Q1 2025 Report

Investor Market Share Soars as Traditional Buyers Retreat

26.8%

Market Share

265,000

Homes Purchased

150M+

U.S. Properties

1000+

Data Points

20,000+

BatchService Users

2021

Founded

About BatchData

Founded in 2021, BatchData is a comprehensive real estate data platform providing enterprise-grade APIs with access to 1000+ data points for over 150 million U.S. properties. Serving businesses from startups to Fortune 500 companies, BatchData delivers robust lead generation, AI predictive data, skip tracing, data enrichment, and seamless integrations with real-time updates and industry-leading accuracy.

Unlike static data aggregators, BatchData’s in-house data science team enriches datasets from multiple tier-one providers while leveraging real-time feedback from over 20,000 BatchService users to maintain the highest data quality standards in the industry.

This report is presented in conjunction with CJ Patrick Company.

Key Market Insights

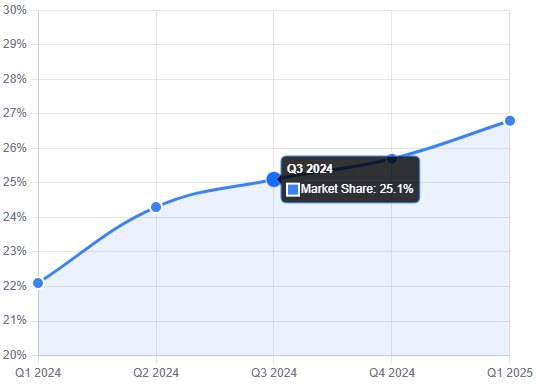

Critical data points that define the current investor landscape in residential real estate – highest market share in at least five years

26.8%

Record Market Share

↑ 8.3% from 2020-2023 average

90%

Small Investor Control

1-10 properties per investor

39.9%

Hawaii Leadership

Tourism-driven market

$366,424

Avg. Purchase Price

Below market average

Market Share Surge Driven by Buyer Retreat

Market Contraction Effect

Overall home sales collapsed 30% from their 2021 peak of 6.9 million to just 4.8 million in 2023, creating a vacuum that investors increasingly filled.

Stable Investor Volume

Investor purchases remained relatively stable—growing only 9% from 1.1M annually to 1.2M in 2024.

Primary Liquidity Providers

Investors are currently one of the market's primary liquidity providers as traditional buyers struggle with affordability constraints.

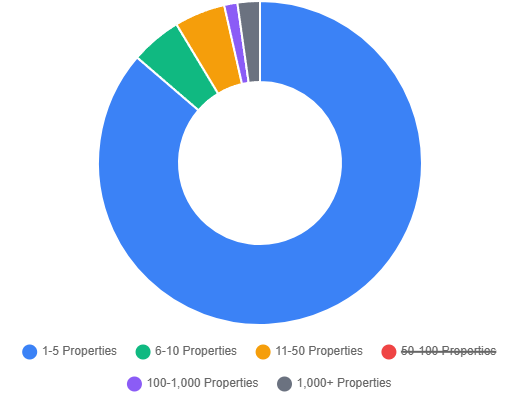

The Smallest Investors Dominate Despite Institutional Headlines

Small investors control 90% of investor-owned housing, shattering conventional wisdom about institutional dominance.

Key Finding

The 15.6 million properties owned by investors holding 1-5 homes represent 85% of all investor inventory, while those with 6-10 properties add another 5%, bringing small investor control to 90% of the market.

Market Implication

This concentration pattern reflects accessibility rather than consolidation. Small investors benefit from lower capital requirements, local market knowledge, and operational flexibility that institutional players have difficulty replicating at scale.

Investor Property Ownership by Portfolio Size

| Portfolio Size | Properties Owned | Market Share | Trend |

| 1-5 Properties | 15,644,919 | 85% | ↑ Growing |

| 6-10 Properties | 905,881 | 5% | → Stable |

| 11-50 Properties | 1,001,207 | 5% | ↑ Growing |

| 50-100 Properties | 200,134 | 1.1% | → Flat |

| 100-1,000 Properties | 247,220 | 1.3% | ↓ Declining |

| 1,000+ Properties | 405,154 | 2.2% | ↓ Retreating |

Geographic Strategies Drive Concentration

While the largest states have the highest number of investor-owned homes, three distinct investment strategies drive the highest concentrations of investor ownership in other parts of the nation.

Tourism & Vacation Rentals

Hawaii

39.9%

Alaska

35.5%

Cash Flow & Affordability

Arkansas

30.0%

West Virginia

30.0%

Lifestyle & Migration

Vermont

30.0%

Wyoming

30.0%

Investor Ownership by State

Highest Investor Concentration

Hawaii

39.9%

Alaska

35.5%

Arkansas

30%

West Virginia

30%

Investment Strategy Insights

Tourism Markets

Hawaii's 30,000 short-term vacation rentals represent 5% of total housing inventory, capitalizing on millions of annual visitors.

Affordability Markets

Arkansas offers properties with average rents of $1,093 and landlord-friendly laws. West Virginia delivers the nation's most affordable housing at $112,902 median values with $3.2 billion in infrastructure investments through 2026.

Migration Markets

Vermont saw a 6.9% increase in farm numbers between 2012-2017, driven by urban-to-rural migration trends.

Regional Investment Patterns

Three states dominate investor ownership, accounting for nearly 25% of all investor homes nationwide

Leading States by Investor Properties

1

Texas

1.66M

Massive post-COVID migration

2

California

1.45M

Most populous state (40M+ residents)

3

Florida

1.21M

Major destination for interstate migration

Three Distinct Investment Strategies

Investor concentration follows clear economic fundamentals across different market types

Growth Markets

Demographic Shifts

Market Fundamentals

Key Insight

Rather than random distribution, investor concentration follows clear economic fundamentals. Population growth, demographic shifts, and strong market fundamentals drive the highest concentrations of investor ownership across the nation.

Large Investors Execute Strategic Retreat

Mega-investors appear to be executing a coordinated retreat from single-family markets, selling 76% more properties than they purchased in Q1 2025.

4,200

Properties Sold

2,400

Properties Bought

Pricing Strategies Reveal Market Segmentation

$366,424

Average Investor Price

Below market average

$503,800

Market Average Price

All home sales

$262,064

Large Investor Avg

Focus on Midwest & South

Key Takeaways

Critical insights that define the future of investor participation in residential real estate

$366,424

Small Investor Control

Geographic Strategy

Institutional Retreat

Pricing Discipline

Structural Change

Get the Complete Analysis

Access detailed methodologies, additional data points, and strategic recommendations for your investment decisions.

- Quarterly trend analysis and forecasting

- Market-specific investment strategies

- Detailed demographic and pricing data

- Executive summary and policy implications