorithmic bias", especially if the data they rely on contains systemic inequities. Research from the Urban Institute in 2024 found that AVM errors are more frequent in majority-minority census tracts, underscoring how historical inequities can still influence algorithmic outcomes.

Traditional appraisals, by contrast, involve subjective judgment. Two appraisers might arrive at different valuations for the same property, depending on their experience and the comparables they choose. While this subjectivity can introduce variability, it also allows appraisers to account for qualitative factors – like curb appeal, interior upgrades, or unique property features – that algorithms overlook. Moreover, their detailed narrative reports provide a level of transparency that AVMs, often criticized as "black box" systems, simply cannot match.

"Despite high average accuracy levels, statistically based valuations may be widely off the mark and need to be augmented by professional judgment." – George Andrew Matysiak, Krakow University of Economics

Pros and Cons of Each Method

Choosing the right approach for property valuation means weighing the strengths and weaknesses of each method carefully.

AVMs: Advantages and Disadvantages

AVMs (Automated Valuation Models) are known for their speed and affordability. They provide instant results and are either free on consumer platforms or cost less than $100 for professional-grade reports. This is a stark contrast to traditional appraisals, which typically range from $400 to $800. AVMs also excel in handling high-volume assessments, making them a go-to choice for bulk property evaluations.

That said, AVMs come with notable limitations. Their accuracy hinges entirely on the quality of data they process. They assume all properties are in "average" condition, which means they can’t account for things like deferred maintenance, custom renovations, or structural problems. AVMs also struggle with unique properties – think rural homes, newly built houses, or properties with large acreage. In particularly complex markets, such as New York City, AVMs can falter significantly. For example, a 2024 study found Zillow’s Zestimate had a median absolute percentage error of 17.5% in that market. Additionally, advanced machine-learning models often lack transparency, functioning as "black boxes" that obscure how specific valuations are calculated.

"AVMs are more efficient and consistent than a human appraiser, but they are also only as accurate as the data behind them." – Investopedia

For properties that require a deeper level of assessment, traditional appraisals provide a valuable alternative.

Traditional Appraisals: Advantages and Disadvantages

While AVMs shine in speed and scalability, traditional appraisals offer a level of detail and human insight that algorithms simply can’t match. Licensed appraisers conduct thorough on-site inspections, evaluating everything from interior finishes to structural integrity. This hands-on approach allows them to capture details that AVMs miss – like a recently remodeled kitchen or signs of water damage. Appraisers also produce detailed narrative reports, clearly explaining how they arrived at their valuations. This transparency makes traditional appraisals particularly useful for unique properties or legal scenarios, such as divorce settlements.

The downside? Traditional appraisals are time-consuming and expensive. They are not practical for evaluating large property portfolios due to the labor-intensive process. Additionally, human judgment introduces a degree of subjectivity. Two appraisers might arrive at different values for the same property based on their experience or choice of comparables. Research also indicates that around 90% of traditional appraisals meet or exceed the contract sale price, which may reflect a bias toward confirming the agreed-upon deal price.

The table below highlights the key differences between AVMs and traditional appraisals:

| Aspect | AVMs | Traditional Appraisals |

|---|---|---|

| Speed | Instant | Days to weeks |

| Cost | Free to <$100 | $400–$800 |

| Scalability | High volume | One at a time |

| Property Condition | Assumes average | Full inspection |

| Best For | Standard homes, portfolios | Complex, unique properties |

| Transparency | Black box | Detailed reports |

When to Use AVMs vs. Traditional Appraisals

Deciding between an AVM and a traditional appraisal comes down to your specific needs, timeline, and the nature of the property. Each method has situations where it performs best.

When to Use AVMs

AVMs are all about speed and efficiency. They’re particularly useful for Home Equity Lines of Credit (HELOCs) and home equity loans, where lenders aim to close quickly without compromising accuracy. In fact, a growing portion of GSE loan balances now rely on AVM waivers.

They also play a key role in portfolio management. Financial institutions depend on AVMs to assess risk across large property portfolios, while real estate investors use them for quick screening of undervalued or overvalued properties before committing to a full appraisal.

For loan pre-qualification and preliminary underwriting, AVMs are a strong choice – especially for refinancing when the loan-to-value ratio is low (typically 75% or less). They’re most accurate for standard single-family homes in suburban areas where comparable sales data is plentiful. Additionally, lenders often use AVMs as a quality control tool, offering a second opinion to catch potential errors or bias in traditional appraisals.

"AVMs… offer borrowers upside through lower cost originations and faster closings, without sacrificing accuracy." – U.S. Department of the Treasury

However, it’s important to check the AVM confidence score. A low score suggests insufficient comparable data, signaling the need for a traditional appraisal. For added reliability, advanced data enrichment services, like those from BatchData, can improve AVM accuracy.

That said, when deeper, on-site evaluations are needed, traditional appraisals are the way to go.

When to Use Traditional Appraisals

While AVMs excel in speed, traditional appraisals are indispensable for situations requiring detailed, in-person evaluations. For purchase transactions, most conventional lenders and mortgage underwriters mandate a full appraisal. This is especially critical for complex or unique properties – think high-end homes, custom builds, or properties with unique features like barns or outbuildings – that lack comparable data.

Traditional appraisals are also better suited for rural or agricultural areas, where sparse market data often results in low AVM confidence scores. Properties with large acreage or multiple structures benefit from the detailed, subjective analysis that only a licensed appraiser can provide.

If a property is undergoing renovations or is in poor condition, traditional appraisals capture details that AVMs can’t. Automated models assume average conditions and can’t account for ongoing construction, deferred maintenance, or recent upgrades like pools or landscaping that aren’t yet reflected in public records.

They’re also the go-to choice for legal matters like estate settlements, divorce proceedings, or disputes. In these cases, the detailed narrative reports provided by traditional appraisals ensure transparency and defensibility.

"AVMs work best with widely traded, homogeneous assets; their performance degrades with increasingly heterogeneous assets or assets that are thinly traded." – RICS (Royal Institution of Chartered Surveyors)

Conclusion

Choosing between AVMs and traditional appraisals depends on your specific situation and priorities. AVMs offer speed, cost savings, and scalability, making them a great fit for tasks like portfolio management, refinancing with low loan-to-value ratios, and initial property evaluations. They perform best with standard single-family homes in suburban areas where data is abundant. On the flip side, traditional appraisals provide the in-depth, on-site analysis needed for purchase transactions, unique or complex properties, rural locations, and legal situations requiring highly defensible valuations.

Recent advancements in regulations and technology have helped bridge the gap between these methods. For instance, new federal regulations coming into effect in 2025 will impose stricter quality controls on AVMs used in residential mortgage valuations. These changes aim to improve data accuracy and ensure fair, non-discriminatory practices.

For professionals using AVM workflows, having access to high-quality data is critical. Providers like BatchData play a key role by offering enriched property data and APIs that deliver accurate, up-to-date information at scale. This level of detail enhances valuation confidence scores and supports faster, better-informed real estate investing decisions for lenders, investors, and analysts alike.

FAQs

How accurate is an AVM for my home?

AVMs, or Automated Valuation Models, are capable of delivering reasonably accurate home value estimates. However, their reliability hinges on the quality of the data they use and the current state of the housing market. For homes that are actively listed on the market, the median error rate is around 1.92%. Off-market properties, on the other hand, often see higher inaccuracies because the data used for these estimates may be outdated. The key to improving accuracy lies in having access to detailed and up-to-date information.

When will a lender require a traditional appraisal?

When a lender needs an independent, in-person property valuation, they turn to a traditional appraisal. This is often required by regulations or internal risk management policies. It usually comes into play for specific mortgage or loan applications or if an automated valuation model (AVM) doesn’t meet the necessary standards for accuracy, compliance, or risk evaluation.

What is an AVM confidence score?

An AVM confidence score indicates how reliable an automated valuation model’s property estimate is. It provides users with a way to gauge the trustworthiness of the valuation by assessing the model’s accuracy and consistency.